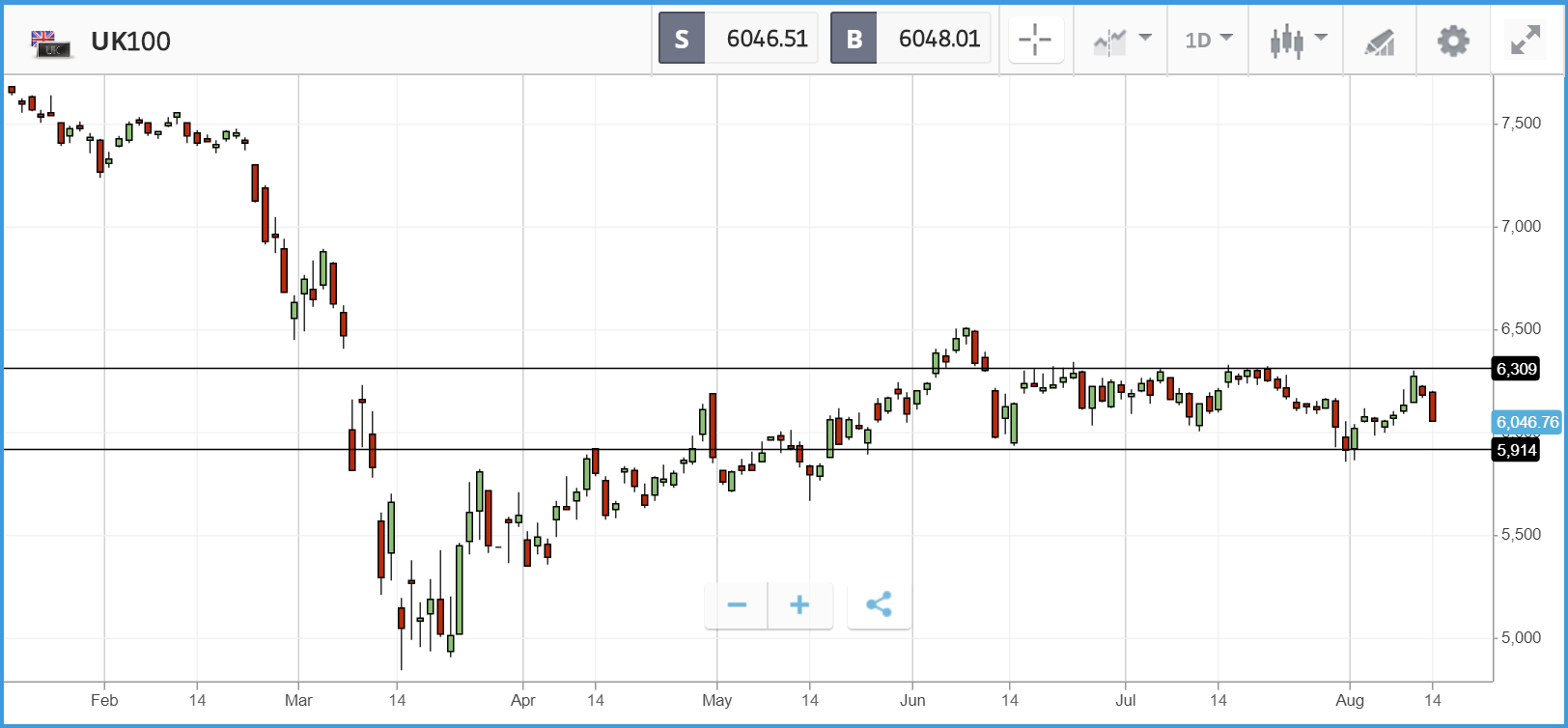

European markets have followed Asian shares lower as Chinese industrial production and retail sales data disappointed. This, coupled with the fact that a US fiscal stimulus deal has not yet materialised, has seen the sentiment switch to risk-off as we close out the week. The FTSE100 is the worst affected market, down 2.2% as the UK imposes a two week quarantine for travellers returning from France as of tomorrow at 4am, the French benchmark CAC40 is down by a similar amount. This has hit travel names hard with Ryanair and easyJet down 4.5% and 7.5% respectively.

Yesterday, it was reported that initial unemployment filings in the US fell to below one million last week, the first time since March that the figure has come in at less than seven figures. In addition, the number of people collecting unemployment benefits through state programs fell to 15.5 million at the start of August — although that figure remains more than double the level reached during the global financial crisis. The figures may compare poorly to history, but the direction of travel shows that employers have resumed some hiring and that the US economy is supporting the creation – or at least the resumption – of jobs.

