Hi Everyone,

“To some extent, humanity is gotta roll with the punches and enjoy the massively uplifting benefits.”

-Vitalik Buterin speaking about whether the world is ready for crypto mass adoption.

In fact, we do still have a lot to learn about how cryptoassets and distributed ledger technology (DLT) can improve financial equality. Vitalik speaks a lot about using blockchain to improve things from social responsibility and democracy as we know it but how about financial markets?

Raphael Auer is a researcher at the Bank of International Settlements and he’s recently put together a new research paper showing how regulators can use DLT tech in order to vastly improve their workflow saving time, energy, and money.

The end result of this is a net advantage for newer and smaller financial firms who will be able to use these savings to improve their business structure, thereby leveling the playing field and removing barriers for new players to compete in the traditionally difficult to enter financial markets.

The ICO revelation of 2017 showed us how DLT can be used to democratize the way startups raise capital, but now it’s clear to see that with a little bit of refinement, and a bit more knowledge, the entire global economy has a lot to gain.

Today’s Highlights

- Fed Day Ahead

- The Crude Effect

- Is this a new altseason?

Traditional Markets

Traders and investors across the world will tune in today for the Federal Reserve’s interest rate announcement, which will take place at 2:00 PM on Wall Street.

The US Fed is by far the largest player in the global financial markets so any action they take has a direct impact on all assets from currencies, to commodities and stocks, and some would say even cryptoassets.

Even a small adjustment in the interest paid on the US Dollar can have a huge effect on market prices. So it pays to pay attention.

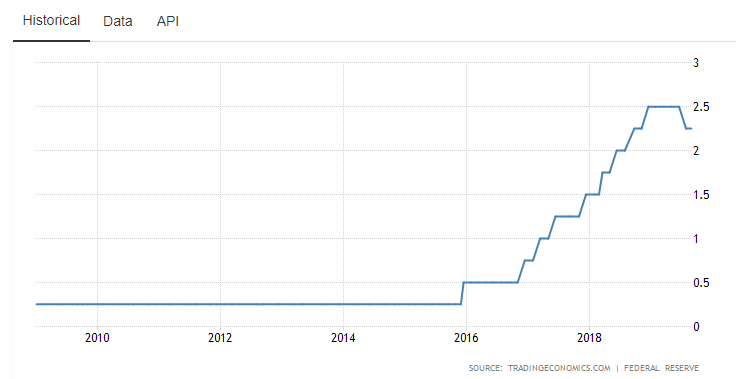

Today, they are widely expected to cut the rate for the second time in a row from 2.25% to 2% even. This could have the effect of freeing up more capital for investment and the hope is that it will lift the price of stocks. It is also expected to have a negative impact on the US Dollar.

Crude Capacity

It was a bit of a surprising statement if you think about it. Saudi Arabia has been trying to raise the price of oil for years by artificial means. So I’m really not sure what’s their rush to get everything back online so quickly.

In addition, the Saudi Finance Minister has now stated on Bloomberg that Sunday’s attack has had zero impact on the company’s revenues. Another odd statement to make.

By now, crude oil has given back more than half of the ill-gotten gains.

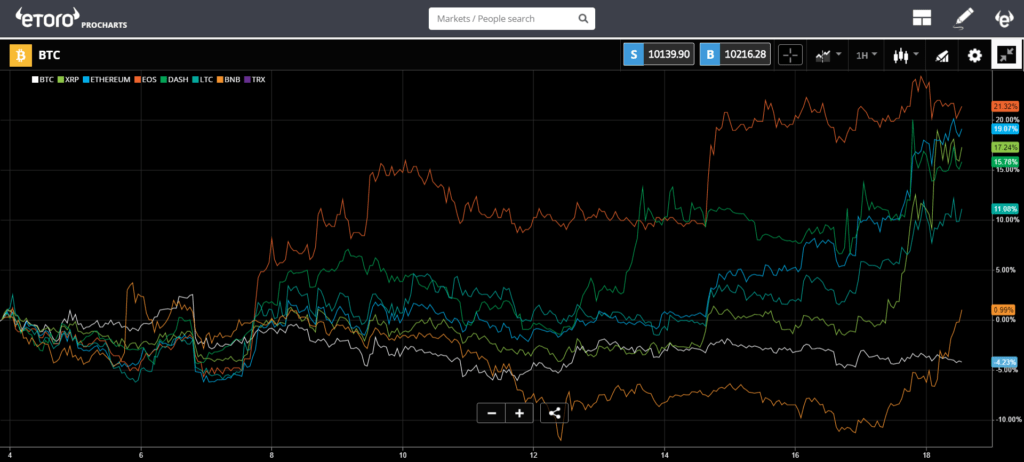

Is there a new Altseason?

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.