The impact of the coronavirus on the UK’s income-producing stocks was in focus this morning after the release of the latest quarterly dividend monitor.

The report, from investor services business Link Group which tracks payouts from UK companies every quarter, showed a fall in dividends of £22bn in Q2. It is the lowest quarterly dividend figure since 2010 and a 57% drop compared to the second quarter last year.

More broadly, markets got off to a mixed start for the week as EU leaders failed to reach agreement over the size of a coronavirus recovery fund on Sunday night.

Japan’s benchmark Topix index was up marginally, while Hong Kong’s Hang Seng was flat, but China’s markets jumped amid expectations of further government support. China’s CSI 300 index of Shanghai- and Shenzhen-listed stocks jumped 2.6% on Monday, as the government hinted it would provide more stimulus to markets.

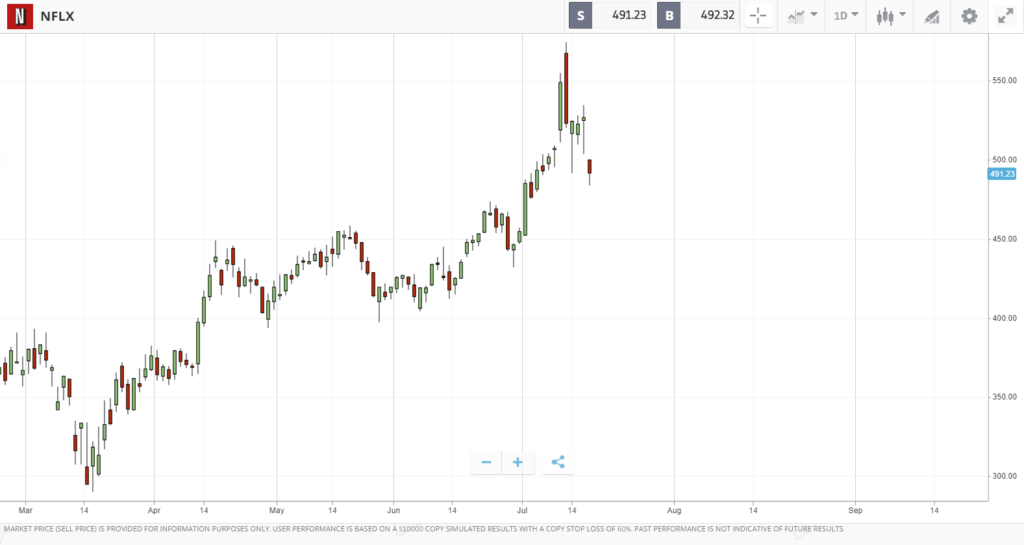

The gains come after the all-important earnings season kicked off last week in the US. Amid some mixed results, Netflix was in focus on Friday. Despite reporting a massive uptick in user numbers, the streaming giant sank 6.5% on Friday after missing analyst profit expectations and providing investors with a weak outlook for third quarter subscriber growth. Management said that as consumers pass through the shock of the pandemic, and social restrictions ease, the rate of new adopters will slow. In Q3, Netflix said that it expects to add 2.5 million net subscriber additions, after adding 10 million in the second quarter. For context, last year the company added 28 million subscribers in total.

BlackRock enjoyed a better day after posting its own quarterly results on Friday. The $91bn market cap firm gained almost 4% after announcing that it reeled in $100bn in new client cash during Q2, with net profits up 20% year-over-year despite revenue only climbing 3%. Currently, the asset management business is a mixture of haves and have nots; the largest scale players, plus some small specialist boutiques, are having the greatest success. BlackRock is the world’s largest asset manager, and one of the more richly valued. Its stock trades at a price-to-earnings ratio of around 20, per Zacks Equity Research, versus 10 for the investment management industry as a whole.

Tech stocks fall back, banks set aside $30bn plus for loan losses

The Dow Jones Industrial Average and S&P 500 both posted gains last week, with positive sentiment around progress towards a Covid-19 vaccine outweighing mixed earnings reports and surging case numbers. Value stocks outperformed growth during the week, with losses from some of the major tech stocks dragging the Nasdaq Composite down 1.1%. Amazon fell 7.4% over the course of the week, Microsoft lost 5.1%, and Tesla’s recent mammoth rally took a pause with the electric carmaker dropping 2.8%.

