Get a jump on your trading with pre-market access on eToro! We’ve added extended-hours trading for select US stocks, with more on the way soon.

Let’s take a look at how it works and how to take advantage of this trading feature in your own portfolio.

What is extended-hours trading?

Standard trading hours take place when the stock markets are open, typically 9:30 a.m. to 4:00 p.m. EST in the United States. Any trading outside of open market hours — either before or after — is called extended-hours trading.

eToro will be offering pre-market trading, i.e., trading before the market opens. Pre-market orders may be set at any time, but will be executed from 6:30 a.m. to 9:30 a.m. US EST (10:30–14:30 GMT).

What are the benefits of extended-hours trading?

There can be a number of reasons investors would want to take advantage of extended-hours trading:

- Take action on pre-market news and earnings: Many companies release earnings reports and other significant news outside of standard trading hours, leading to price changes which investors may want to react to pre-market.

- Enjoy greater flexibility: Trade when it’s convenient for you, on your schedule. Investors in other time zones (particularly in the UK and Europe) may find US pre-market hours more convenient for executing trades.

- Take advantage of price movements: With lower trading volumes and higher volatility more common in extended-hours trading, there can be more opportunities to purchase stocks at lower prices or sell at higher prices.

- Get ahead of the game: Trading data during extended hours can provide insights into the potential opening price of a stock, which can help traders prepare and form strategies for the coming day.

Is extended-hours trading riskier?

Because there is generally less trading volume during the extended-hours market, price moves can sometimes be more volatile or less representative of broader market sentiment. Here are a few things to watch out for during extended-hours trading:

- Lower liquidity: There are typically fewer buyers and sellers during extended hours, which can mean lower trading volumes and wider bid-ask spreads that could make it harder to execute trades at desirable prices.

- Higher volatility: Lower liquidity can also lead to greater price volatility, with the potential for rapid and significant price moves.

- Increased competition: Extended-hours traders may also be competing with professional traders and institutional investors who have access to more resources.

- Influential news: Companies may make financial updates and other announcements during extended hours which, combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on stock prices.

- Wider spreads: Lower liquidity and higher volatility in extended-hours trading may result in wider than normal spreads (the difference in price between what you can buy a security for and what you can sell it for).

Which stocks will be available for extended-hours trading?

Currently 45 stocks and two ETFs, chosen for their popularity and high trading volumes, are available for pre-market trading at this stage. You can view them here.

Stay tuned, as we plan to continue adding more assets.

What is an EXT symbol?

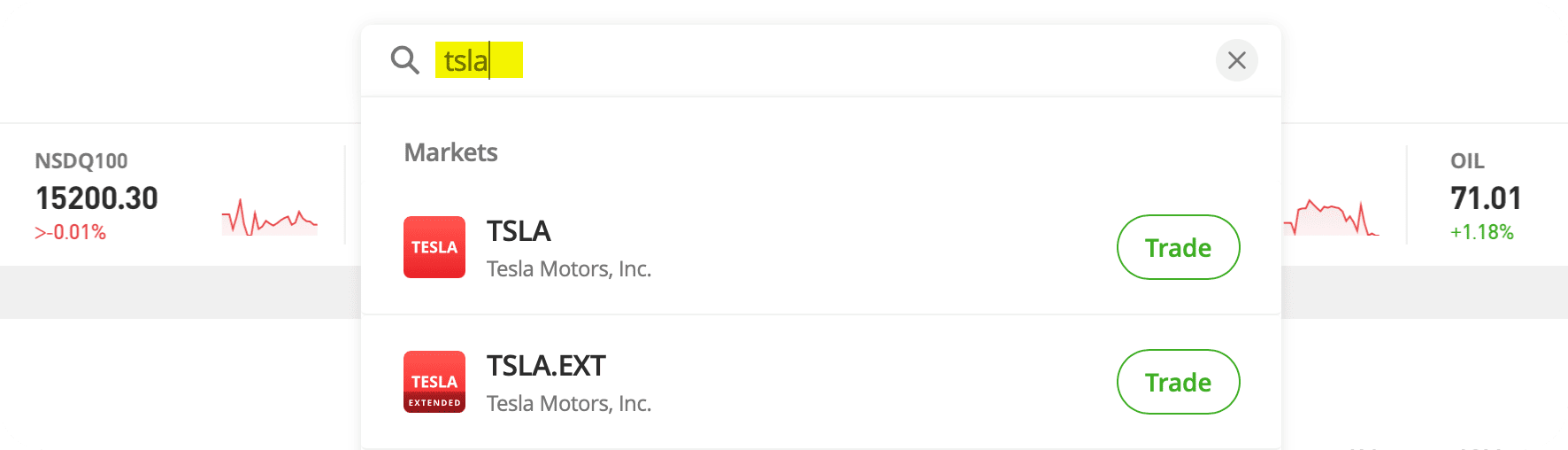

It’s important to note that pre-market trades can only be made on a stock via its EXT counterpart. This is a separate symbol which ends in .EXT as seen in the example below:

