The weekend was packed with M&A news, with three deals all likely to be well worth of $10bn apiece reported. First up, Oracle has reportedly won the bidding to buy TikTok’s US operations, with the Microsoft-Walmart joint offer being rejected. According to The WSJ, the deal may not take the form of an outright sale, with Oracle instead set to become TikTok’s “trusted tech partner” in the US. More details are likely today, as The White House it yet to comment on whether the deal has secured its approval.

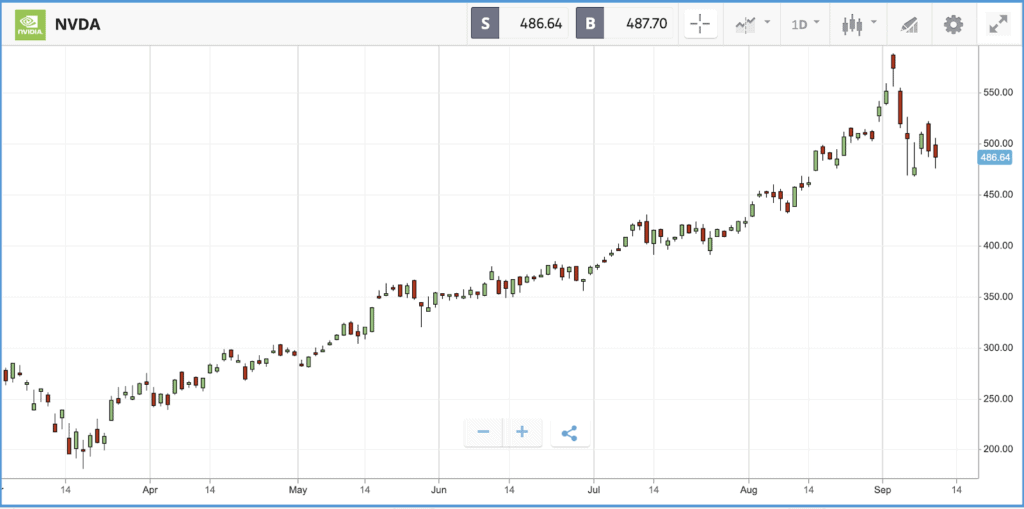

Elsewhere, Nvidia is buying chip designer Arm Holdings from SoftBank for $40bn, which the Japanese investment firm took private when it initially acquired the British firm in 2016. Arm designs architecture is used in mobile phone chips and is set to benefit from Apple shifting its computers from Intel chips to an Arm design.

Last up, Gilead Sciences plans to acquire biopharmaceutical company Immunomedics for $21bn, adding to its cancer treatment portfolio, including a new breast cancer drug that received regulatory approval in the US in April.

The deals buoyed stocks in Asia, with the Japanese Nikkei and Hong Kong’s Hang Seng both higher by 0.7%, while US futures were pointing upwards ahead of their open later today.

Tech, energy names sink stocks in bumpy week

Tech stocks and energy names dragged all three major US stock indices into the red last week, with the Nasdaq Composite falling hardest, losing 4.1%. The slump took the Nasdaq into correction territory on Tuesday, as the index has fallen more than 10% from its record high set less than a week earlier. Tesla closed the week 10% lower, Amazon fell 5.4% and Apple was down 7.4%, as investors questioned the fragility of the tech sector’s recent runup and opted to take profits. The price of crude oil dropping below $40 once more was another source of pain in the markets. Oil giants Chevron and Exxon Mobil both lost more than 5% over the course of the week, while exploration names such as Occidental and Apache fell by double-digits.

In a Friday note, investment and financial advice firm Edward Jones said that investors should expect stock pullbacks to be more frequent from here, as “the economic fundamentals supporting the rally are likely to be less vigorous as we move from stage two of the recovery to stage three.”

