European markets have opened fairly flat this morning as investors may be apprehensive amid second wave fears as many nations, including Britain have imposed new restrictions. The quarantine imposed on travellers returning from Spain has put the European tourism reopening under threat this summer (more on how this affected travel stocks below). Elsewhere other nations have reimposed some lockdown restrictions including Hong Kong banning gatherings of two or more people.

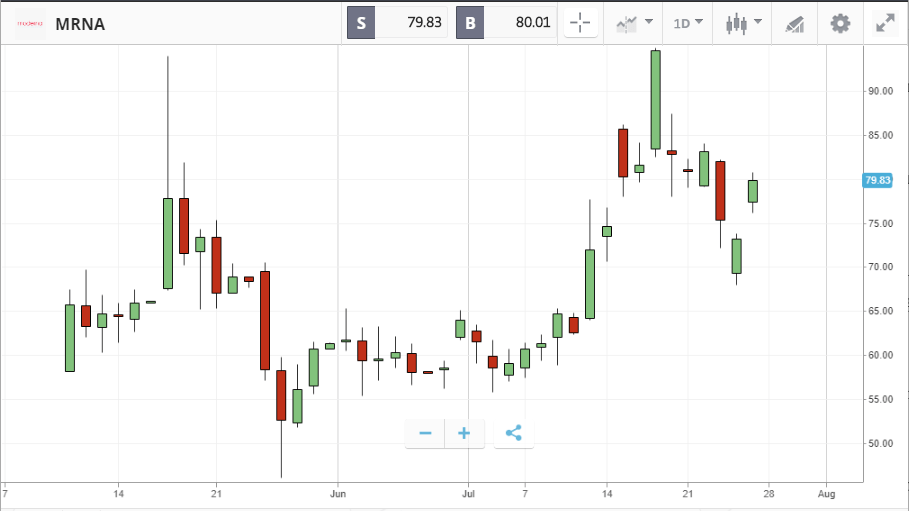

There may still be hope yet, US stock markets climbed on Monday as both Moderna and Pfizer’s Covid-19 vaccines entered phase three trials, where test subjects will receive doses of the vaccine. Both firms plan to enroll 30,000 healthy people for the crucial testing rounds, which will aim to test for both the efficacy of the vaccines and any side effects. For the sectors of the stock market that have been hardest hit by the pandemic, including the retail, financial and travel sectors, an effective vaccine is a crucial component on the road to normality. Pfizer and Moderna’s share prices have diverged hugely in 2020; $209bn market cap Pfizer is down 4.2% year-to-date, while $28bn Moderna has soared by more than 300%.

Investors also had to digest Republican lawmakers’ proposal for a $1trn stimulus plan, which looks certain to lead to a confrontation with Democrats. The plan includes cutting emergency unemployment benefits dramatically, a new round of direct payments to individuals, and funding for small business loans — but no major support for state and local governments running low on cash. There are several points of contention, but broadly speaking Democrats argue that it falls far short of what is needed.

Intel overhauls management after development debacle

Tech stocks regained some of their shine in the US on Monday, with the information technology sector leading the S&P 500 to a 0.7% daily gain. It was not all smooth sailing in the tech sector, however. Intel announced an overhaul of its leadership following the revelation that it is a year behind in the development of its next generation of chips. Murthy Renduchintala, who was in charge of all US manufacturing and engineering, has left the firm, with Ann Kelleher taking up the hot seat. Intel also recently lost high-profile head of design engineering Jim Keller, who quit last month. Keller had built a reputation for product breakthroughs at several chip companies, including Tesla, per the FT. Intel stock fell 2% on Monday, following its double digit collapse last week.

Pharmaceutical names dominated the top of the S&P 500 on Monday, with Alexion, Biogen and Regeneron among the top 10 performers. All three closed out the day around 5% higher. Of the major stock indices, the Nasdaq Composite delivered the best day, led by Tesla, which climbed 8.7% after reports that the firm may be about to reveal new battery technology.