- Regular symbol: AMZN

- Extended-hours symbol: AMZN.EXT

Trades via regular stock trade symbols (without .EXT) will be executed during regular market hours.

How to trade EXT stocks

EXT stocks can be accessed in a number of ways on the eToro platform:

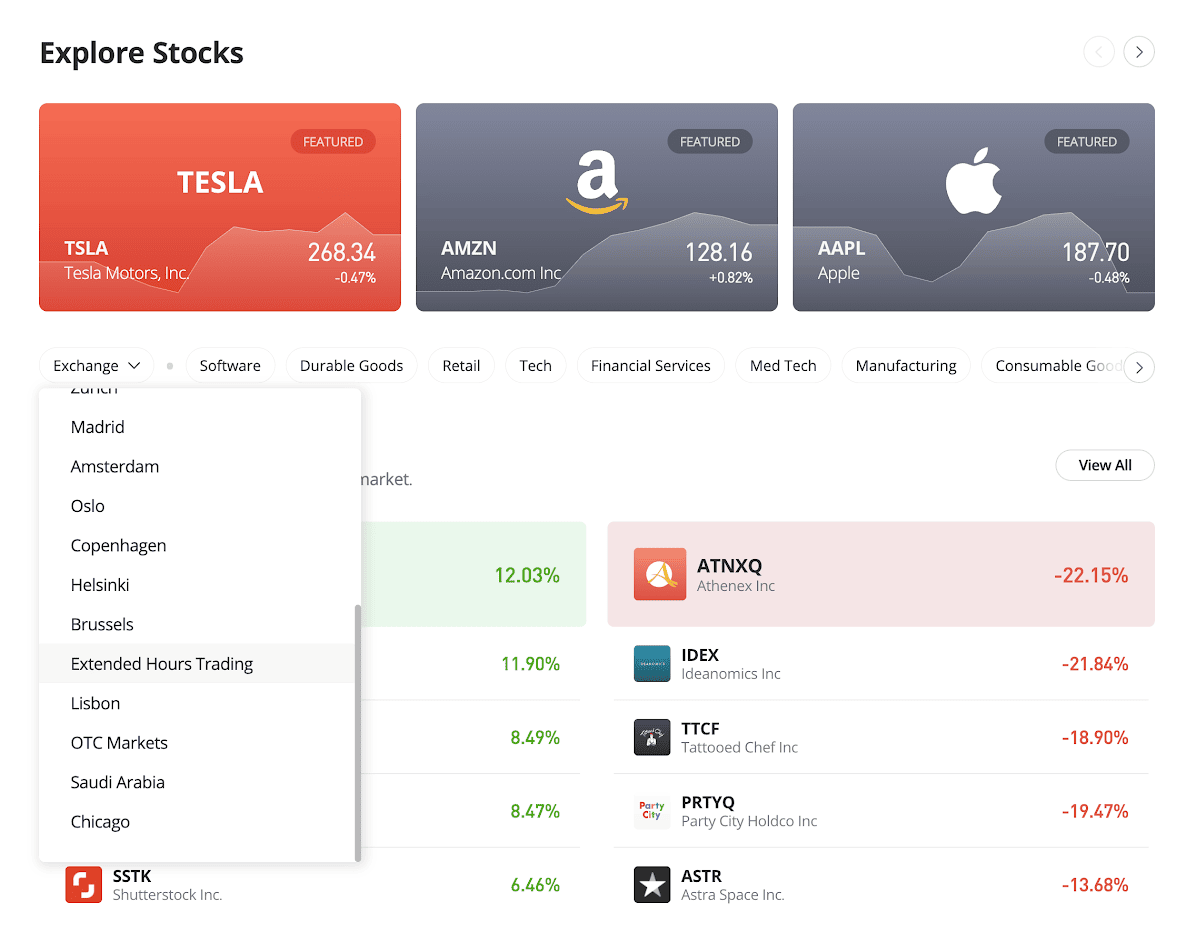

- Discover page: Access extended-hours assets through the Exchange drop-down menu on the Discover (Stocks) screen:

- EXT Market Page: The extended-hours stocks are listed on a dedicated market page.

