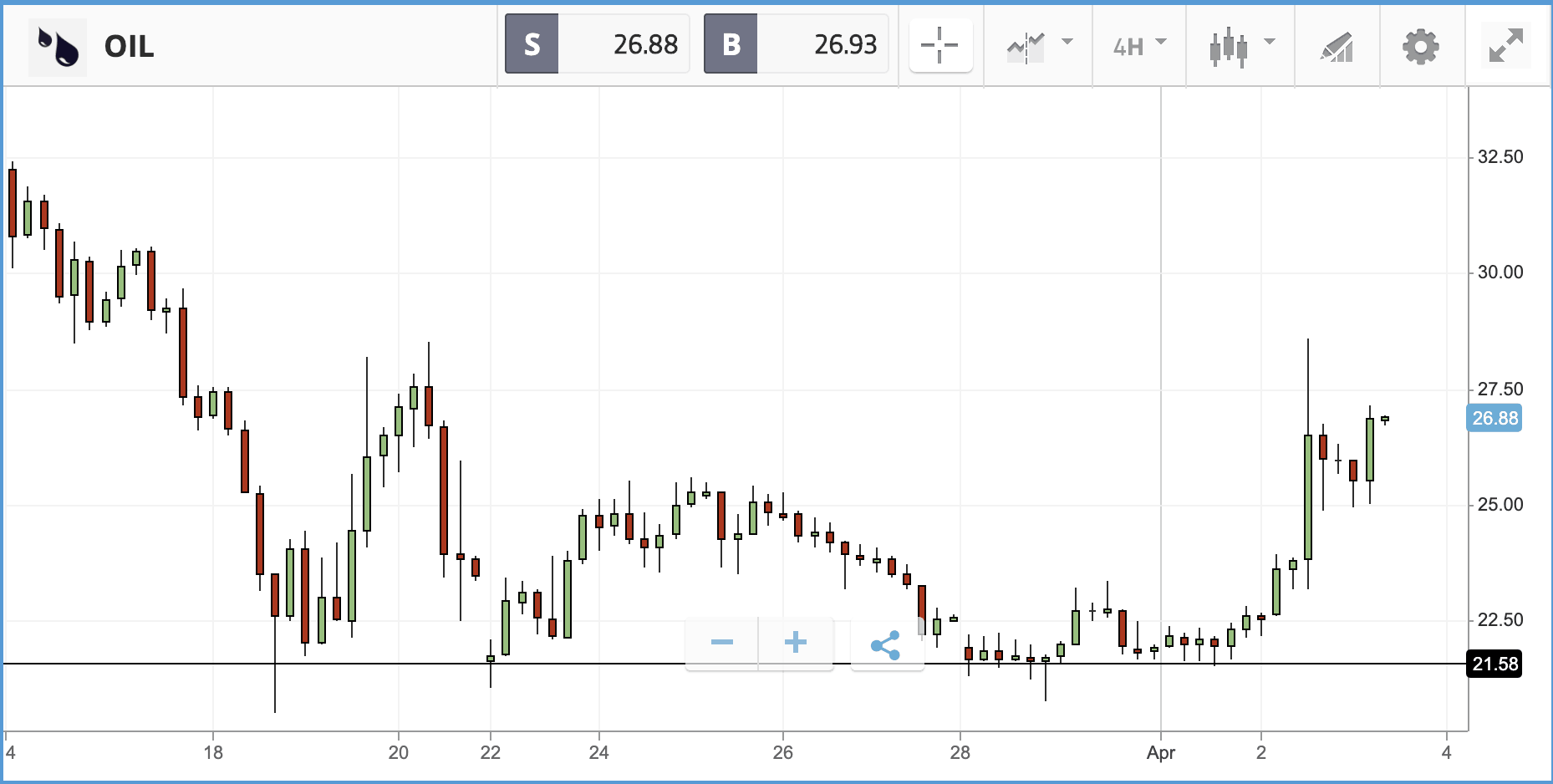

UK shares were off marginally in early trading, down 0.8% at 5,434 points, after a Thursday session in the US that saw all of the major US stock indices close higher. Investors were buoyed by hopes that Saudi Arabia and Russia may reach a deal on oil supply cuts, with the oil price rallying after President Trump tweeted that he expects a deal to include huge production cuts.

The situation remains fluid; while Saudi Arabia said it is calling an emergency Opec meeting after Trump’s statement, the Russian government rejected the President’s remarks, according to the Financial Times. One Opec official told the newspaper that the President’s tweet amounted to “talking before his brain engages”.

Nonetheless, the comments helped the S&P 500 post a 2.3% gain on the back of rallying oil and energy stocks, countering a truly staggering weekly initial jobless claims figure that came in far beyond even the worst case expectations. This week, 6.6 million people in America signed up for unemployment benefits, taking the total over the past two weeks close to 10 million. Last week’s 3.3 million figure was already multiple times the previous record.

