Please feel free to sign up to watch this month’s live Platinum webcast here.

View the eToro Club Benefits or speak to your account manager for more details on how you can join the next live discussion!

As expected, geopolitics has played a huge role in the financial markets lately. Even the central banks, the largest players in the market, have stood by watching. Now that we’re moving closer to a resolution of some of the main themes, let’s take a look at the markets from the unique perspective of our senior market analyst, Mati Greenspan, who will review with you the latest trends of stocks, commodities, currencies and crypto.

1:02min | What was covered:

- Battle of the Traders

- Geopolitics Back in Focus

- Central Banks Looser than ever

- Rewarding Risk

- Bitfinex Premium

- Napoleon X

1:18min | Battle of the Popular Investors

rubymza – This Popular Investor from England has been with eToro since mid-2016. According to her bio, she is a data scientist who uses advanced statistical tools to make trading decisions and minimise risk. She focuses mainly on stock trading and keeps her positions open for 9 months on average.

6:41min | Learn how to compare traders to the market; charting tool explained

8:20min | Petas11 – This Popular Investor from Portugal has been with eToro since 2013 and actively discusses his actions on his news feed. He trades mostly currencies and likes to keep his risk score low. According to his bio, he encourages patient and responsible trading, and asks that his copiers do the same.

11:38min | Review of USD/HUF in Petas11’s portfolio and how to reach out to Popular Investors

15:25min | Geopolitics Back in Focus

19:30min | Google’s earnings report and FAANGM;

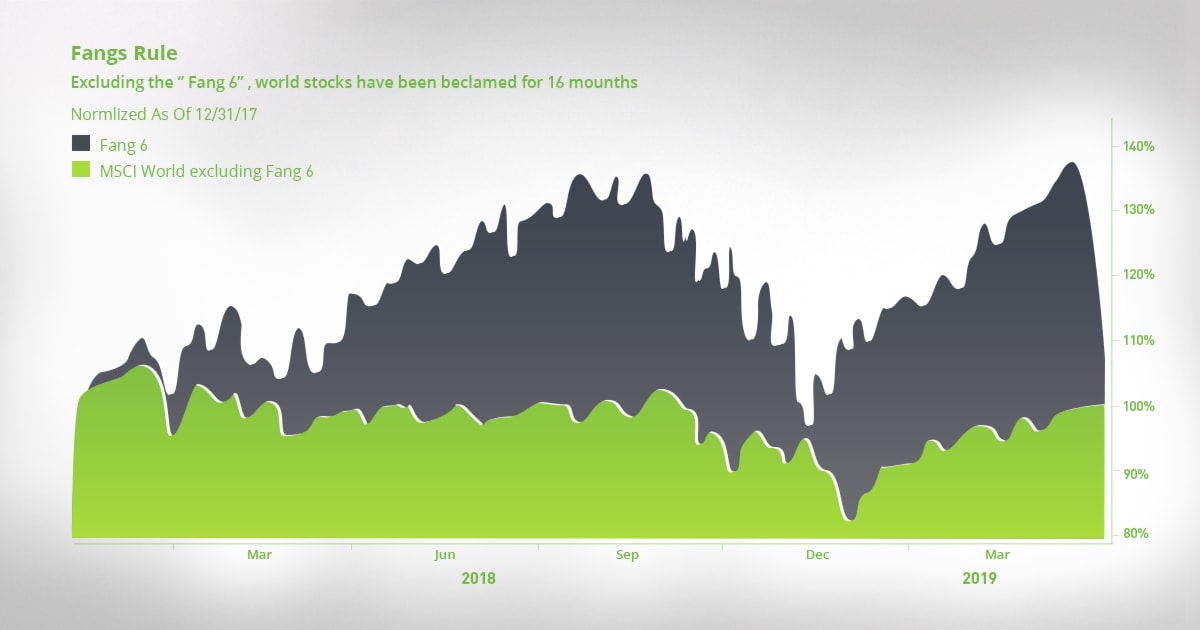

The white line represents the Fang 6 (Facebook, Amazon, Apple, Google, Netflix, and Microsoft). The blue line is the MSCI world index excluding the Fang 6 — basically all the rest of the stocks in the world.

As we can see, these tech giants aren’t only disrupting tech. They’re pretty much disrupting all investments on the planet.

