Hi Everyone,

Of course the stock market rose while Jerome Powell delivered his speech yesterday. A big part of his job is making sure investors are happy. What wasn’t expected though was the impact his words may have had on bitcoin.

In this graph, the purple rectangle is the precise time of the speech. The Nasdaq (blue line) was the best performing stock index at that time. Within a few hours of the speech, we can see that bitcoin had an even bigger rise.

Did bitcoin rise because Chairman Powell was laying the groundwork to introduce fresh liquidity into the system?

Somehow I don’t think so. But it is fun to track.

Today’s Highlights

- More and more and more stimulus

- Bitcoin Interest

- Russia Getting Closer

Traditional Markets

Chairman Powell did a fairly good job of keeping things boring at last night’s meeting. In many ways, he’s keeping his options open here.

The US economy is doing pretty well overall, but as we’ve seen there are some serious warning signs ahead. Powell is doing his best to explain that he’s happy to react to any sudden downturn in the economy with additional stimulus but that that doesn’t necessarily have to happen.

Still, markets are taking this as a very dovish tone. Volatility is now at the lowest point it’s been since early May and we’re seeing huge gains across all assets.

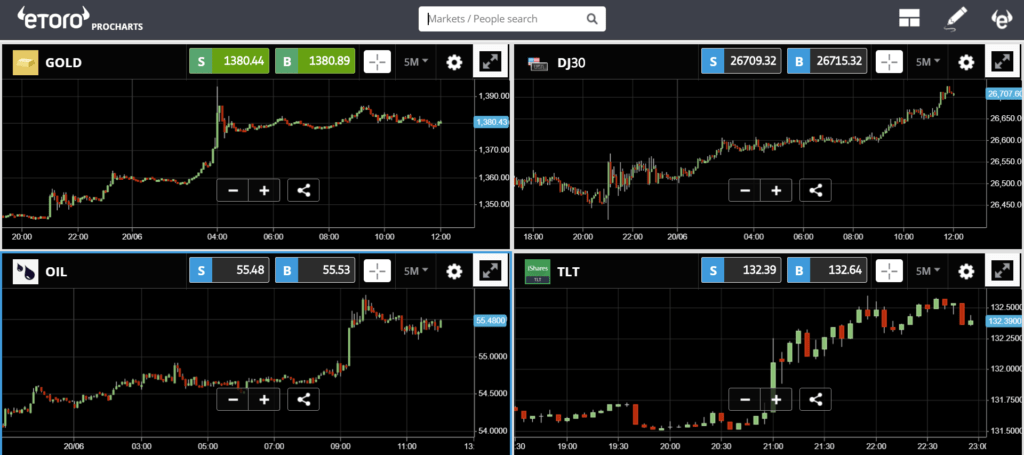

Gold, Oil, Stocks, and Bonds are all up since the speech.

Bitcoin Interested

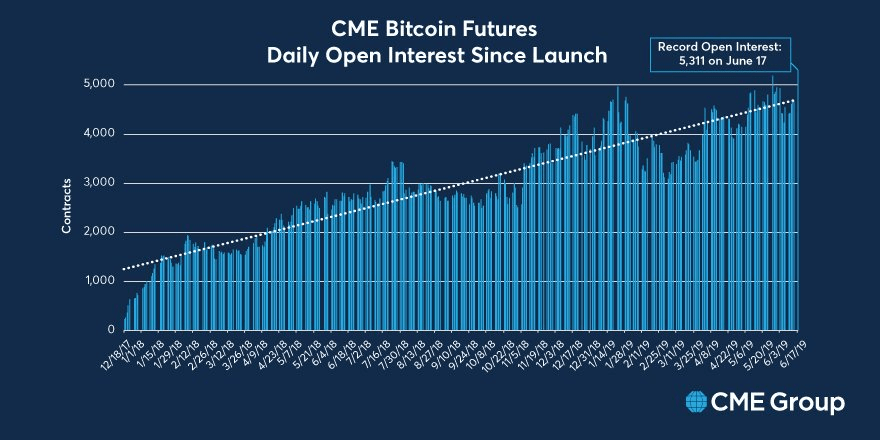

What this shows is that ever since the bitcoin futures were launched in December 2017, CME has been seeing steadily increasing activity and demand for this product.

Open interest represents the number of contracts that are open on a specific asset on a given day. This is a bit different than volume because volume only shows the amount traded, while open interest includes all of the positions currently being held.

According to Investopedia, a rise in open interest that corresponds with a price increase is generally taken as a bullish sign. On Monday, the Bitcoin futures on the CME hit a record high open interest.

Crypto Overview

After facing calls for a halt from US lawmakers it seems that Libra coin will soon come in for closer scruitiny.

A hearing in Congress is now set for July 16th. Personally, I’m looking forward to seeing Facebook execs try and explain blockchain technology to the elderly Senate Banking Committee. This can only be good for the industry.

Meanwhile in Russia, lawmakers have now stated that the crypto regulation bill they’ve been working on could possibly be signed by July 4th. It’s interesting to see this news coincide with this tidbit…

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.