S&P 500: +0.1% Friday, +3.4% YTD (-2.5% last week)

Dow Jones Industrial Average: +0.5% Friday, -3.1% YTD (-1.7% last week)

Nasdaq Composite: -0.6% Friday, +21% YTD (-4.1% last week)

Pound tumbles on Brexit tension, boosts FTSE 100

London-listed stocks recorded gains last week, as significant tensions between the United Kingdom and European Union over Brexit sent the value of the pound tumbling. Sterling fell from close to $1.33 on Monday to sub $1.28 by the weekend. Any negative movement for sterling tends to lead to a positive reaction for UK share prices, given the large percentage of revenues that large listed British stocks make overseas in other currencies. The more international FTSE 100 added 4% over the course of the week, while the FTSE 250 – which has more of a domestic-overseas balance – added 1.2%.

Several FTSE 100 names gained more than 10% during the week, including miner Rio Tinto, insurer Aviva and JD Sports Fashion. It was a good week for miners in general, with Glencore and Anglo American both posting gains of close to 10%. At the other end of the spectrum, British Airways parent International Consolidated Airlines Group suffered another tough week, falling by more than 10%, with its year-to-date loss standing at 68.9%.

FTSE 100: +0.5% Friday, -20% YTD, (+4% last week)

FTSE 250: -0.1% Friday, -19.8% YTD (+1.2% last week)

What to watch

Lennar Corporation: Homebuilder Lennar is the largest in the US by revenue. New home demand has maintained despite the pandemic, particularly as Americans pour out of densely populated cities to more rural areas where they are looking to purchase homes. Supply has also been constrained, as existing owners wait and see what will happen to prices before selling. That adds to the demand for new-build homes. Lennar’s shares are up 38.9% year-to-date ahead of its latest quarterly earnings figure release today, followed by an analyst call on Tuesday. Wall Street analysts are anticipating an earnings per share figure of $1.55, up from the $1.14 they had expected for the quarter three months ago.

UK unemployment rate: Tomorrow the July unemployment rate and June employment change figures will be released in the UK. The unemployment rate came in at 3.9% for June, with consensus expectations pointing to an uptick in July. Figures may worsen substantially in the autumn; on Sunday the BBC reported that employers in Britain are planning more than double the number of redundancies as they did at the height of the global financial crisis more than a decade ago.

Brexit negotiations: Given the near-term sway Brexit may have over the value of the pound; Brexit negotiations are worth keeping an eye on as they continue this week between the UK and EU. Chief negotiators from both sides have been fighting on Twitter, and Boris Johnson’s government has admitted it may break international law to prevent a hard border with Northern Ireland.

All eyes on the Fed

One of the biggest events of the week is the Federal Reserve’s final meeting before the November presidential election in the US. There will be details of the meeting’s content and a speech from chair Jerome Powell on Wednesday, in which investors will be watching for more detail on the Fed’s plan to allow inflation to run above target. Powell’s views on the economic recovery from here, and any hints on potential additional stimulus to come, are other likely highlights. The pressure is on the Fed stimulus wise, as negotiations between Democrats and Republicans on the next pandemic relief bill have stalled.

Crypto corner: Bitcoin miners see revenues surge

Bitcoin miners made $368.3 million in revenue last month, while ethereum miners also saw a huge surge in revenues, amid soaring prices for both cryptoassets.

According to a report by cryptoasset website The Block, the climb in bitcoin revenues was the highest figure, when accounting for block rewards and transaction fees, in the past three months.

Bitcoin’s transaction fees grew from roughly 8.5% in July to 10.7% in August, while ethereum’s transaction fees jumped 98% to $285.1 million in revenue in August.

Both coins have seen their prices rocket to multi-month highs in August, with bitcoin peaking at $12,228 and ethereum at $469, before both retreated sharply. This morning bitcoin is at $10,338 per coin, while ethereum is at $364.

All data, figures & charts are valid as of 14/09/2020. All trading carries risk. Only risk capital you can afford to lose.