eToro’s “people-based” Smart Portfolios (GainersQtr, SharpTraders, and ActiveTraders) are the essence of what the eToro platform is all about. Leveraging the power of state-of-the-art quantitative investment tools, data from millions of traders, and machine learning — which aims to learn from historical data to maximise the probability of success going forward — these strategies aim to identify the investors who are statistically most likely to outperform the market in the months ahead without taking excessive risks. We like to think of these portfolios as the ideal building blocks for a diversified investment portfolio. With these investment strategies, you can have your own team of top traders working for you around the clock.

While the people-based Smart Portfolios have performed well in the past — regularly beating major indexes in both up and down markets — we recently decided that it was time to give them an upgrade. We wanted to make a clearer distinction between the three different strategies involved. We also wanted to enhance the investor selection process, to ensure we were identifying the most consistent traders on eToro and improve the chances of generating strong investment returns while minimising risk. Here are some key points to know about the investment process and the recent changes.

New goals and risk profiles

Let’s start with a brief explanation of the three people-based Smart Portfolios, and a breakdown of their goals and risk profiles.

As in the past, all of these strategies are based on eToro’s traders. All of them consist of 20 investors trading assets such as stocks, indices, ETFs, crypto, commodities, and currencies, and more. However, the three portfolios now have distinct investment goals and risk profiles.

All three strategies are considered “moderate” risk due to a high level of diversification and embedded risk management mechanisms (which we will expand on below). Yet, within this range, risk levels vary. GainersQtr is lower risk, SharpTraders is medium risk, and ActiveTraders is relatively higher risk. And as is always the case in investing, potential gains are directly proportional to the level of risk taken. Therefore, ActiveTraders is designed to achieve the highest returns of the three.

The portfolio that is right for you will depend on your financial objectives and risk tolerance:

- If you are seeking solid returns, but have a relatively low risk tolerance, GainersQtr may be the best choice for you.

- If you don’t mind taking a little more risk in an effort to achieve higher-than-average returns, SharpTraders could be a good option for you.

- If you are comfortable taking on a higher level of risk in the pursuit of high returns, ActiveTraders may be the best choice for you.

79% of retail CFD accounts lose money.

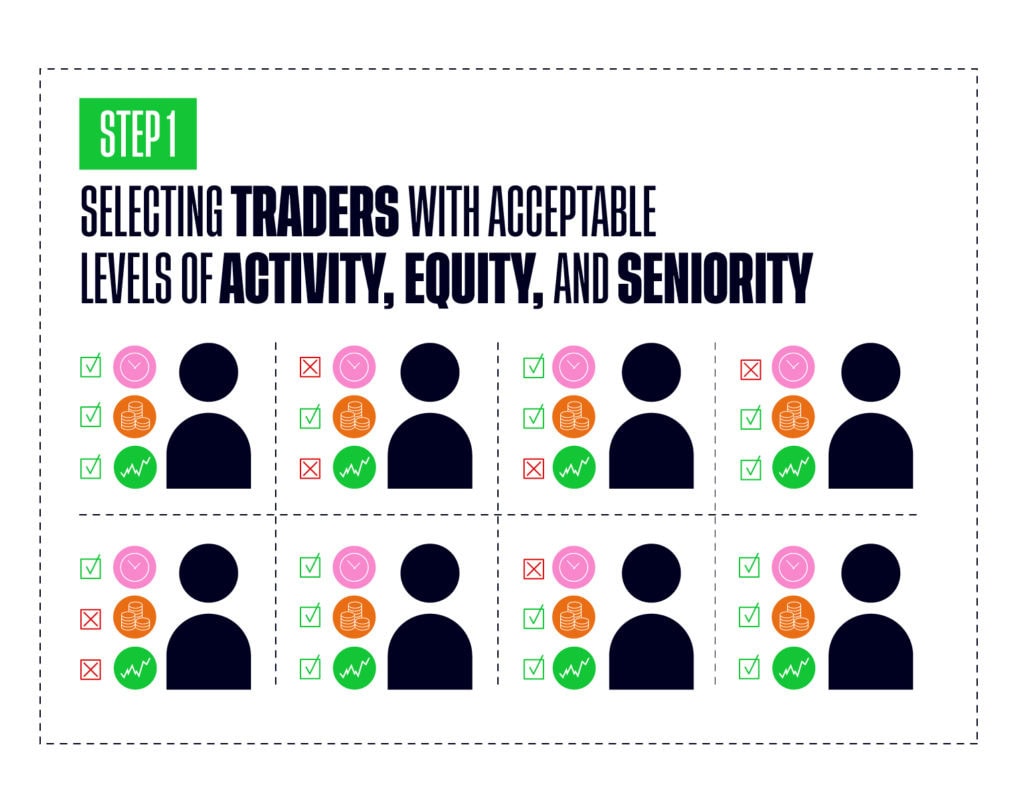

Three-step selection process

As for how traders are selected for the Smart Portfolios, the process has changed significantly. We now employ a three-step process that is designed to identify consistent, stable, risk-aligned investors.