- Search: Enter the stock name in the search bar, and if the asset has an EXT counterpart, it will appear along with the regular stock in the results:

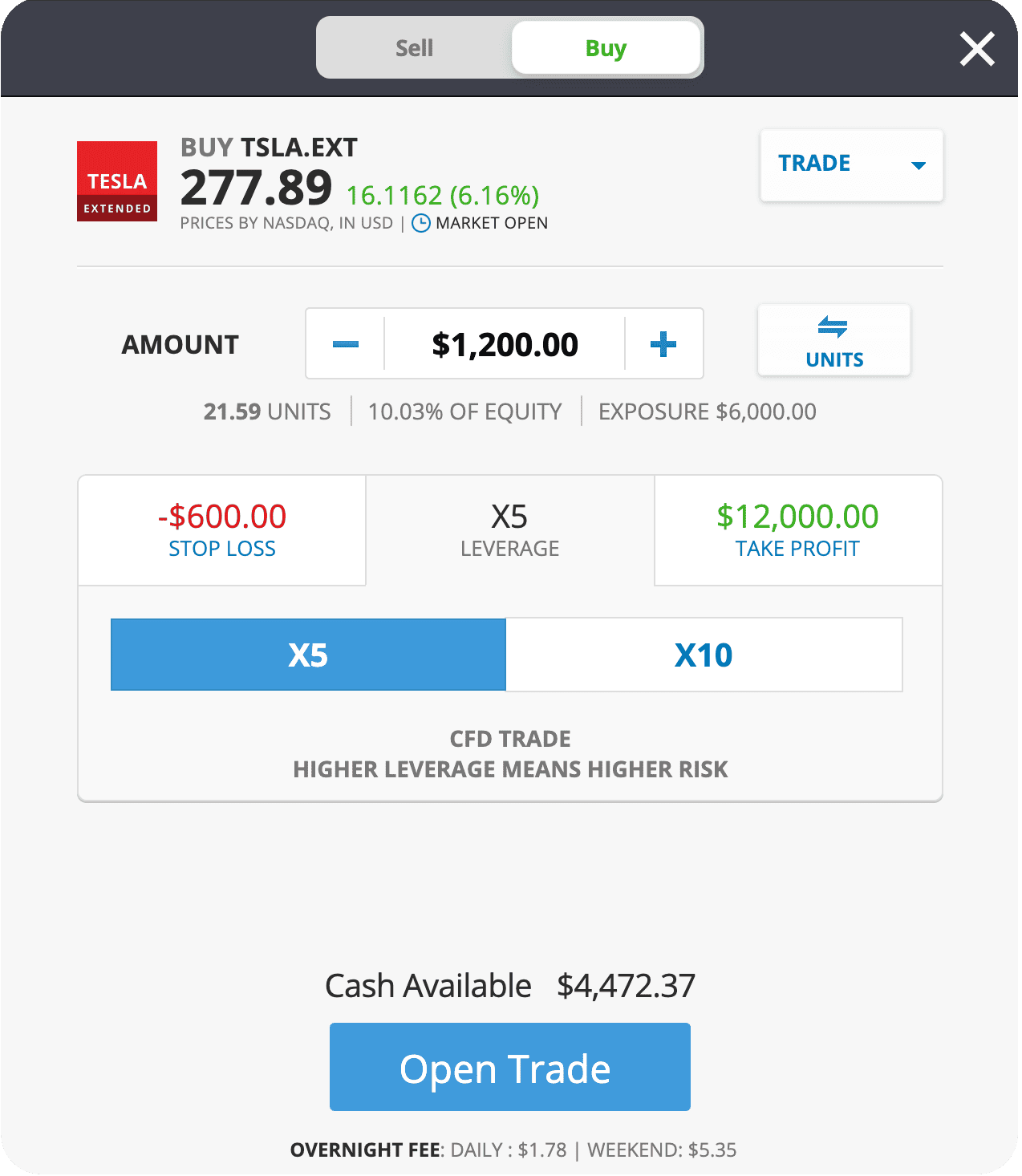

Once you have located the EXT stock you wish to trade, the process is similar to a regular CFD trade, where you can choose to buy long or sell short:

It is important to note that EXT positions are executed as CFDs, at x5 leverage.

