Despite clear geopolitical tensions, markets have trucked ever higher in the first half of 2019. Yes, there is some clear turbulence and unresolved situations but the ones in charge of the money have moved in to support the financial markets aggressively. What does this mean for you? Simple. Lots of volatility and plenty of trading opportunities. Let’s discuss a few of them in our quarterly all access webcast.

Please feel free to sign up to watch our quarterly all access webcast here.

1:02min | What was covered:

- Battle of the Popular Investors

- Member benefits

- Trade war shifting focus

- US Economy is fantastic

- Institutional Crypto

- Libra

- Tether

1:40min | View the eToro Club Benefits or speak to your account manager for more details on how you can join the next live discussion!

4:30min | Trade war shifting focus

8:37min | GBPUSD reviewed for different Brexit outcomes

10:25min | Hong Kong protests’ effect on the markets – HKG50 rally reviewed

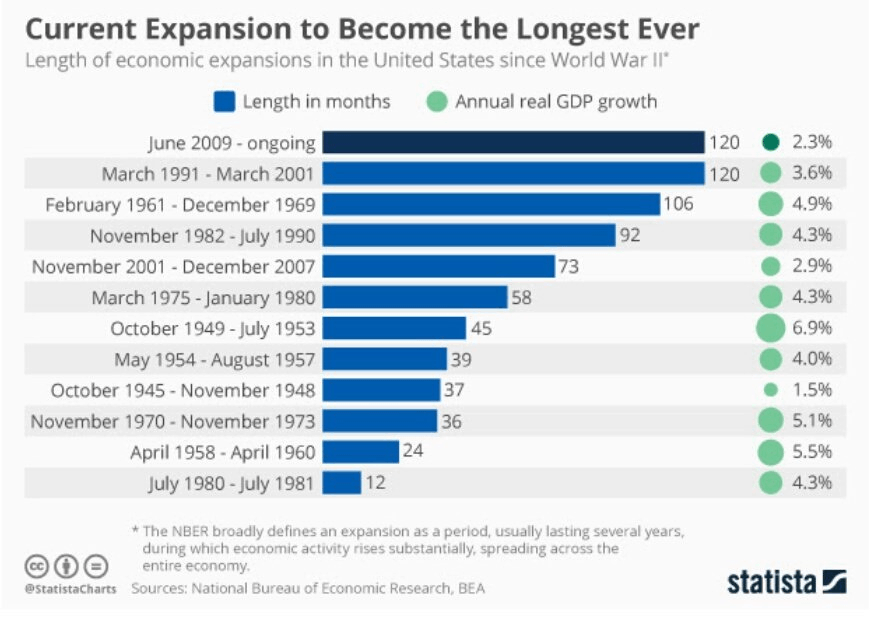

14:24min | US Economy is fantastic

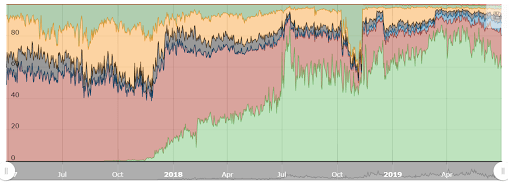

This chart, which was produced last month, shows that the period from June 2009 until today is the longest ever without a recession.

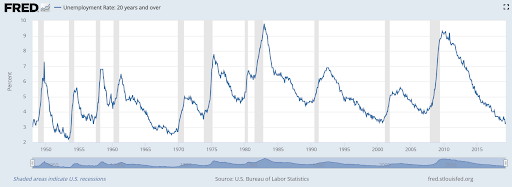

15:00min | The US Unemployment Rate and the Fed discussed

Please see the chart below as it was not shown due to technical difficulties

18:37min | How the DJ30 reacted to the Fed raising interest rates

22:00 | min How the market is controlled by the Fed

DJ30 and Bitcoin

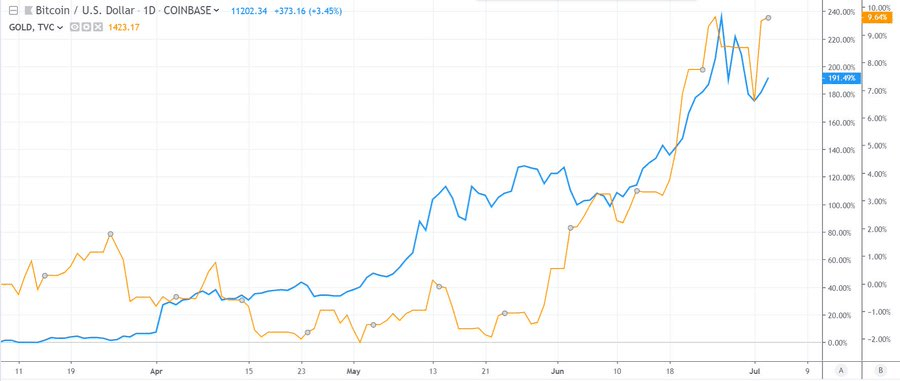

No doubt the world’s most popular precious metal and the world’s first cryptocurrency have a lot in common, but until now, price action wasn’t really one of them. Until now…

Here we can see the price of gold (yellow) against bitcoin (blue) have been moving very similarly since the beginning of May.

Here’s a discussion that arose regarding this analysis on the eToro social network.

30:59min | Question: Any comments on the trends of Gold, and US indices, specifically NSDQ100?

Answer: Pumped liquidity from the Fed, all assets are rising

34:35min | Institutional Crypto – Learn about the cycles of crypto

41:50min | We were finally introduced to Libra, Facebook’s highly anticipated crypto venture. See our Blog Post about Facebook’s planned cryptocurrency, Libra.

46:50min | Libra Association Smart Portfolio that offers exposure to the global equity participants in the project. You can review that here.

48:00min | Tether

48:19min | Question: What is your opinion on Tether being behind this manipulated bull run?

Answer: Tether and trust discussed

49:00min | Tether, what it is and more

57:00min | Battle of the Popular Investors

Barryjones381 – This Hong Kong-based Popular Investor describes himself as a long-term, value-based investor, which is why he often chooses to invest in assets when they are on correction. He says that he focuses on technology, healthcare, marijuana and emerging markets, alongside investing some of his funds in crypto.

Feingoldresearch – This German Popular Investor is the co-founder of Feingold Research, a financial research company; he and his partner have a combined 25 years of experience in financial markets. On eToro, he manages his portfolio according to the company’s trading ideas and strategies.

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, Twitter, LinkedIn.

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short time frame and, therefore, are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and, therefore, is not supervised by any EU regulatory framework. Your capital is at risk.

Past performance is not an indication of future results

Data presented during the webcast is accurate as of July 2nd, 2019.