Markets have had a softer open this morning following two straight days of gains, the first time this has happened since February. At present, these 1.5-2% losses are far less severe than we have seen in recent weeks.

In the early hours of the morning the US Senate survived a protest vote by some Republicans to pass the enormous fiscal stimulus legislation. The upper chamber voted through the bill by 96 to 0, with the stimulus package now moving to a vote in the Democrat-controlled House of Representatives on Friday. If this passes as expected it can be signed and enacted by US President Donald Trump. However, while investors will be relieved to see the bill continue to make progress, all eyes will now be on US initial jobless claims data on Thursday morning — which we’ve covered in more detail below.

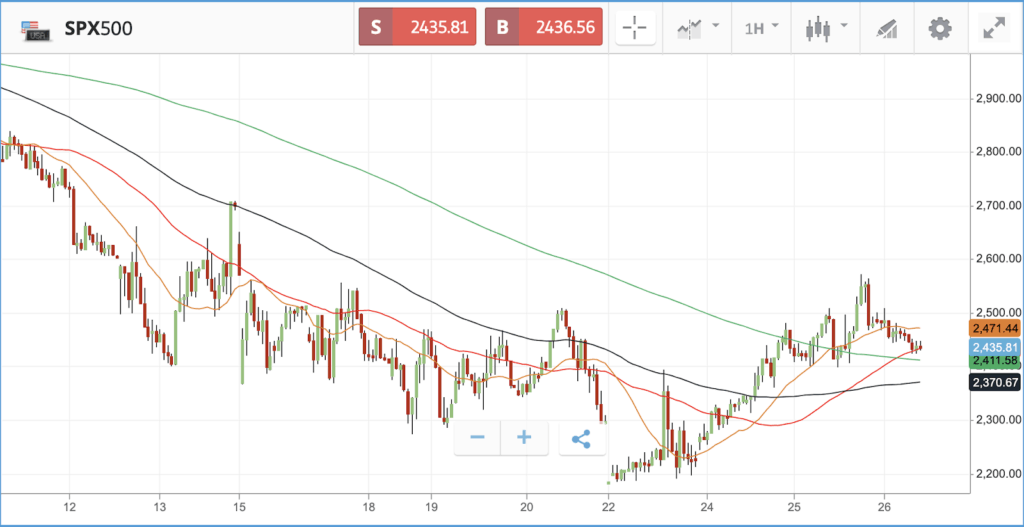

From a technical point of view, on the hourly chart of the S&P we can see that the 20 hour moving average (orange) has been rising support for much of the rally we have seen since the start of the week, however, this was breached overnight. The index is now testing the 50 hour (red) which could see the price bounce off the level, or if it breaks we could be taking another leg lower.