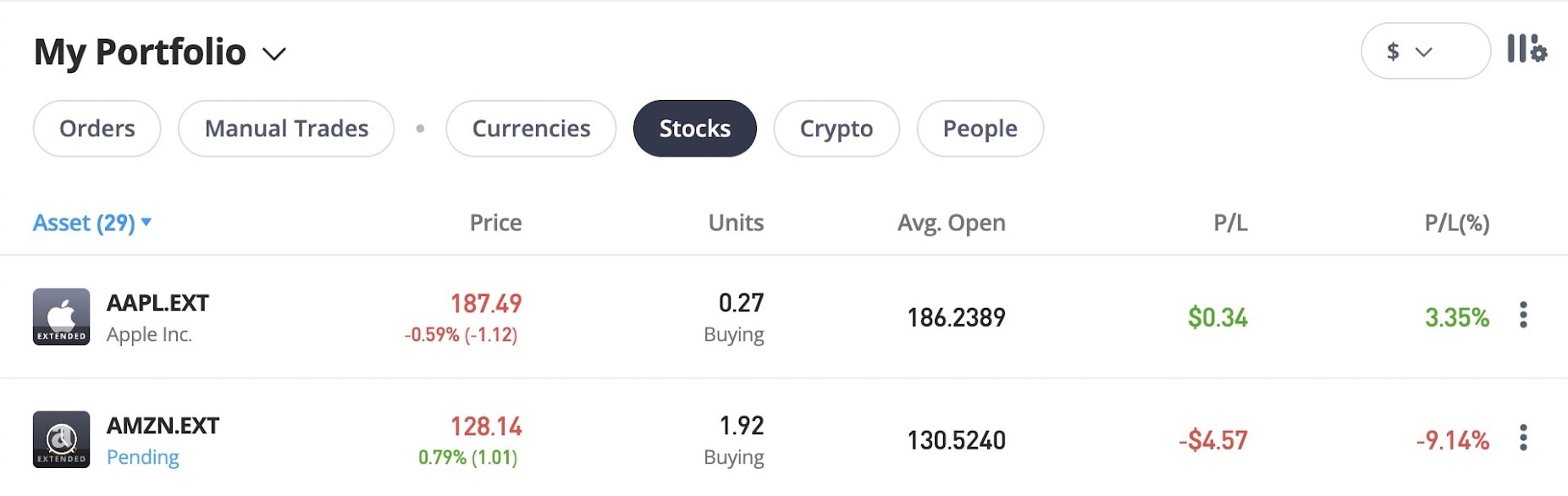

Upon execution, the open EXT position will be shown as a separate asset in your portfolio, like so:

Note that EXT market orders may be placed prior to 6:30 a.m. to be executed at pre-market open.

Limit orders, stop-loss and take-profit parameters on an EXT position will trigger automatically during the pre-market or regular market hours if the assigned price target is hit.

