Good morning everyone,

Markets around the world rallied overnight and this morning after one of the worst days on record. Monday saw the biggest one day decline since the 2008 financial crisis, trumping last week’s rout.

The FTSE 100 is up over 3%, moving back through the 6,100 point mark, whilst both Japan and Hong Kong’s Hang Seng posted gains of 0.9% and 1.5% respectively. Gold also dipped back from highs to trade at $1,657, having been within touching distance of $1,700. US futures look set for an even healthier open, indicating over 4.5% higher at time of writing.

There is widespread hope of a coordinated stimulus package from the world’s biggest Central Banks. President Trump has promised “major steps” in shoring up the US economy in response to the virus. The Federal Reserve increased its fund injections yesterday and many analysts are now pricing in an interest rate cut to zero by April, all eyes will be on next week’s meeting to see what is actually delivered.

The Bank of Japan has also unveiled plans to roll out a further $4 billion stimulus package. We saw last week though that, even in the face of renewed stimulus, the continued spread of the virus in Italy and other European countries saw selling pressure override this; how long will printing money be the solution? It seems to be losing its effectiveness. The virus is still spreading in many countries outside of China and it may get worse before it gets better.

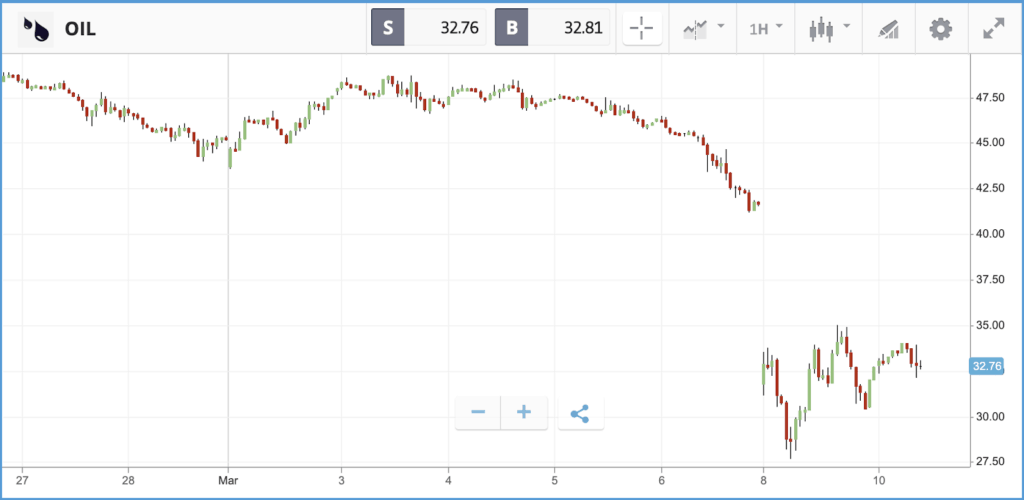

Yesterday’s sell-off was sparked by the eruption of an oil price war between Saudi Arabia and Russia, two of the world’s largest producers, over the weekend. The energy and financials sectors fell hardest, sinking 20.1% and 10.9% respectively in the US, after the price of Brent Crude crashed to around $35 a barrel following Russia’s decision to bail on a deal with OPEC over oil production cuts.

This morning, oil has increased 7% as virus cases slow in China, bringing with it the hope that demand will start to increase. The current output levels are not sustainable, however, and it seems inevitable that a deal will have to be reached. The first to bow out will be the US shale producers who have a much higher break even level, but even the biggest OPEC members will be feeling the pain at these prices.

The rapid 7% drop experienced by the major US indices at the start of the day triggered a ‘circuit breaker’ for the first time since 1997, temporarily halting trading. A rush for safety sent the yield on the 10-year US Treasury plummeting, hitting as low as 0.34% before bouncing back to 0.5%. UK gilts saw yields briefly turn negative for the first time ever at certain points on the curve. Even the 30-year Treasury yield sunk below 1%, meaning investors are accepting interest well below the rate of inflation on long-duration debt, such is their desire for a safe haven.

The oil price war rocked investors already struggling to make sense of the continuing news flow on the coronavirus epidemic. Late on Monday, President Trump said he plans to push for a payroll tax cut and assistance for hourly workers, aimed at dampening the impact of the epidemic amid major concerns of how the administration has handled the crisis. Across the Atlantic, Italy expanded its quarantine to the entire country, after the death toll from COVID-19 increased to 463 on Monday.

Oil exploration stocks sink 50%, big banks down double digits

Of the 500 firms in the S&P 500, only nine posted a positive day on Monday, while 10 fell by more than 30%. Oil and energy names were hit hardest, with exploration firms Apache, Occidental Petroleum and Marathon Oil closing the day 53.9%, 53.4% and 46.9% lower respectively. Exxon Mobil and Chevron, the two largest US oil companies, fell 12.2% and 15.4%.

The finance majors were also in the firing line, as the collapse in asset values and prospect of further interest rate action from the Federal Reserve significantly hampers the sector’s ability to turn a profit. JPMorgan fell 13.6%, Wells Fargo 12.5% and Bank of America 14.7%, with all three now having lost around a third of their value since the start of the market rout last month.

In the Nasdaq Composite, which fell by 7.3% on Monday, Tesla was one of the worst performers. The electric carmaker finished 13.6% lower, although its share price is still up more than 100% over the past year.

In M&A news, two of the world’s largest insurance brokerage and investment consultants are merging, with Aon buying Willis Towers Watson in a $30bn all-stock deal. The $232 per share deal valued WTW at a 16% premium versus its Friday closing price, but the firm sunk 7.5% on Monday in the broad market sell-off, putting the premium at 25.6% versus its $184.74 Monday closing price.