In the first step of the selection process, we screen our investor universe for top traders. Here, we look for those with significant trading activity, a medium- to long-term track record on the eToro platform, substantial capital invested across a wide range of assets and instruments, and a risk level that is in line with their objectives. This screen filters our large universe of traders down considerably.

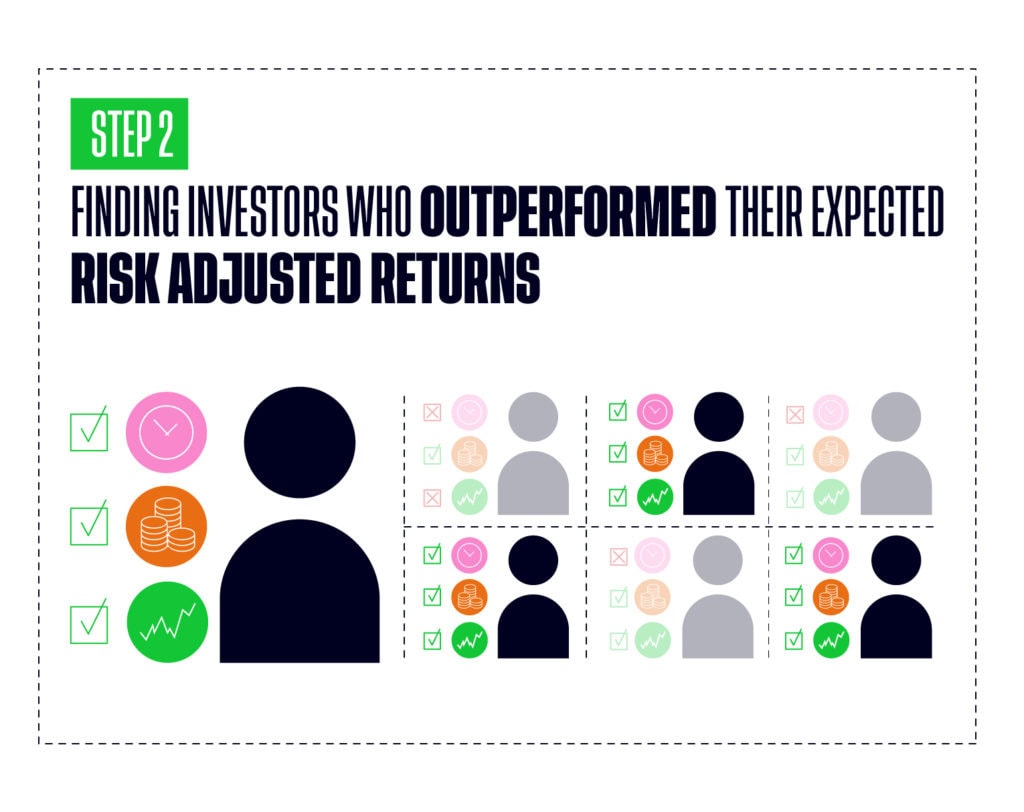

The next step involves identifying traders who are able to generate performance on a consistent basis. The goal here is to find the traders with the greatest skill. To do this, we use advanced statistical tools to divide investor performance into two key areas — beta and alpha. Beta represents the investor’s sensitivity to the markets. A beta of 1.0 means that if the market rises by 2%, the investor gains 2%. Similarly, if the market falls by 2%, the investor’s portfolio falls by 2%. In contrast, alpha is the part of their returns that is not explained by the markets. In other words, it measures the investor’s ability to outperform the market. By analysing both beta and alpha, we can identify those who have a proven ability to beat the market.