21:09min | Questions from our Platinum clients

Question: on how to take advantage of the belt and road initiative

Answer: Mati reviewed Asian related markets, eToro has HK stocks or FXI.

26:12min | Central Banks Looser than ever

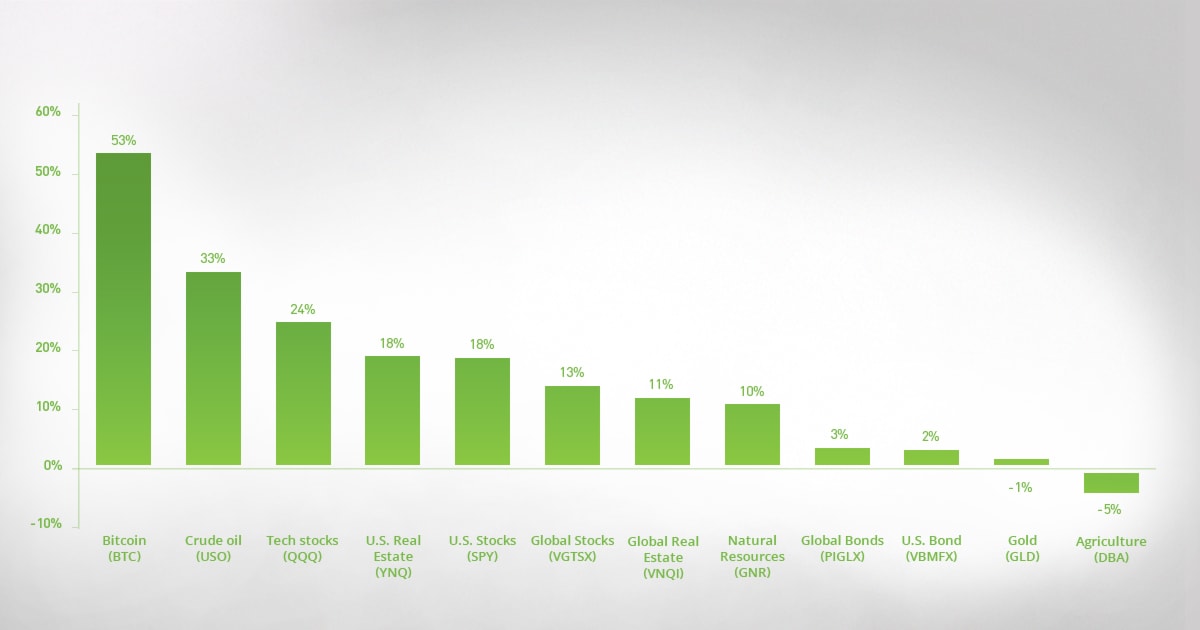

27:55min | Rewarding Risk – Diversification explained if there is an economic downturn

30:05min | Questions from our Platinum clients

Question: Are sanctions on Iran affecting NatGas?

Answer: NatGas reviewed

Question: Review the stocks: Beyond Meat and SolarEdge

Answer: Review of the trends and the Renewable Energy Portfolio

41min | Crypto Review

41:40min | BTC review

43:34min | Chart review and Bart Simpson pattern

45:49min | Uber reviewed

Bitfinex Premium

47:21min | Crypto watch discussed – Tracking crypto price on all exchanges

53min | Discussed the new Smart Portfolio, Napoleon-X– Crypto Algo Partner Portfolio.

This new, very exciting partner portfolio was opened this morning for investment. NapoleonX has developed machine learning-driven investment strategies and has initially offered a crypto portfolio on eToro. Its proposed strategy takes long-only positions in the top 5 crypto assets (BTC/ETH/EOS/LTC/XRP) with low-frequency rebalancing to actively manage the cryptocurrencies’ exposure.

The rebalancing mechanism is 100% quant-based and has been developed internally by its research team. Historically, this strategy has enabled investors to participate in the crypto bull run while limiting the downside in more turbulent markets.

You can follow the portfolio here.

FuturePayments– Digital Money – This is a portfolio that combines global equities in the mobile, contactless payment space, alongside crypto assets expected to also disrupt the payments industry.

58:40min | Crypto risk and review

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, Twitter, LinkedIn.

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short time frame and, therefore, are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and ,therefore, is not supervised by any EU regulatory framework. Your capital is at risk.

Past performance is not an indication of future results

Data presented during the webcast is accurate as of May 7th, 2019.