Good morning everyone,

US stock futures hit their daily down limit of 5% and shares in Asia dived as the first shots were fired in an all-out global oil price war and waves of negative coronavirus news continued to break.

Energy markets were hit with a deluge of information late last week and over the weekend. In Vienna on Friday, OPEC negotiations with Russia fell apart. Russia rejected an agreement on supply cuts to sustain the price of oil. Over the weekend, Saudi Arabia then retaliated by cutting its export prices by over 10%, starting what is likely to be a brutal price war.

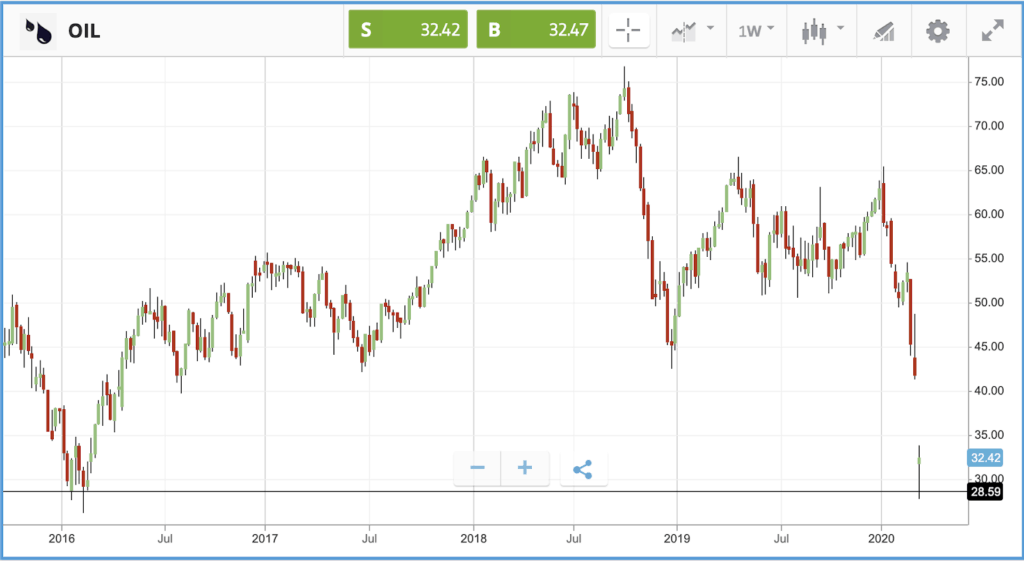

Futures markets reacted violently, with oil sinking more than 25% to around $33 a barrel, touching as low as $31 along the way. There will be significant collateral damage from Russia’s decision, which comes at a time when there are already concerns among oil producers that the coronavirus epidemic will weaken demand. The last time we saw a price war culminate in a price collapse was back in 2016, when there was an attempt to shake out the US shale producers, the intraday low today saw the price get close to this $28 level.

