Hi Everyone,

There aren’t many companies around these days that are big enough to initiate their own holiday but for some online shoppers, Prime Day is bigger than Christmas.

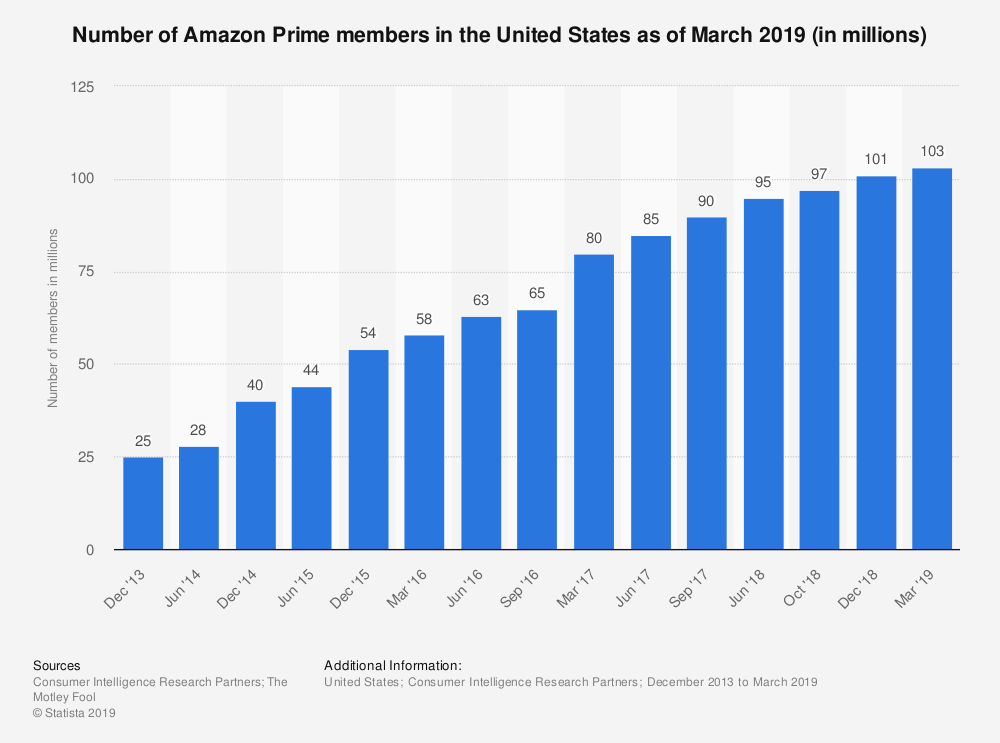

Amazon’s internet answer to Black Friday begins today and in the next 36 hours, with their stock just a whisk away from all-time highs, Amazon could very well break a new high for Prime Members, which has already exceeded 50% of US households.

Last year’s festivities went off without a hitch but it seems this year that several warehouses are planning to halt production in protest of poor working conditions.

However, even though these protests may affect delivery times in some places, it doesn’t seem like sales will be affected as the gripe is about making things better for workers who feel that they’ll manage to get management’s attention by walking out while the pressure is peaking. At this point, nobody is actually advocating to boycott the holiday.

Long live capitalism. Happy Prime Day!

Today’s Highlights

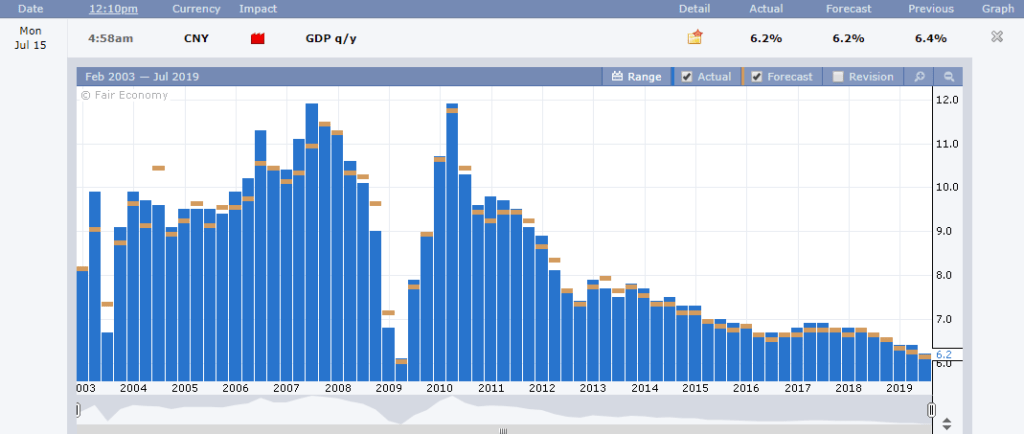

- China’s Landing

- Earnings Season

- Peak Hash?

Traditional Markets

Of course, the markets are taking this bad news as good news. Worse economic figures raises the likelihood of further stimulus from the PBoC.

