Hi Everyone,

One major factor of uncertainty may now be removed from financial markets, possibly paving the way for a prolonged period of exceptional stability for investors.

President Donal Trump has officially kicked off his 2020 presidential campaign.

From now until November 2020, Donald J Trump is likely to be on his best behavior, at least as far as the markets are concerned.

Today’s Highlights

- Perfection Fed

- Libra’s Wake

- Sell the News

Traditional Markets

Will the markets get everything they want from the Fed today? From the way I see it, it doesn’t seem likely. Don’t get me wrong. Markets rarely drop when Powell is talking, but somehow it seems that the Fed can’t get any more dovish without raising some serious alarm bells.

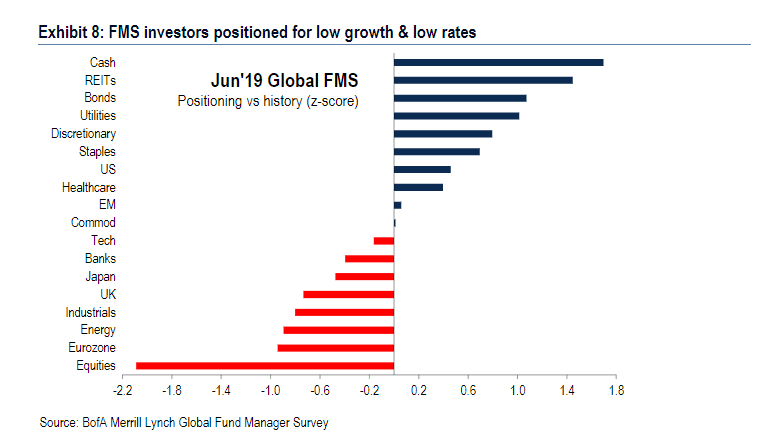

It’s important to note that even though stocks are on a tear, fund managers are still quite pessimistic. Analysts from Bank of America have recently concluded that the markets are the most bearish they’ve been since the financial crisis.

Which of course, is being taken as a positive sign by many pundits who say that they can’t get much more bearish so the next move must be bullish.

This chart from Bloomberg shows pretty clearly how portfolios are currently much less into risky assets and much more into safe havens then they usually are.

Libra’s Wake

To be perfectly honest, I was really wrong about yesterday’s Facebook announcement. My feeling was that we would get a small press release or blog post confirming which of the widespread rumors were true and which were not.

Instead, we received a massive data dump with plenty of documentation and even an early look at the opensource code of the new ‘blockchain’.

As far as it seems, the tech is very similar to that of XRP or XLM. At this point, I wouldn’t say that the former has much to worry about but the latter might be in a spot of trouble. Stellar Lumens’ main market is remittances, the exact market that Libra aims to disrupt.

With all the seemingly good intentions from Facebook, there’s even a fair chance this project never gets off the ground. Within hours of the data release, French Finance Minister Bruno Le Maire presented some serious opposition. Not only that, it seems that even US lawmakers may not be 100% onboard and some called for a complete halt of the project pending further details.

Even though this is a stable coin, many people are quite bullish. So it’ll be interesting to see this play out.

Sell the News?

Over the last few weeks, many clients and journalists have asked me just how much of the current rally in bitcoin is due to Facebook’s new crypto?

Well, I couldn’t exactly say but we should get a clearer picture in the next few days. As the old market saying goes, “buy the rumor, sell the news.”

Well, here we can see the massive run up on bitcoin. The blue circle is where Techcrunch announced the release date of the white paper two weeks ago, the yellow line is when the time the white paper was released.

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.