Good morning everyone,

Once again markets are a sea of red this morning as investors seek safe-havens as concerns grow over the coronavirus outbreak. European markets have fallen sharply again and US futures are pointing towards more selling at the open to the tune of 0.6-0.8%. The spread of the virus outside of China is causing real concern as it’s difficult to see such drastic travel and restrictions being feasible in mainland Europe for example.

We have also seen oil dip below $50 a barrel as it continues its decline, erasing all of its gains from the relief rally we saw earlier this month. There are fears that even production cuts from OPEC+ will not be enough to offset the decline in demand for energy caused by the virus. The price could well decline further later this afternoon when the US inventory numbers are released at 15:30 GMT, the consensus is the data will show a continued rise in stockpiles.

Dow all red for second day in a row

Yesterday, the market sell-off carried on at pace, with US stocks falling by more than 3% for the second day running and the yield on the 10-year US Treasury sinking to a record low as investors sought safe havens. Fears that the coronavirus epidemic is turning into a global pandemic that will cause significant damage to the world economy have been fueled this week by a jump in cases in countries including Italy and South Korea. Late yesterday, US health authorities said that they expect a wider spread of the virus in the US and are preparing for a potential pandemic. The major US indices opened the day higher, but sank steadily until the closing bell, with all 30 stocks in the Dow Jones Industrial Average finishing in the red for the second day in a row. Mario Gabelli, the billionaire CEO of investment firm GAMCO, said that the degree of algorithmic trading at work reminds him of 1987, when so-called programme trading was blamed for causing or exacerbating the Black Monday crash. He added that investors should remain patient, as the volatility is likely to create opportunities. Asian markets followed suit, with the Nikkei down 0.8% to take it to three straight days of declines, and Hong Kong’s Hang Seng (which is still open at the time of writing) poised to record its fifth consecutive day of losses, with the index currently off 0.9%.

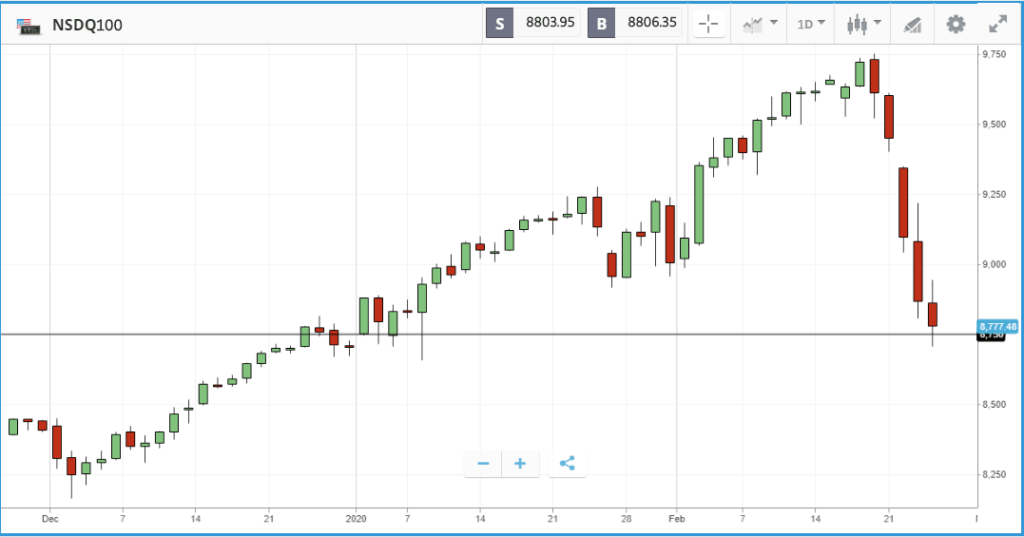

Nasdaq Composite erases 2020 gains

Yesterday’s sell-off took the Nasdaq Composite index into negative territory for the year, dragged down by names including American Airlines, which fell 9.2%, and Marriott, which fell by 8%. In the S&P 500, which fell by 3%, it was a similar set of names to Monday’s sell-off which found themselves at the bottom of the pile. American Express is now down double digits since the start of the week, and UnitedHealth has fallen by more than 12%. Smartphone giant Apple is down 8% for the week so far, and close to 10% over the past five trading days, knocking more than $130bn off its market cap. This is equivalent to losing more value than the market caps of Goldman Sachs and General Motors combined. There were eight firms in the S&P 500 that delivered a positive day yesterday, with HP’s 5.7% gain a standout. In a post-market close earnings update on Monday, the computer and printer maker set out plans to cut costs and buy back stock to win investor support in its defense against a hostile takeover attempt from Xerox. The printer firm recently raised its bid for HP and is attempting to replace the company’s board with its own nominees.