This brings us right into our next market theme…

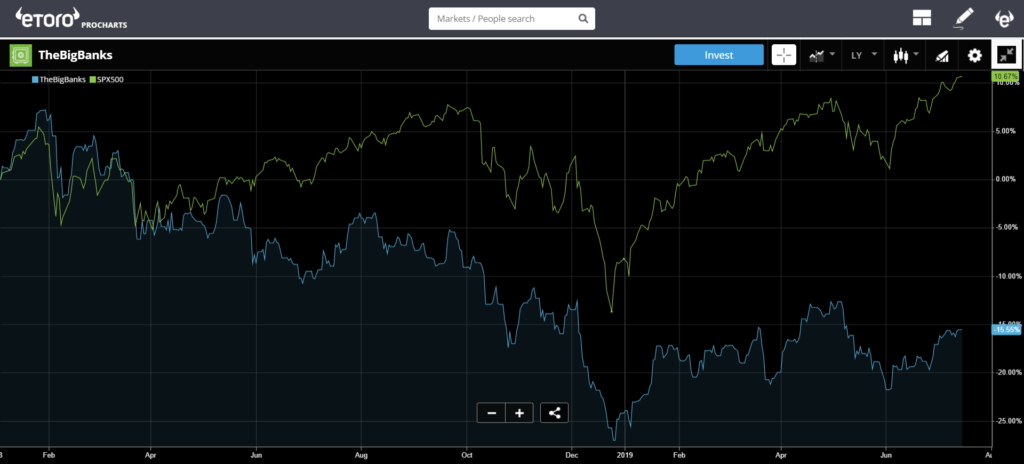

Earnings Season

As far as earnings season goes, this one is expected to be quite a downer. Many companies have already preempted their quarterly reports with a warning that profits were quite weak in the last few months.

First up are financial companies who have been hammered by central bank easing. When the largest player in the market is willing to buy debt with a negative yield, it’s particularly difficult for regular investment banks to turn a profit.

Here we can see eToro’s @TheBigBanks smart portfolio in blue against the S&P 500 index in green. Notice how the central bank driven recovery that has floated the markets since the beginning of 2019 has not been quite as jubilant for bank stocks.

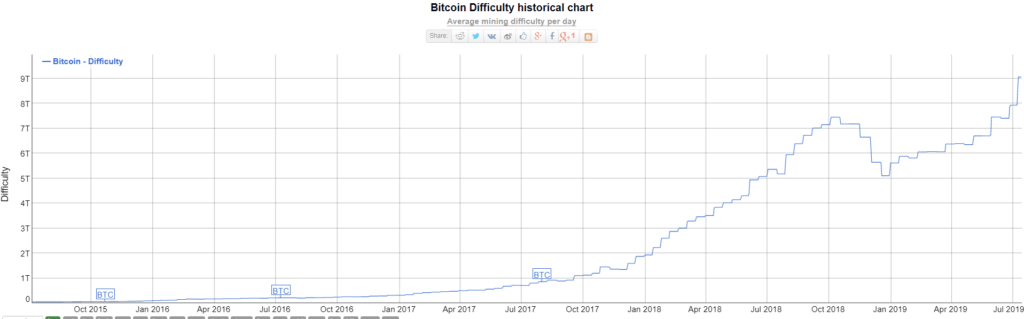

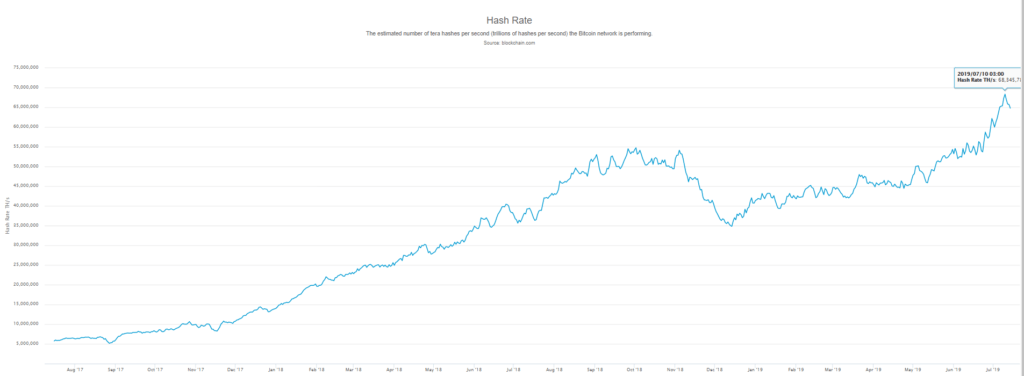

Peak Hash?

Those of you who’ve been watching closely may have noticed that Bitcoin is now more difficult to mine than ever before.

Without getting into too much technical detail, it’s worthwhile to know that bitcoin is designed to turn out a new block approximately every 10 minutes. At times when there is more hashrate (computing power) contributing to the network, bitcoin’s algorithm adjusts itself to be more difficult to mine a block.

This adjustment takes place automatically every two weeks and the adjustment that happened last Wednesday has made it extremely difficult to mine a block.

Best regards,

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.