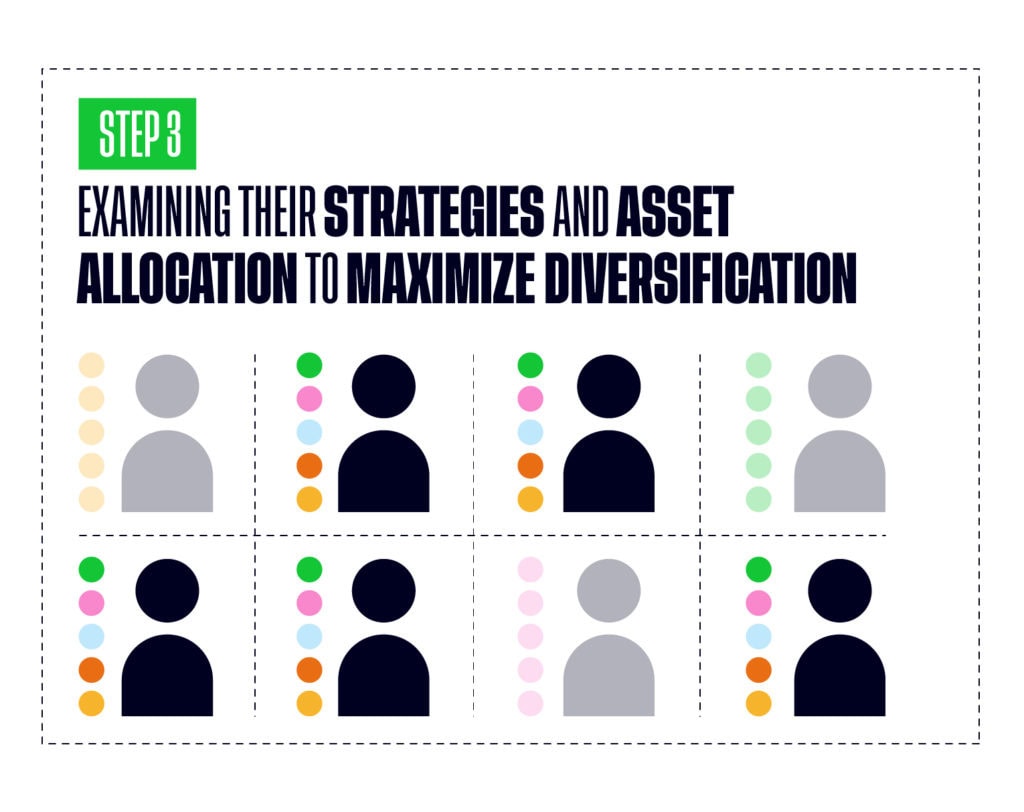

The final step involves a deep analysis of traders’ portfolios. The aim here is to select 20 top investors with different strategies, whose portfolios are not highly correlated. We do this in order to optimise portfolio construction and ensure that the Smart Portfolios are highly diversified.

Risk management

Like the original portfolios, the new portfolios have an embedded stop-loss mechanism as a risk management feature. For GainersQtr and SharpTraders, this is 5%. However, for ActiveTraders, it is 10% (versus 5% in the past) so that it can endure a higher level of volatility. So, for example, if a trader in the GainersQtr Portfolio experiences a portfolio decline of 5%, the stop-loss is triggered, the trader’s position is liquidated, and the remaining capital is kept in cash until the next portfolio rebalance.

The portfolios are rebalanced quarterly (or at eToro’s discretion, pending market conditions), giving traders time to outperform while ensuring that the strategy is aligned to market trends. The fact that each individual trader has their own stop-loss means that, even if a handful of traders underperform and are stopped out, the strategy can continue to take advantage of other investment opportunities.

This stop-loss feature, combined with the high level of diversification within individual portfolios (stocks, indices, ETFs, commodities, cryptoassets, etc.), the geographical spread of investors (traders are based all over the world, meaning that they have expertise in different areas of the markets), and the low correlation between traders’ portfolios, means that the Smart Portfolios are well-constructed from a risk management perspective.

And, of course, investors in these Smart Portfolios can set their own individual stop-losses to further minimise risk.

Your team of expert traders

With millions of registered traders and investors generating billions of financial metrics every day, eToro is the perfect environment for advanced data analysis technologies. Using cutting-edge technology such as machine learning, we can leverage the colossal amount of data available to create revolutionary, data-driven investment strategies.

By investing in eToro’s people-based Smart Portfolios, you can benefit from the skill and expertise of the world’s top traders, taking advantage of the countless opportunities the world’s financial markets have to offer.

Are you looking to invest in the best traders, using the new machine learning algorithm, with low risk? GainersQtr may be the right portfolio for you. Have a high risk tolerance? ActiveTraders may be the portfolio for you. Somewhere in between? SharpTraders could be the best choice for you.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Smart Portfolios are not exchange-traded funds or hedge funds and are not tailored to your specific objectives, financial situations and needs. Your capital is at risk. See PDS and TMD.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.