Good morning everyone,

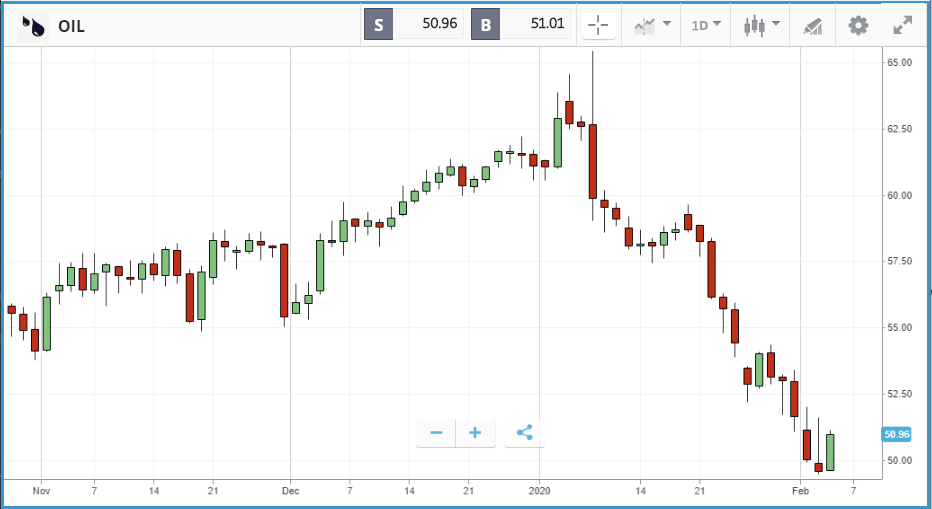

After seeing prices slashed by 20% from its 2020 peak, oil has started to put up a bit of a fight on hopes that OPEC may intervene and cut output by 500,000 barrels per day due to the impact of the coronavirus. US crude is up just over 2% today at $50.83 per barrel at the time of writing.

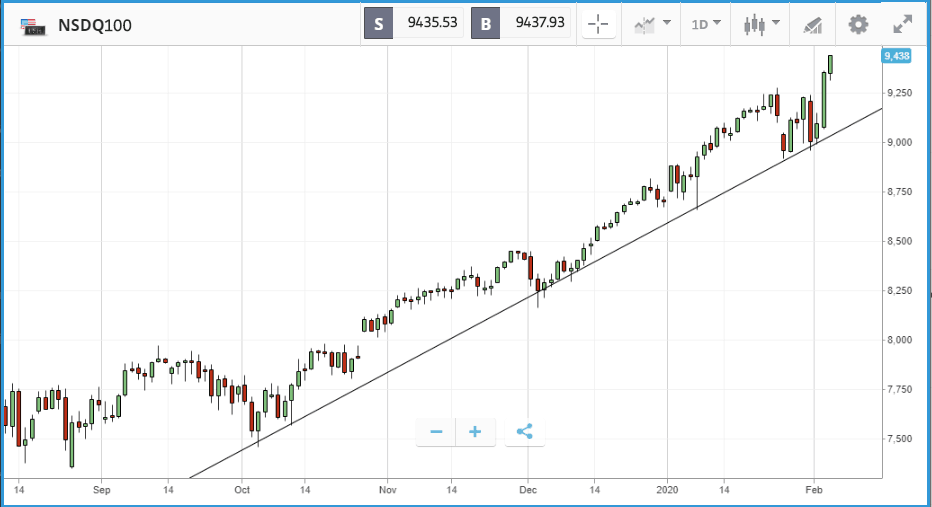

Markets have been lapping up the People’s Bank of China stimulus, in particular the Nasdaq, which posted record highs yesterday. Futures are pointing towards another positive open with all 3 US indices up 0.9-1.1%. With China hinting that further stimulus could be forthcoming, we could see this rally continue barring any significant deterioration with the coronavirus situation.

Barratt raises the roof with higher half year profits

Barratt Developments, Britain’s biggest house builder, reported a 3.7% rise in pre-tax profits for the last six months to the end of December, up to £423 million. During the period, the firm said it sold its highest number of homes compared with similar periods over the last 12 years, selling more houses at lower prices.

Conversely, competitor Redrow reported a 15% fall in profits this morning, blaming Brexit uncertainty. Pre-tax profits fell to £157m, while revenues dropped by 10% to £870 million. Describing performance as “robust”, Redrow said Brexit had slowed the time it took to sell homes, particularly in complicated selling chains. However, reservations for new builds had risen by 18%.

Pepco, the owner of discount chain Poundland, reported strong revenue growth in its first quarter and said it was confident of further growth across the rest of the year. Revenues for the group, which also includes European brands Dealz, rose 13.3% to $1.2bn, partly driven by new store openings. Like for like revenue grew by 3.9%.