S&P 500: -3% Tuesday, -3.2% YTD

Dow Jones Industrial Average: -3.2% Tuesday, -5.1% YTD

Nasdaq Composite: -2.8% Tuesday, -0.1% YTD=

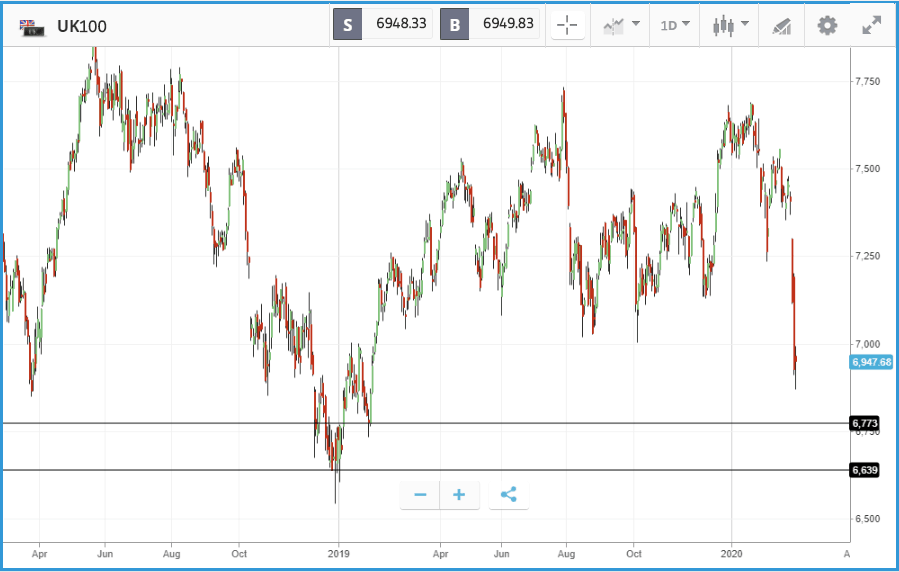

easyJet weekly losses exceed 20% as London-listed shares sink

The FTSE100 has now sank below the psychologically important 7,000 level, bringing losses for the week to over 5% and the lowest level we have seen in the last 12 months. The FTSE is heavily weighted with oil giants such as BP and Shell and big miners like Glencore and BHP, all of whom are heavily influenced by China.

London-listed stocks were also hit by Tuesday’s continued sell-off, but not to the same degree as their US counterparts. There were no double digit fallers in the FTSE 100, but travel names such as Carnival, TUI and easyJet continued to lose ground. Cruise operator Carnival was the biggest loser among the UK’s 100 largest firms, closing the day 5.9% lower and taking its loss this week past 12%, while as of this morning easyJet’s weekly losses exceed 20%

In the FTSE 250, names such as Pets At Home, Restaurant Group and William Hill all sank by more than 4%. The biggest FTSE 250 faller however was insulation firm SIG, which closed the day 17.9% lower following the resignation of both its CEO and CFO, with the former boss of Patisserie Valerie – which went bust last year – taking over on an initial contract until the end of the year.

FTSE 100: -1.9% Tuesday, -7% YTD

FTSE 250: -1.9% Tuesday, 5.3% YTD

Stocks to watch

Lowe’s: Following key rival Home Depot’s expectation-beating earnings report earlier in the week, home improvement retailer Lowers will deliver its own update this morning. Over the past 12 months, the stock has gained 10%, and analysts have an average 12 month price target of $135.50 on the stock, versus its $118.52 Tuesday close. Investors will be hoping the factors that buoyed Home Depot’s quarter will also have helped Lowe’s, which last year cut thousands of jobs in an outsourcing exercise to reduce costs. Last quarter, multiple analysts probed management on compensation costs.

Booking Holdings: Booking Holdings is the firm behind many travel search websites, including Booking.com and Kayak.com. The company’s Q4 earnings update post-market close today will be one to watch, as analysts are certain to ask how the coronavirus epidemic is feeding through into demand. The firm’s share price is already down 15.9% year-to-date, and 12.3% over the past five trading days, on the back of the epidemic. Wall Street analysts currently have an average 12 month price target of $2,144.80 versus its $1,726.58 Tuesday close.

Square: San Francisco-based mobile payments and merchant services business Square has been a popular target for short sellers, but those sellers have been reducing their bets against the firm this month ahead of the company’s quarterly earnings report today. Square’s share price is up 23% year-to-date, despite falling 9.6% over the past five trading days. The company is run by CEO Jack Dorsey, who is also still the CEO of Twitter – he founded both firms. Analysts are split on the prospects for Square, with 12 month price targets ranging from $30 to $105, versus its $77.05 at Tuesday’s close. Currently, 19 analysts rate the stock as a buy or overweight, 16 as a hold, and six as an underweight or sell.

Crypto corner

Cryptoassets’ safe haven status is in the spotlight as they continue to tumble, with the heavy selling this week having continued overnight.

Bitcoin is now close to the $9,000 mark, having sunk 10% in the past ten days to trade at $9,114.

Meanwhile Ethereum is approaching a one-week bear market after sinking from $283 seven days ago, to trade at $235 today. XRP is also flirting with a bear market in the same time frame after slumping back to $0.24.

Bank of Canada won’t release digital currency unless Libra succeeds

The Deputy Governor of the Bank of Canada, Timothy Lane said in a speech that there is no compelling case to issue a central bank digital currency (CBDC) at the moment and the current payment ecosystem is fit for purpose. Referencing the Libra project, led by Facebook, Lane cited this as a good example of technology that would affect how the bank would need to respond to the future of money, but said it was tough to predict whether it will live up to its promises.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.