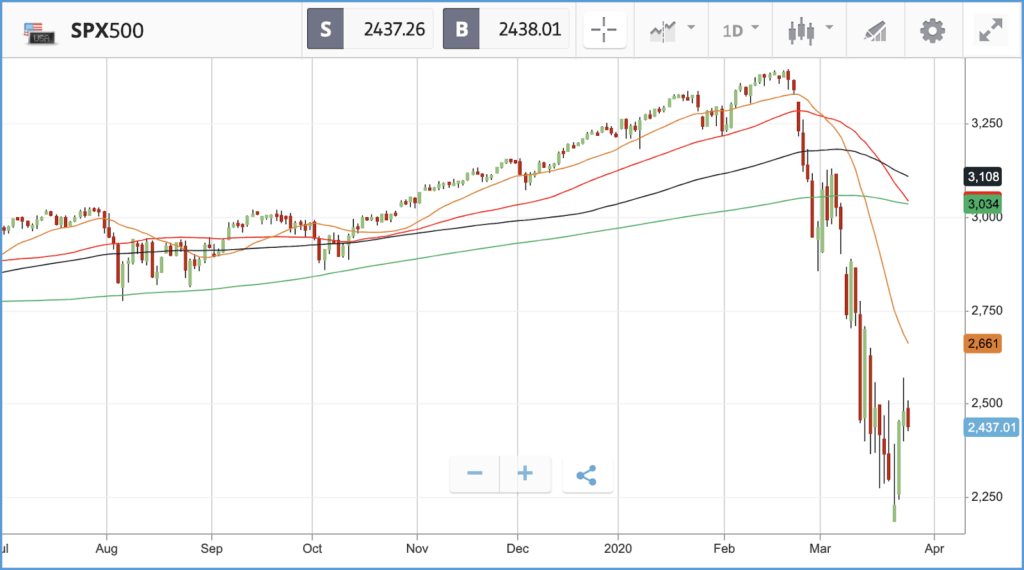

However, in a daily time frame, the recent two day surge stopped short of troubling the 20 day moving average (orange). The 50 day moving average (red) is also very close to crossing over the 200 day (green), which is known as a ‘death cross’ and can be a bearish signal. We saw this happen prior to the significant sell off at the end of 2018.

Boeing pushes aerospace sector higher, while Nike’s online growth helps it beat virus disruption

The industrials sector posted the best Wednesday out of the 11 sectors that make up the S&P 500, according to data from Fidelity, with aerospace and defence the top performing subsector gaining 11.1%. Boeing was a significant contributor, gaining 24.3% as the stimulus deal includes support for the aviation industry. The bill includes $17bn in loans for businesses considered “critical to maintaining national security,” which according to Washington Post sources is intended to meet Boeing’s needs — although the firm has stated publicly that it can survive without a taxpayer bailout. CEO David Calhoun has made it clear that he would not accept having to give the federal government an equity stake in return for assistance and would look at other options if it came to that.

Nike was one of the other big winners among the 30 names in the Dow Jones Industrial Average, gaining close to 10% after reporting quarterly earnings that included a 36% increase in digital sales — which the firm said offset the impact of Covid-19 on its business in China.

The Nasdaq Composite also gave up gains in an end-of-day selloff, which in the Nasdaq’s case took it into negative territory for the day. Several names that have been faring better than the broader market overall fell hardest, including Netflix and Gilead Sciences, which sank 4.2% and 5.8% respectively.

S&P 500: +1.2% Wednesday, -23.4% YTD

Dow Jones Industrial Average: +2.4% Wednesday, -25.7% YTD

Nasdaq Composite: -0.5% Wednesday, -17.7% YTD

London-listed stocks close higher after volatile day

The UK market closed before the US stimulus bill’s hiccup on Wednesday evening, and both the FTSE 100 and FTSE 250 closed out the day up more than 4%. It was a hugely volatile day for both indices; however, the FTSE 100 had climbed by up to 6% around 9am, before sinking to a daily loss less than two hours later and rallying during the afternoon.

Investors were digesting multiple events, including a monthly survey of retailers from The Confederation of British industry that showed that the retail sector has its lowest expectations for the month ahead since early 2009. In the FTSE 100, which is still down 24.6% year-to-date, JD Sports Fashion, Legal & General Group and housebuilder Persimmon led the way, with gains of 20.2%, 16.2% and 15.3% respectively. JD Sports has now gained close to 80% over the past week, although it remains 38% down year-to-date. Its Wednesday rally came despite a statement on Tuesday from the company which said that all of its UK stores are closed, and that online orders represent “a comparatively small mitigation in terms of overall profit contribution.” In the FTSE 250, 19 firms delivered a daily gain of more than 15%, including names such as Aston Martin Lagonda, William Hill and WH Smith.