In corporate headlines, embattled US banking giant Wells Fargo lost its chief compliance officer Mike Roemer, who joined two years ago in an effort to right the ship following a huge fake accounts scandal. Per the FT, his departure is due to a disagreement with CEO Charlie Scharf – who joined late last year – over how to structure the company’s risk operations. Scharf favours a decentralised approach with divisional chief risk officers. Getting its risk overhaul right is crucial for Wells, which faces constant regulatory scrutiny and restrictions, including an asset cap that limits its growth.

Cisco suffers from legacy hardware business

Having spent much of the day in the green, the S&P 500 fell to a small loss by the end of Thursday, dragged down by technology names including Cisco, Hewlett Packard Enterprise, and Micron.

Cisco faced the worst day, sinking by more than 11% after delivering a disappointing earnings forecast. The company has been left behind by many of its tech counterparts, as its historic strength in office hardware has matched up poorly with the pandemic environment, and driven customers to large cloud services. CEO Chuck Robbins said that customers continue to delay purchasing decisions, and even sales in its applications business – which includes Webex video calling software – sank. In addition, the company announced CFO Kelly Kramer will be retiring.

The Nasdaq Composite was the only one of the three major US stock indices to post a positive day yesterday, adding 0.3%. Tesla led the way with a 4.3% gain, after Morgan Stanley analysts hiked their price target on the firm, due to the prospects for it to supply electric vehicle batteries to other firms.

S&P 500: -0.2% Thursday, +4.4% YTD

Dow Jones Industrial Average: -0.3% Thursday, -2.3% YTD

Nasdaq Composite: +0.3% Thursday, +23.1% YTD

National Express sinks 16% after Covid warning

Despite the positive jobless claim figures out of the US, London-listed stocks sank yesterday, with the FTSE 100 falling by 1.5%. ITV and International Consolidated Airlines Group faced the worst day, closing 5% and 4.2% respectively. It was the financial sector that dragged the FTSE lower, however, with insurer Phoenix Group, NatWest, HSBC, Legal & General, Aviva and more all falling by over 3%. Britain’s two biggest oil firms, Royal Dutch Shell and BP, also fell 3.7% and 3.2% respectively.

In the FTSE 250, travel firm National Express faced the worst day, falling 16.2% after it warned that its recovery from the Covid-19 pandemic will be slow and painful as it delivered a £60 million loss for H1 2020. Management did not offer any guidance on earnings for the rest of the year, and the company’s share price is down close to 70% year-to-date.

FTSE 100: -1.5% Thursday, -18% YTD

FTSE 250: -0.9% Thursday, -18.1% YTD

What to watch

US retail sales: Retail sales data for July gets reported in the US on Friday, after increasing 7.5% in June and 18.2% in May. Expectations are more muted for July, with an increase of around 2% anticipated, but retail sales have come in above expectations in the previous two months. The US economy is highly dependent on consumer spending, versus the more service driven UK economy, and the sales figure will be closely watched.

Consumer sentiment: Also being reported in the US on Friday is August’s consumer sentiment index, which economists are anticipating will come in at a similar level to July. The index will be another closely watched figure, as it will provide some insight into how consumers are balancing the continued surge of the Covid-19 virus against improving unemployment claimant numbers and state reopenings.

BHP Group: Multinational mining firm BHP, which has stock listings in London, New York, Australia and South Africa, reports its latest quarterly earnings next Tuesday at 8:30am Melbourne time (Monday evening New York time). The company’s share price has surged more than 40% over the past three months on the back of gains in the price of commodities, such as copper and silver, plus significant iron ore demand from China. How sustainable that iron ore demand is, and BHP’s outlook for commodity prices from here, will be key points to watch out for when it reports earnings. Also noteworthy, is that BHP offers a decent dividend yield of around 4%.

Crypto corner: US Federal Reserve actively experimenting with Blockchain

Federal Reserve Board Governor Lael Brainard has said the Fed is actively testing out distributed ledger technology (DLT) to better understand how a digital currency would function in the financial system, according to Coindesk.

Giving a speech to the Federal Reserve Bank of San Francisco’s Innovation Office Hours, Brainard said the Fed had been studying digital currencies for several years to understand what impact it might have on banking, financial stability, monetary policy and the payments ecosystem.

Brainard said the coronavirus crisis reinforced the need for “immediate and trusted access to funds.” Despite this there is yet to be a concerted public effort to create a central bank digital currency (CBDC) by the US, unlike other countries such as China and the UK which are more actively working on proposals. However, Brainard’s remarks would suggest the Fed is further along in its exploration of the tech than previously thought.

All data, figures & charts are valid as of 14/08/2020. All trading carries risk. Only risk capital you can afford to lose.