There are hopes that many of the layoffs are temporary while the pandemic rages, but the figures demonstrate the devastating effect the coronavirus-induced shutdown is having on the US economy. This wave is unlikely to be the end, and it is those in lower paying roles who are hit hardest. The situation is worse in some states than others; in Hawaii this week for instance, 73 people per 1,000 workers in the state’s labour force claimed for unemployment insurance, a reflection of the state’s tourism dependent economy. Michigan, Pennsylvania, Kentucky and Rhode Island were the other states where the figure was over 50 per 1,000 this week.

Overseas, Asian shares were also flat, with the Nikkei closing up 1 point (0.01%) at 17,820 points, and the Hang Seng down 0.5% at 23,164.

Oil names surge, Walgreens says sales drop off may offset stockpiling gains

All 11 S&P 500 sectors were in the green on Thursday, but energy was by far and away the biggest winner, gaining 9.1% overall. It was some of the hardest hit names in the sector that posted the biggest daily gains, although they still paled in comparison to the losses the firms have suffered in recent weeks. Occidental Petroleum, which activist investor Carl Icahn recently took a stake in, gained 18.7%, although remains close to 60% down over the past month. Apache, Chevron and Halliburton were among the other names in the sector to post double-digit daily gains.

In the Dow Jones Industrial Average, which finished the day 2.2% higher, Chevron and ExxonMobil were the biggest gainers. Walgreens Boots Alliance found itself at the bottom of the pile after announcing its latest set of quarterly earnings. The pharmacy retailer said that store sales were up 26% in the first three weeks of March as customers stockpiled, but tanked in the last part of the month with the declines potentially offsetting the initial gains. As with other firms reporting during this period, the business said its outlook is uncertain.

In corporate news, T-Mobile borrowed $19bn on Thursday to fund its long fought for $66bn acquisition of rival Sprint. The firm secured the debt against some of its assets to ensure it had an investment grade rating on the bonds, which were oversubscribed by close to four times.

S&P 500: +2.3% Thursday, -21.8% YTD

Dow Jones Industrial Average: +2.2% Thursday, -25% YTD

Nasdaq Composite: +1.7% Thursday, -16.6% YTD

UK Banks in the spotlight for dragging heels on small business help

It was a mixed but relatively flat day for London-listed stocks, with banks again back in the spotlight over concerns that they have been sluggish in issuing emergency business loans to customers under a government scheme launched last week. Late on Thursday, post-market close, Chancellor Rishi Sunak banned banks from requesting personal guarantees for emergency loans to small businesses and extended the scheme, where the government underwrites loans, to all small companies affected by the pandemic rather than just those unable to secure funding elsewhere. The controversy comes after banks were pressured by regulators into scrapping billions in imminently due dividend payments to investors.

In the FTSE 100, which climbed 0.5% on Thursday, BP and Royal Dutch Shell — two of the biggest names in the index — were among the top performers, boosted by the oil price spike. Cruise firm Carnival, which is dual listed in London and New York, saw its London listing sink by more than 20% after announcing that in its massive fundraising round it is cutting back on the amount being raised through equity and increasing the portion raised through debt.

The FTSE 250, which fell by 0.8% on Thursday, was taken lower by double-digit losses from names including National Express and gambling firm GVC Holdings.

FTSE 100: +0.5% Thursday, -27.3% YTD

FTSE 250: -0.8% Thursday, -34% YTD

What to watch

Constellation Brands: Alcoholic drinks firm Constellation Brands reports its latest set of quarterly earnings on Friday, with an 11:30am earnings call New York time. The company sits behind brands including Corona, Modelo and Svedka Vodka, and has likely suffered significantly from mass closures of bars and restaurants in many of its markets. Constellation has been a beneficiary of a preference for more premium beer options and aims to boost growth in its wine and spirits segments. Analysts will be watching closely for indicators of how much the bar and restaurant losses are being offset by orders from grocery stores for consumption at home. The company’s share price is down 30.9% year-to-date; Wall Street analysts favour a buy rating on the stock, with 15 buy overweight ratings, six holds and no sells.

March US jobs report: The March jobs report, due out today, will be among the most closely watched sets of economic data released this week. It is worth noting that there is significant lag in the feed through into this report, and the truly disastrous numbers aren’t likely to rear their head until next month’s release. The figures in this month’s report may appear somewhat muted by comparison to current events. Expectations right now, after 273,000 jobs were added to nonfarm payrolls in February, is for anything from 100,000 added to 700,000 lost in March, with a consensus of around 84,000. The unemployment rate is expected to tick up past 4% in the numbers being released on Friday, but warnings of an impending double-digit unemployment rate have been widespread and are backed up by the huge weekly initial jobless claim figures being reported.

Crypto corner:

The rebound for major cryptoassets shows no signs of abating as we enter Friday, bitcoin continues to move back towards $7,000, up marginally this morning following a strong showing yesterday to trade at $6,777. Ethereum is up 1.2% this morning at $141.6, whilst XRP is ahead by 0.5% at $0.177.

Despite the recent rally, pressure on crypto prices has caused mining manufacturers to put equipment on sale ahead of next month’s halving event — as much as 20% off. On average, it takes an investor around 15 months to make their money back from the investment in the hardware and the drop in price was intended to keep this lead time constant.

All data, figures & charts are valid as of 03/04/2020. All trading carries risk. Only risk capital you can afford to lose.