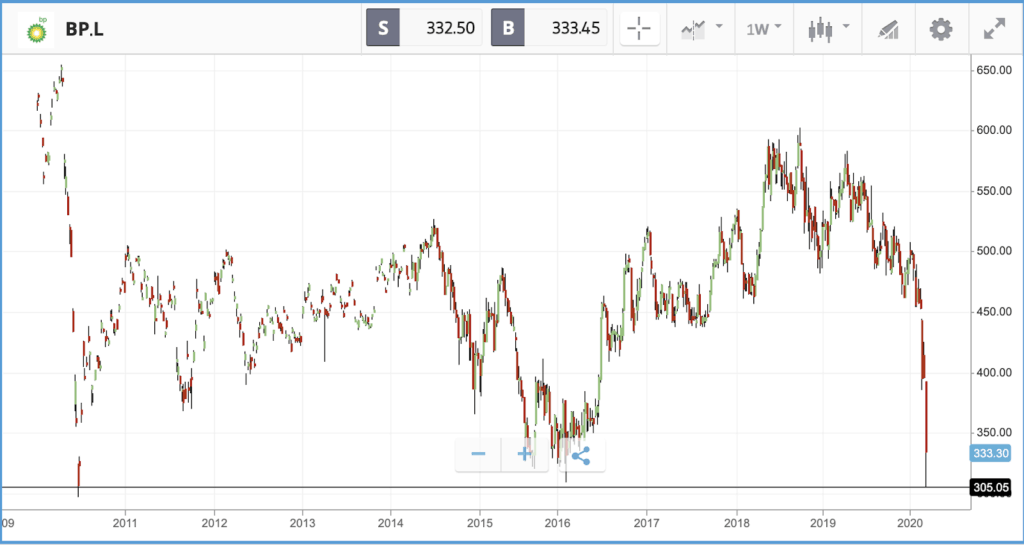

Asian markets have plunged in response, with Japan’s Nikkei closing down 5.1% to leave it close to bear market territory. The commodities-heavy FTSE100 is the benchmark showing the biggest loss for the day, at one point losing over 8%. The index houses oil and mining giants such as BP, Royal Dutch Shell and Rio Tinto, which have been hit hard by the sell off this morning. Investors in BP and Shell in particular, both down over 15%, will now be questioning whether or not the robust dividend the two companies pay out is sustainable. BP’s share price even touched lows last seen during the 2010 Gulf of Mexico oil spill disaster.

Gold held steady in response at $1,665, with government bonds again the main beneficiary of the risk-off trade. The yield on ten-year US Treasuries has dropped to a new record low of 0.33%.

The news has overshadowed positive economic data. US jobs report smashed expectations last week, with the US economy delivering 273,000 new jobs in February versus an anticipated 175,000. This pushed the unemployment rate down to 3.5%, in line with a 50-year low, although the results need to be taken with a hefty dose of salt as the data was gathered before the coronavirus spread increased substantially.

It was Italy that dominated coronavirus headlines over the weekend, after hundreds of deaths from the disease led the authorities to quarantine more than 16 million people in the north of the country.

Markets eke out positive week but Fed rate cut fails to stop the bleeding

Aside from the continued spread of the COVID-19 virus in the US, where cases now number more than 500 with 22 deaths, the Federal reserve’s emergency 50bps rate cut on Tuesday was the biggest market news of the week. Several major asset managers responded with surprise, with $5trn behemoth Vanguard putting out a rare statement which described the move as a premature “high-risk bet.” Edward Jones, a financial advice firm which manages around a trillion dollars, noted the disconnect between lower interest rates and the physical impact virus containment efforts could have on the economy. All three major indices managed to post a positive week, despite heavy selling on Thursday and Friday; from Wednesday’s close to Friday’s close the S&P 500 fell 5%.

One of the biggest winners of the week was $100bn market cap biotech firm Gilead sciences, which climbed more than 15%. It was driven by the fact that one of its drugs is being tested as a potential COVID-19 treatment. The sector is also in focus after presidential candidate Bernie Sanders – who has a nationalised healthcare system as a core policy – came up second best against Joe Biden on Super Tuesday (a key day in picking the Democratic Party’s nominee).

S&P 500: -1.7% Friday, -8% YTD (+0.6% last week)

Dow Jones Industrial Average: -1% Friday, -9.4% YTD (+1.8% last week)

Nasdaq Composite: -1.9% Friday, -4.4% YTD (+0.1% last week)

Supermarket share prices hold up as shoppers stockpile

Both the FTSE 100 and FTSE 250 sold off heavily in the latter half of the week, taking them closer to the 20% fall marker which would denote a bear market. The FTSE 100 is now down 14.3% year-to-date and is close to 16% down since its January peak.

British supermarkets were one standout during the week, with Tesco, Morrisons and Sainsbury’s all closing the week higher as shoppers start to stockpile essential items in the face of the continuing epidemic. Over the weekend, Tesco announced it is limiting the number of essentials customers can buy, including dry pasta, antibacterial gel, tinned vegetables and more.

On Friday, miners and oil firms were the biggest losers, dragging the FTSE 100 down 3.6% for the day. There were only four companies among the UK’s 100 largest that posted a positive day, led by International Consolidated Airlines Group, which rallied by 2% after falling more than 15% in the earlier part of the week.

