Hi Everyone,

Let’s start off by saying that Facebook’s new Libra coin (under current proposal) should not be called a stablecoin.

A stable coin is one that’s pegged to a specific currency, or other asset, in order to reduce volatility and therefore the exchange rate remains similar to that of the asset it is pegged to. What Libra is proposing is actually a new currency with a floating exchange rate.

In fact, the Libra is set to act more like an asset-backed ETF, only with a small twist. Libra holders won’t get the profits.

According to the Libra White paper, the Libra Association in Switzerland will be responsible for managing the assets that back the new currency and will receive all the yield from the incoming investments.

This structure creates a moral hazard for the association members who will be incentivized to seek the maximum yield at any cost.

Last Friday, I alluded to this concept on Twitter just to check the reaction. After seeing this article in the Wall Street Journal yesterday, it seems my fears have been confirmed.

Today’s Highlights

- Rate Cut City

- Markets are Trending

- Crypto Contest – Win a Prize

Please note: All data, figures & graphs are valid as of June 25th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

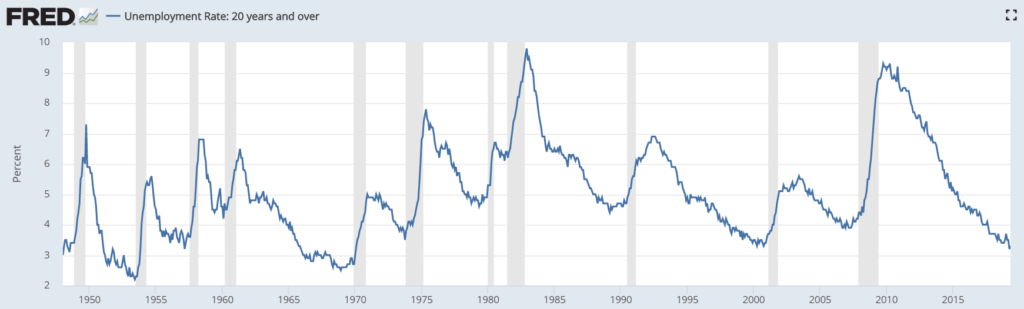

Ever since it became clear that the Fed and other central Banks are going along with calls from the market and calls from politicians to ease up on monetary policy, we’ve been in a bit of a different market.

This chart shows the market expectations for US interest rates by the end of the year. Take a look at the black line, which signals three cuts by the December meeting.

What are the trends?

Gold is going nuts, now at its highest levels since the crash in 2013.

The Dow Jones is happy and nearing its all-time highest levels.

Crude Oil is ok. But with all the OPEC and Iran stuff it’s difficult to tell.

Of course, the underlying factor here is the weaker US Dollar.

Crypto Contest – Win a Prize

We also did a short term technical analysis and took a look at where it might land in the event of a pullback, but my chance of predicting these things isn’t any better than yours.

All you need to do is guess what the price of bitcoin will be on Monday, July 1st. The most accurate answer wins a prize.

Watch the video and leave your comment below. What are you waiting for? Do it now!!

Click this link to play: https://youtu.be/

Have an excellent day!!

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.