New York Stock Exchange owner makes $30bn move for eBay

In US stocks, the owner of the New York Stock Exchange, Intercontinental Exchange Inc, has reportedly made an offer to buy eBay for more than $30bn. The news was met with mixed reactions by investors in the two firms. ICE has been a serial acquirer, picking up several businesses in recent years, but investors did not show confidence in the prospects for the eBay deal. ICE’s share price fell 7.5% after the news broke. Shares in eBay gained 8.8% after falling double digits over the previous six months. The online retail market has been under pressure from hedge funds and activist investors to offload its classified ad business and StubHub to focus on driving growth in its core business. For ICE, the value in a deal would be in the marketplace business, not classified ads, as while the consumer sphere is new territory the firm has transferable experience from running financial marketplaces.

Tesla posts another huge day, and lithium stocks follow it higher

Tesla posted another monster day on Tuesday, climbing 13.7% as US markets continued their bounceback from Friday’s selloff. The electric carmaker’s share price is now up more than 56% in the past five trading days alone, and 112% since the start of the year. All three of the major US indices posted strong gains, with the Nasdaq Composite leading the way at 2.1%, topped by Tesla and eBay. The S&P 500 climbed by 1.5%, with lithium producer Albermarle top of the pile after jumping 11.9%. Albermarle was one of a number of firms involved in battery production to post gains on Tuesday, after Panasonic reported that its joint battery venture with Tesla has delivered its first quarterly profit. Fashion brand Ralph Lauren was another winner, climbing 9.2% after beating both profit and revenue estimates, although the firm noted that its forward looking projections have not yet taken into account the impact of the coronavirus epidemic. CEO Patrice Louvet said that the potential financial impact was still being assessed, and said that the company has shut half of its 110 stores in China. In after-hours trading, Ford fell around 10% after posting a loss for the fourth quarter.

S&P 500: +1.5% Tuesday, +2.1% YTD

Dow Jones Industrial Average: +1.4% Tuesday, +0.9% YTD

Nasdaq Composite: +2.1% Tuesday, +5.5% YTD

BP helps take the FTSE 100 higher

The FTSE 100 gained 1.6% yesterday, driven higher by oil giant BP and mining names including Evraz, Glencore and Anglo American. BP climbed 3.6% after beating its earnings projections and increasing its dividend despite a falling oil price and recent lackluster updates from other major oil names. Despite the continuing coronavirus epidemic, International Consolidated Airlines Group and InterContinental Hotels Group both gained more than 3%. The two stocks have been among the hardest hit by the crisis. While the FTSE 250 climbed 1.3%, constituent Micro Focus lost 21% thanks to a massive profit drop and the resignation of chairman Kevin Loosemore. This is the third double digit step down in the software company’s share price over the past year, and it is now more than 60% off its 2019 peak. This is the second time it has posted a peak to trough fall of that magnitude in the past five years. Part of the problem has been Micro Focus’ acquisition of a portion of HP Enterprise in a £6.9bn deal back in 2017. The acquisition tripled its headcount, but proved to be more than it could handle from a technical standpoint.

FTSE 100: +1.6% Tuesday, -1.4% YTD

FTSE 250: +1.3% Tuesday, -2% YTD

Stocks to watch

Pharma giants: Two pharmaceutical giants will report earnings this morning New York time. NYSE-listed Merck & Co has trailed the broader market over the past 12 months with a 14.5% gain. Last quarter the company posted a huge earnings beat and raised its forecasts, after sales of immunotherapy drug Keytruda passed $3bn in a single quarter. GlaxoSmithKline, which is listed in both London and New York, has marginally outpaced Merck’s share price, and offers a higher dividend yield. Given GSK’s London headquarters, Brexit is likely to be a feature of its earnings call.

Qualcomm: Chipmaker and telecoms equipment firm Qualcomm has had a big year, gaining more than 75% over the past 12 months. The potential growth that 5G technology offers the company will certainly be a focus on its Wednesday earnings call, and analysts will be sizing up the market share in chips for 5G smartphones that Qualcomm might be able to capture. Wall Street analysts currently have an average 12 month price target on the stock of $100.91, versus its $88.93 Tuesday close.

Spotify Technology: Audio streaming specialist Spotify has had a difficult year, with its 10.7% gain over the past 12 months well behind the broader market. At $154.31 on Tuesday, the company’s share price is still below the $190 plus peak the company hit in the months following its 2018 IPO. Spotify reports its Q4 2019 earnings today, having not yet delivered a profitable year in its history. At present, 17 analysts rate Spotify as a buy or overweight, nine as a hold and four as an underweight or sell.

Crypto corner

Bitcoin is sitting at around $9,200 this morning as some commentators suggest that consumer sentiment has become exhausted following talk of a bull run last week. BTC hit a three month high of $9,600 on Monday, but has fallen since then.

It has been suggested that this ‘fatigue’ amongst buyers could indicate the start of a reversal in prices for the cryptoasset. As we highlighted yesterday we would want to see the upward trendline of 2020 broken to validate this scenario. Alternatively if the support holds, there could be a fresh bounce if buying sentiment returns.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.