Bitcoin, the world’s largest cryptocurrency by market cap, is in the holding pattern of the halving countdown, due to take place in May. Bitcoin is often compared to gold; sometimes even referred to as Digital Gold. The comparison is because the digital currency has a limited supply, unlike fiat currency. As soon as 21 million bitcoins have been produced, the network will stop producing more. The upcoming bitcoin halving will further stretch Bitcoin’s limited supply; yet how will this impact the market, and the effect the bitcoin halving will have on altcoins remains to be seen.

What is a Halving Event, and how does it correspond with the Bitcoin economic model?

The halving processes are used as a tool to combat inflation within the Bitcoin ecosystem; comparable to how Bitcoin was created in response to the global recession of 2008. Current speculation is that Bitcoin’s upcoming halving event could herald an historic bull run. This also indicates that we may see an increased number of investors trading bitcoin.

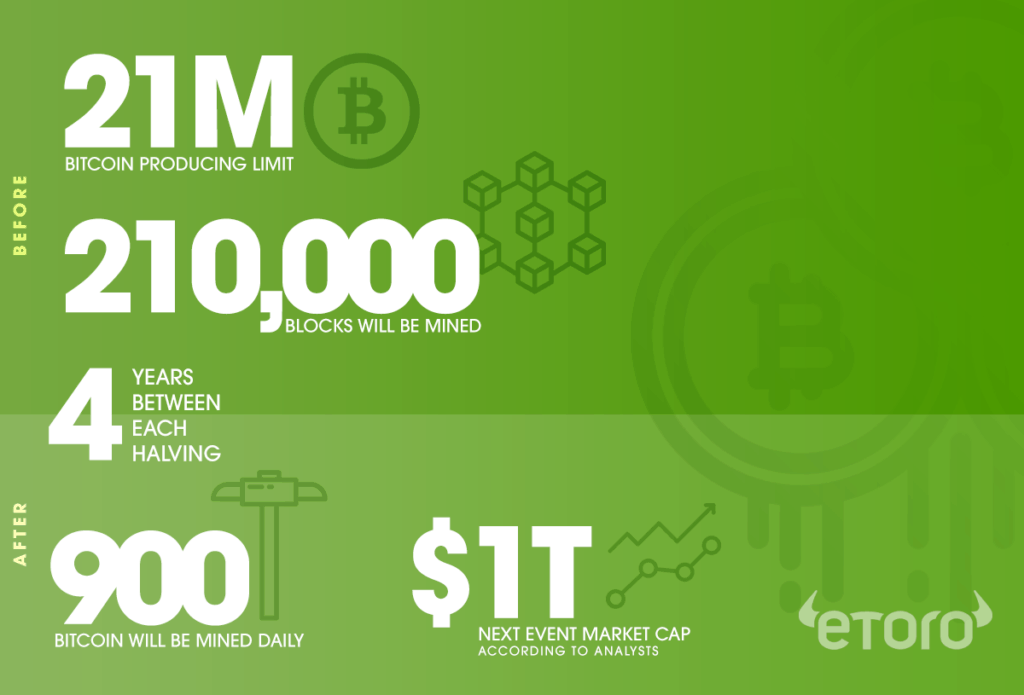

The Bitcoin halving refers to the Bitcoin reward halving when a miner successfully mines a new block. The halving timeline occurs approximately every 4 years, after 210,000 blocks have been mined by the system. The Bitcoin block halving and the reward halving will decrease following the May Bitcoin halving. After this a mere 900 bitcoin will be mined on a daily basis.

Given the Bitcoin block halving, how will the miners be impacted?

When a halving occurs, the Bitcoin block rewards received by miners for validating transactions are reduced by 50%. After the 2016 halving event, the blockchain went from mining 3600 bitcoin down to 1800 bitcoin daily. The halving of the mining reward means that if the reward currently stands at 12.5 bitcoin per block, after the halving it will be reduced to 6.25 bitcoin.

Bitcoin Pricing: Economic Theory in Practice

The halving of the supply of Bitcoin means that the coin de facto becomes more rare. The laws of supply and demand state that constant demand for an asset will result in a rise in its value and price. Much as seen with the previous two halvings, the third halving could potentially mean a hike in the price of Bitcoin.

Will bitcoin’s halving cause the price to skyrocket soon?

Many analysts are predicting that the number of active users of Bitcoin will soar, both in the run up to the halving in May, and following the event. This could also have an effect on other cryptocurrencies and crypto prices. You can check out what will happen by following crypto on eToro.

What has Bitcoin’s performance been like before and after previous halvings?

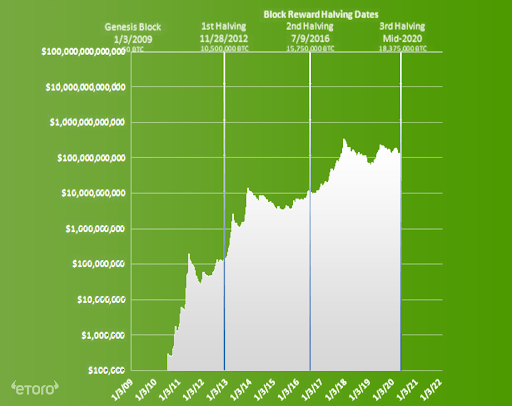

Credit:@Bitcoin Charts, Twitter

As shown in the above image, previous Bitcoin halvings have seen the price of trading Bitcoin significantly increase. A year after the first halving in 2012, Bitcoin price hit $1,000 (in November 2013), and a year after the second halving in 2016, its price peaked at $20,089. Analysts say the coin could even reach a $1 trillion market cap following the event.

Institutional Interest

There have also been reports of a rise in institutional interest in Bitcoin market. These state that Bitcoin investments by banks and other institutions grew over the course of 2019. Grayscale reported a dramatic increase in “inflows, which tripled Q-on-Q, from $84.8 to $254.9 million, and that a majority of investment (84%) came from institutional investors, dominated by hedge funds”. This indicates that Bitcoin could be a good way to hedge against economic and political risk.

It seems that institutional interest is on the rise leading up to the next halving, and this seems to be far from a coincidence. With a post-Coronavirus recession imminent, institutional investors could well begin to see Bitcoin as a way to hedge against a global financial crisis.

When is the next Bitcoin halving?

The halving timeline has a halving event occurring approximately every 4 years. After the May 2020 Bitcoin halving event, the next predicted Bitcoin halving is due to take place in May 2024.