FTSE 100: +4.5% Wednesday, -24.6% YTD

FTSE 250: +4.6% Wednesday, -32.3% YTD

What to watch

US initial weekly jobless claims: After last week’s jump from 211,000 to 281,000 initial weekly jobless claims in the US, expectations are for figures to skyrocket this week, with the consensus being that 2.5 million individuals will have filed for unemployment over the past week. The range of predictions is large, with estimates sitting anywhere from one million to four million. Figures at the top end of the range will likely be viewed poorly by the market, and while investors are broadly anticipating a grim set of numbers, there may be a fear factor in seeing the data for real for the first time. With large sectors of the economy shut down, businesses have been laying off and furloughing staff in huge numbers; although firms including Walmart and Amazon have also said they are hiring hundreds of thousands of temporary workers to deal with surges in demand caused by shoppers stockpiling and switching to online orders. There is no doubt that the economic shock of the pandemic will lead to a huge jump in unemployment, but there is still uncertainty about how quickly and aggressively that shock will feed through. Some employers may have been holding off on making a decision to see what support the stimulus package will bring, and the speed with which the newly unemployed file their paperwork is also a factor.

Lululemon Athletica: High end athletic wear brand Lululemon’s Thursday earnings update follows Nike’s report yesterday, and investors will again be looking for the extent to which online sales can counteract the impact of the firm’s highstreet stores being closed. Similar to other firms reporting during this chaotic period, Lululemon is unlikely to put out detailed guidance for 2020. On the company’s last quarterly earnings update, management set out continued investment in its digital channel, including a more personalised website experience; its goal is to double its online business by 2023. Currently, 20 Wall Street analysts rate the stock a buy or an overweight, with 13 hold ratings. Lululemon’s share price has held up better than the broader market during this crisis, and after a 38% gain over the past week, it is now only down 16.4% YTD.

Crypto corner:

The recovery in cryptoassets has paused as investors take stock after a breakneck rebound that left some cryptos up more than a third in a little over a week.

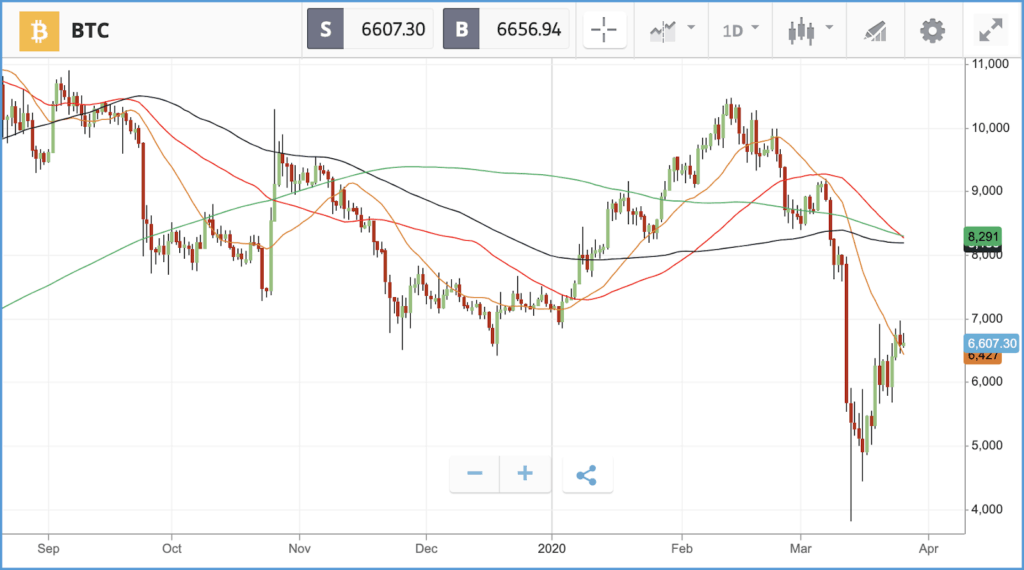

Bitcoin was off marginally this morning, trading at $6,607, having hit a high of $6,733 yesterday, breaking through the 20 day moving average. Similarly to the S&P, we are seeing the 50 day moving average flirting with crossing over the 200 day, which could imply further pressure on the price to come.

Ethereum copied Bitcoin’s trading pattern, down from a $139 peak yesterday to $134.5 this morning, but still well off recent lows.

XRP has diverged a little from peers in recent days and it is up the most in morning trading, ahead by 1.3% at $0.16, although it has fallen further than its larger cousins.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.