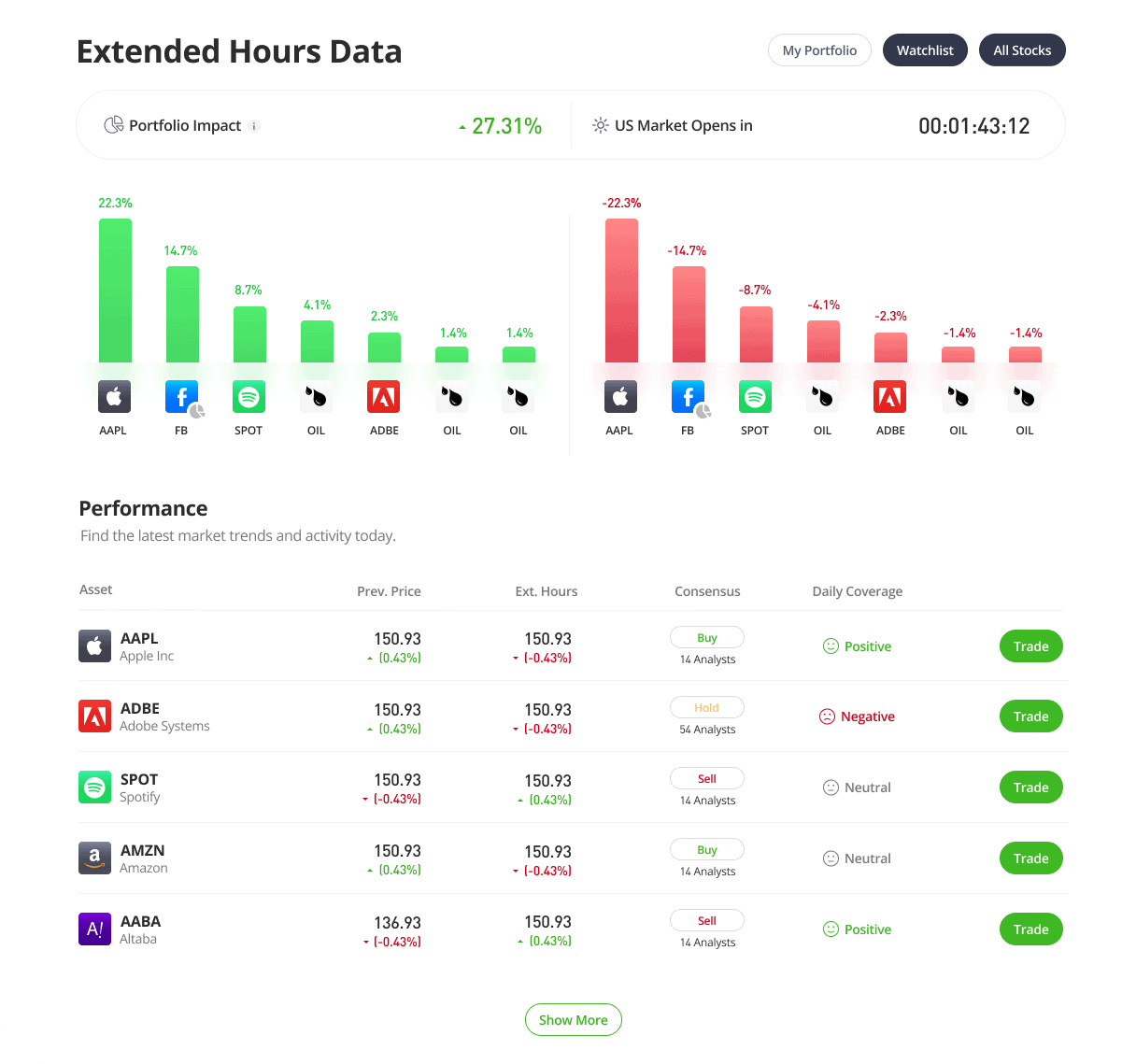

Where can I find extended-hours pricing?

Users can find live extended-hours pricing for all US stocks and ETFs (not just the EXT symbols) during both pre-market and post-market periods.

There is an extended-hours widget, which appears when the market is closed, located on the platform’s home screen:

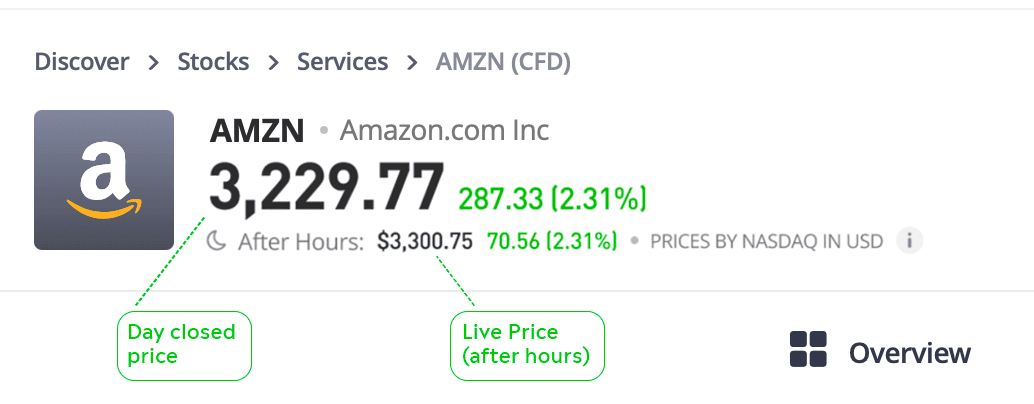

Live after-hours prices are also viewable on the individual asset’s page:

Note that live pricing on the asset page does not indicate that the stock is available for pre-market trading. Only EXT assets are, as described above.

Extended-hours products may be subject to additional risks. Further details of these risks may be found here.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.