Banks were the stars of the show during the first week of Q2 earnings season. JPMorgan, Citi, Goldman Sachs, Morgan Stanley, Bank of America, Wells Fargo, BNY Mellon and more all reported. While the large banks collectively set aside more than $30bn in provisions for expected loan losses, some were buoyed by huge jumps in trading and underwriting revenue. Analysts polled by FactSet anticipate that S&P 500 company earnings will come in 44% lower during Q2 2020 than the same quarter last year, according to investment firm T. Rowe Price.

S&P 500: +0.3% Friday, -0.2% YTD (+1.3% last week)

Dow Jones Industrial Average: -0.2% Friday, -6.5% YTD (+2.3% last week)

Nasdaq Composite: +0.3% Friday, +17.1% YTD (-1.1% last week)

British large caps beat small, BA announces end of the line for 747

British large-cap stocks outpaced their smaller siblings last week, with the FTSE 100 finishing the week 3.2% higher, while the FTSE 250 fell 1%. On Friday, it was mining stocks that helped the FTSE 100 higher. Fresnillo, BHP Group, Rio Tinto and Antofagasta were all among the best dozen stocks in the index, gaining between 2.3% and 4.6% on Friday.

In the FTSE 250, Aston Martin Lagonda was one of three stocks to post a double-digit daily gain to close out the week. The firm’s share price climbed 11.8% on Friday but remains down 65.5% year-to-date and 81.9% over the past 12 months.

British Airways, owned by London-listed International Consolidated Airlines Group, hit headlines on Friday, after announcing that it will be retiring all 31 of its iconic Boeing 747 jumbo jets with immediate effect, due to the pandemic travel downturn. The aircraft are 10% of BA’s fleet and had been scheduled for retirement in 2024.

FTSE 100: +0.6% Friday, -16.6% YTD (+3.2% last week)

FTSE 250: +0.2% Friday, -20.7% YTD (-1% last week)

What to watch

Cadence Design Systems: CDS, a $28bn market cap electronics design and engineering services business, has enjoyed a share price gain of 44.5% in 2020 so far. During Q2, the firm announced a collaboration with Taiwan Semiconductor and Microsoft, in order to use cloud technology to reduce the signoff schedules for new semiconductor designs. The company reports its latest set of quarterly earnings on Monday after the market closes. Currently, Wall Street analysts are split evenly between buy and hold ratings on the stock.

Halliburton: Oil field service firm Halliburton’s share price has been hammered this year and remains down 47% overall despite a 73% rally over the past three months of lows. This year has been difficult for oil service stocks, given the huge drop-off in demand for oil products due to widespread lockdowns. In general, the more drilling there is going on, the better for firms such as Halliburton. The company reports its Q2 earnings on Monday, analysts are expecting a loss of $0.11 a share. One topic certain to be raised by analysts is the recent announcement from the Opec-Russia oil alliance that members will begin increasing production again in August following historic supply cuts to boost the price of oil. Currently, 11 analysts rate the stock a buy or overweight, 18 as a hold and two as a sell.

Consumer confidence and retail bankruptcies

On Friday, a preliminary reading from the University of Michigan’s consumer sentiment index showed a slump in July that would undo the past two months of gains. Consumer confidence is a critical measure of the health of the US economy, which is heavily dependent on consumer activity (versus the UK’s more service-based economy). If consumer confidence plunges once-more, and people cut back on spending as a result, that could lead to a longer recession in the US. Per Business Insider, economists had expected the index to tick up modestly to 79 for July, from June’s 78.1. Instead, the early reading shows it fell back to 73.2.

A drop off in spending could prove disastrous for an already struggling retail sector. In an interview with the Financial Times over the weekend, Levi Strauss CEO Chip Bergh said that he expects the list of bankrupt retail businesses is “going to get longer.” He noted that those companies that have gone under so far have been sunk by too much debt, adding that “it’s payback for highly leveraged companies.”

Crypto corner: PayPal flies the flag for mass crypto adoption

Coindesk reports that PayPal has taken a step closer to facilitating crypto payments. Quoting sources familiar with the matter, the payment provider is expected to announce as early as this week a partnership with broker Paxos to supply its cryptoassets.

Given the number of retailers who already have an integration with PayPal, this move towards crypto could be pivotal for the industry and would be a huge step towards seeing cryptoassets, such as bitcoin and its forks, used to pay for everyday goods and services.

All data, figures & charts are valid as of 20/07/2020. All trading carries risk. Only risk capital you can afford to lose.