S&P 500: -7.6% Monday, -15% YTD

Dow Jones Industrial Average: -7.8% Monday, -16.4% YTD

Nasdaq Composite: -7.3% Monday, -11.4% YTD

Crash sends UK stocks into a bear market

After slipping 7.7% on Monday, the FTSE 100 is now down over 20% year-to-date, even accounting for the gains this morning, putting it into bear market territory. Oil names weighed heavily on the index following the price collapse yesterday. BP and Royal Dutch Shell, two of the UK’s largest companies by market cap, closed the day 19.5% and 18.2% lower respectively. That pushed the dividend yields on both stocks up into double digit territory, with BP now yielding over 10% and Royal Dutch Shell over 11% based on their Monday closing prices. That brings the safety of those dividends into question, as the price of oil is now below the breakeven production price for both companies, which could lead to cost cutting and more aggressive action by management. In a Monday note, UBS analyst Jon Rigby wrote that in the oil price war, “there are no winners, only the less badly burnt.”

Similar to the US, financials were also hit hard on Monday, with asset manager Schroders falling 13% and Royal Bank of Scotland finishing the day 10.4% down. In the FTSE 250, which sank 6.4% during the day, Premier Oil, Tullow Oil and Cairn Energy were the biggest losers, closing 57.5%, 31.8% and 29.2% lower.

FTSE 100: -7.7% Monday, -20.9% YTD

FTSE 250: -6.4% Monday, -19.8% YTD

Stocks to watch

Lukoil: Not normally one we would mention on this list, Lukoil is a Russian energy corporation that has its main listing in Moscow. Given that the firm now finds itself in the middle of an oil price war, its Wednesday earnings call – which is conducted in a mixture of English and Russian – will be one to listen into. Last quarter, the firm said it had investment options on the table such as new wells and optimisation activities if the OPEC+ restrictions, which Russia just pulled out of, were lifted.

Standard Life Aberdeen: Asset manager Standard Life Aberdeen sank 9.4% in Monday’s sell-off, and its Tuesday morning earnings call will be one to listen back to. The stock has been under pressure for years thanks to intense competition in its sector and, given that its revenues are directly tied to assets under management, the market’s capitulation has the potential to cause the firm a serious headache. It was also reported on Monday that the company’s head of global strategy, Andrew Milligan, is leaving the firm after 19 years. Despite this, the firm has reported better than forecast results and has maintained its dividend, which will be at least a small bit of reassurance to shareholders amid the current market turmoil.

Dick’s Sporting Goods: Sporting goods retailer Dicks held up remarkably well on Monday, with its 1.4% fall less than a quarter of the distance the broader market fell. The stock had enjoyed a major rally in the run up to the epidemic-linked selloff, adding around 50% to its market cap, before falling back by around 30% since late January. Last quarter, the company’s earnings beat expectations by a substantial margin, but analysts currently favour a hold rating on the stock. The firm could find itself on the receiving end of the knock-on impact from Nike and other apparel manufacturers, some of which are struggling with production due to the disruption caused by the epidemic in China.

Crypto corner:

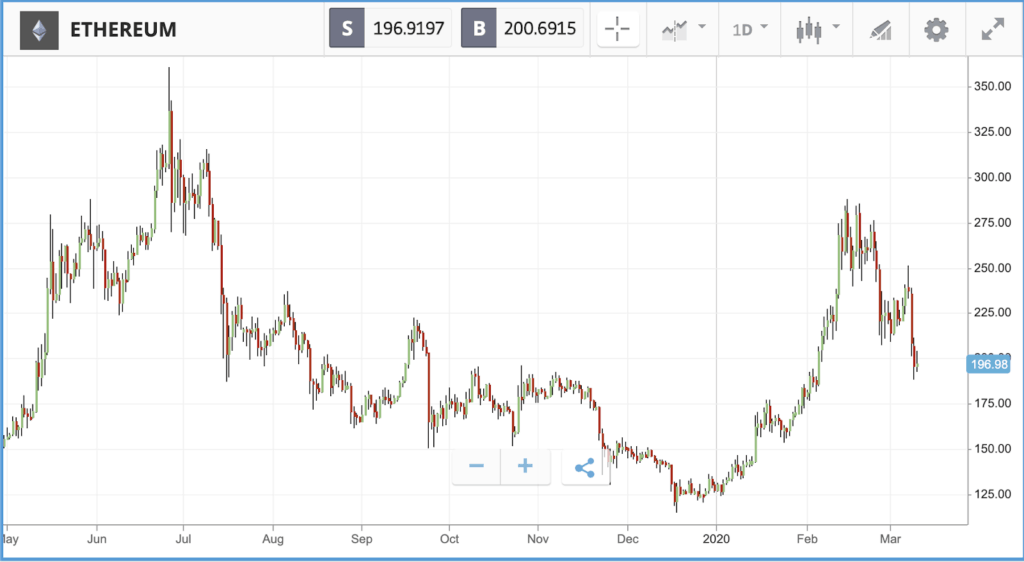

Cryptoassets fell further yesterday amid the record breaking flight to safe havens, with Bitcoin down below $8,000 at one stage to hit a low of $7,784. It has recovered marginally today, trading at $7,903.

It’s worth noting that cryptoassets have not fallen anywhere near as much as the traditional markets, which isn’t usually the case. Often broad based market sell-offs are accompanied by magnified sell offs in crypto. This doesn’t then lead us back to the dubious ‘safe-haven’ question because that clearly isn’t the case here; bitcoin has still sold off as investors leave risk assets, we can see this from the inflated selling volumes across multiple venues, but perhaps it does show a new level of resilience to wider market pressure.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.