FTSE 100: -3.6% Friday, -14.3% YTD (-1.8% last week)

FTSE 250: -3% Friday, -14.3% YTD (-3% last week)

Stocks to watch

Chewy: Online pet food retailer Chewy went public last June at $22 a share, hitting $37 shortly after before sinking back to its $28 Friday close. As with many recent multi-billion dollar IPOs, the firm is still loss making, and analysts will likely probe management on the progress being made on the route to becoming profitable when the company reports its Q4 earnings on Monday. Cost controls are likely to be front and center. Last quarter, the company posted a loss that was larger than analyst expectations, with cost increases outweighing better-than-expected revenues. On the firm’s Q4 earnings call, management highlighted investment into Chewy Pharmacy, which they said is the fastest growing unit in the company.

Vail Resorts: Ski resort company Vail Resorts has been hit hard by the coronavirus epidemic, with its share price falling more than 20% since February 21st. On March 5th, the firm put out a statement saying its resorts are all open and operating normally, along with the precautions it is taking as a company. The epidemic is likely to be front and center of Vail’s quarterly earnings update on Monday, along with its continued integration with Peak Resorts which it acquired last year. Currently, seven analysts rate the stock as a buy, and five as a sell.

US election focus

Amid the coronavirus bedlam, the race to become the Democratic Party’s nominee for president is heating up. Incumbent Donald Trump is the odds on favorite, but Joe Biden’s stock has been rising following his Super Tuesday surge, with Bernie Sanders faltering. Wall Street is very much viewing this as having avoided a worst case scenario. Sanders’ policies revolve around heavily taxing corporations and wealthy individuals, and ploughing that money into education and health care. Biden is far more moderate, with fundraising support from the financial sector, although he may still roll back the corporate tax breaks brought in by Trump. Irrespective of the ongoing coronavirus epidemic, election years can be volatile for stock markets. Here’s a useful breakdown of how stock markets have handled election years in the past.

Crypto corner:

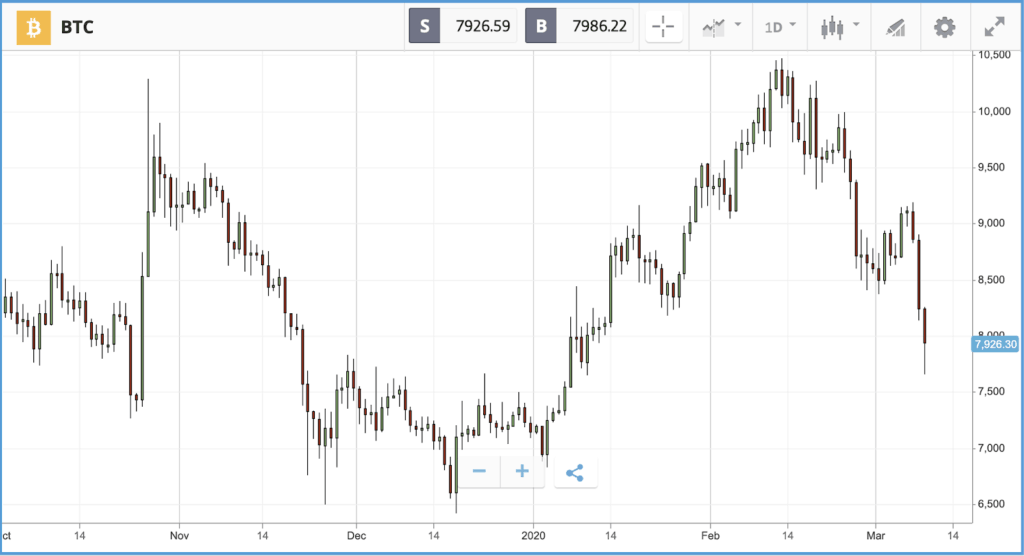

Crypto assets endured a sharp sell-off over the weekend to leave them near 6-month lows as the panic spreading across equity and commodity markets continues to feed through to the sector.

Bitcoin plunged from $9,112 to $7,872, off 4.4% today alone, while Ethereum dived to $20, having been at nearly $240 on Friday. XRP suffered the same fate, off from $0.24 to $0.205 this morning.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.