S&P 500: +0.7% Monday, +0.3% YTD

Dow Jones Industrial Average: +0.4% Monday, -6.9% YTD

Nasdaq Composite: +1.7% Monday, +17.4% YTD

Airline stocks hit by quarantine news

London-listed stocks started the week in the red, with the travel sector taking the market lower after the British government introduced a 14-day quarantine for travellers coming in from Spain. In the FTSE 100, International Consolidated Airlines Group (IAG) fell 5.9% and Intercontinental Hotels Group closed 4% down. In the FTSE 250, easyJet sank by 8%, travel firm TUI fell by 11.4%, and cruise firm Carnival sank 8.4%. The CEO of Ryanair, Michael O’Leary, accused the government of panicking and said the quarantine order was a “badly managed overreaction.”

Major gains posted by mining stocks helped temper the FTSE 100’s losses, with Fresnillo and Polymetal International both closing out the day more than 7% higher. Miners were buoyed by the soaring price of gold, which is fast closing in on $2,000 an ounce as investors pile into perceived safe havens amid concerns that the continued march of the Covid-19 pandemic will threaten the global economic recovery.

FTSE 100: -0.3% Monday, -19.1% YTD

FTSE 250: -0.6% Monday, -21.6% YTD

What to watch

Advanced Micro Devices: Chipmaker AMD’s earnings report today will be one of the most interesting to watch this week, given its major rival Intel now finds itself under huge pressure after revealing a major delay in delivering its next gen chips. There has not been much time since the revelation and AMD’s earnings, but investors will want to know how AMD management plans to capitalise on the opportunity to leapfrog its biggest competitor. AMD’s share price has soared 20% over the past five trading days, and is now up more than 50% year-to-date. Currently, 14 Wall Street analysts have a buy or overweight rating on the stock, 19 have a hold and three have a sell.

Visa: Global payments giant Visa has added 4.8% to its share price this year; while it is losing out on processing fees from retailers and other physical merchants, the surge in demand for online shopping and increased percentage of spending on card over cash has helped support the business. Analysts will likely probe management on how the company has profited from increased online purchase volumes when the company reports its latest quarterly earnings today. Currently, Wall Street analysts lean heavily in favour of a buy rating on the stock.

Pfizer: Pfizer’s earnings report will also be closely watched today, given the pivotal role the firm is playing in the hunt for a Covid-19 vaccine. The company’s share price is in the red year-to-date, and analysts are likely to broach the sensitive topic of how Pfizer might price its Covid-19 vaccine if it makes it through the remaining testing and regulatory hurdles. Pricing a vaccine will be difficult, given the high chance of a PR backlash if the public perceives it to be too high, and the likelihood of investors pushing back if pricing comes in too low. Currently, analyst price targets for Pfizer stock range from $35 to $53, versus its $37.54 Monday close.

Dozens of firms with a $10bn plus market cap report earnings in the US today, including McDonalds, Starbucks, Amgen, Ebay and more.

On Wednesday in the UK, GlaxoSmithKline and Rio Tinto will report their quarterly earnings.

Crypto corner: Bitcoin extends rally as cryptoasset breaches $11,000

Bitcoin continued its good run of form today, hitting a high of $11,420 before retreating slightly late in the day. The price of the cryptoasset is up amid stock market jitters around coronavirus second wave fears.

Bitcoin is now up nearly 20% in the past seven days, and has hit its year-to-date high. However, it is yet to beat its 12-month high of $12,320, posted on 6 August last year. According to Cointelegraph, on-chain exchange volume activity is likewise soaring amid the price breakout.

The two other major global cryptoassets, Ethereum and XRP, have likewise rallied in the past week. Ethereum is up 34% in the past seven days, now trading at $318, while XRP has risen 14%, now around $0.22.

All data, figures & charts are valid as of 28/07/2020. All trading carries risk. Only risk capital you can afford to lose.