In a reversal of fortune, having posted one of their worst days in history on Monday, US indices were halted by their 5% limit-up circuit breaker as the market bounced overnight. They have since come off these levels, but are still positive at time of writing.

Trading in Asia was mixed after yesterday’s rout but there were some bright spots, including Australia closing nearly 6% higher, its best one day performance since 2008. There had been talk from some camps of potentially closing the stock markets in order to prevent further panic selling, the Philippines became the first country to do this. This extreme measure was last taken during Hurricane Sandy back in 2012, and also following 9/11.

European markets have opened strongly as we see some bargain hunters come in to pick up stocks at heavily discounted prices. Oil majors BP and Royal Dutch Shell closed at prices last seen way back in 1996, they have been helped this morning by oil creeping its way back to the $30 a barrel mark. Whether or not this is a ‘dead cat bounce’ and we have another leg down to go is uncertain, but considering coronavirus cases are still rising it’s likely we’re not out of the woods yet.

Classic safe havens continue to offer little respite, with gold sinking to $1,485 (its lowest level yet in 2020), back below levels seen before Christmas. Bonds are also stagnant after the wild ride they have put investors through recently.

Trading halted again; Amazon to hire 100,000 workers to cope with demand

Yesterday, investors reacted to the Federal Reserve cutting the benchmark interest rate to zero, dire economic numbers from China, and the increasingly restrictive measures being put in place to combat the coronavirus pandemic.

The data from China for January and February showed a collapse in the country’s retail sales, industrial production and corporate investments. Whilst not unexpected, the scale of the falls saw investors react by fleeing markets — the Dow Jones Industrial Average fell by 12.9%, its second worst day ever — topped only by 1987’s Black Monday. Boeing was the biggest loser, plummeting by 23.8% and taking its one month loss past 60%. In reaction, the aerospace giant asked the White House and Congress for short-term aid to avoid layoffs and reduce the impact on its smaller suppliers.

In the S&P 500, which fell by 12%, the real estate, financials and information technology sectors were hit hardest. Debt burdened oil exploration firm Apache was one of the biggest individual losers, falling 32.3%, taking its one month loss to 80%. As with previous action taken by central banks during this crisis, the Fed’s rate cut and other central bank actions over the weekend were taken as confirmation of the severity of the coming economic impact.

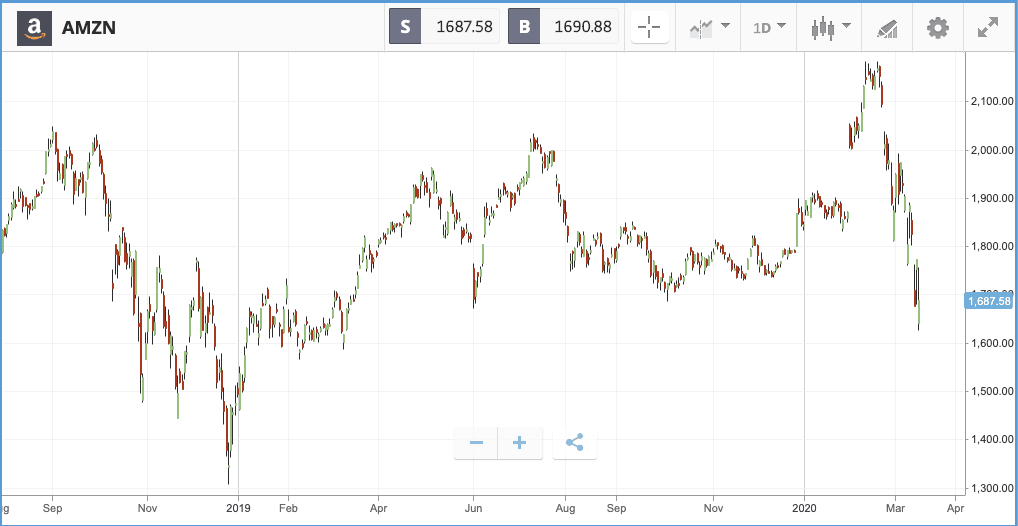

So, who does benefit at a time like this? Amazon announced that it is hiring 100,000 warehouse and delivery workers to handle increased order volume as consumers turn to online options for deliveries. The firm also announced it would raise pay by $2 an hour for employees in such functions. Amazon stock finished the day 5.4% lower; overall the stock has held up better than the broader market and is down 21% over the past month versus the Nasdaq Composite’s 29%. The major US banks fell more sharply than the broader market on Monday, with JPMorgan, Citigroup and Bank of America all sinking by more than 15% after trade body the Financial Services Forum — which all three are a part of — announced its members have suspended stock buybacks.

S&P 500: -12% Monday, -26.1% YTD

Dow Jones Industrial Average: -12.9% Monday, -29.3% YTD

Nasdaq Composite: -12.3% Monday, -23.1% YTD

UK markets rally late in the day after stricter coronavirus policies announced

London-listed shares continued their grind downwards on Monday, with smaller cap stocks hit particularly hard. The FTSE 100 closed 4% lower, amid concerns about the UK government’s response to the coronavirus pandemic, which has diverged significantly from other nations where the focus is on preventing the virus spread and large-scale testing efforts. UK markets rallied during the afternoon as Prime Minister Boris Johnson made an address in which he asked UK residents to avoid all “non-essential contact” and introduced new social isolation policies. School bus firm FirstGroup, Restaurant Group and pub operator Marstons fell hardest in the FTSE 250, with all seeing more than 40% wiped off their share price in a single day. Airlines weighed heavily on the FTSE 100, with International Consolidated Airlines Group (IAG), easyJet and Tui falling by 27%, 19.3% and 12.7% respectively. All airlines are announcing swathes of flight cuts, and on Monday IAG said that it is reducing its April and May capacity by at least 75%, grounding surplus aircraft, deferring non-essential spending and suspending employment contracts.

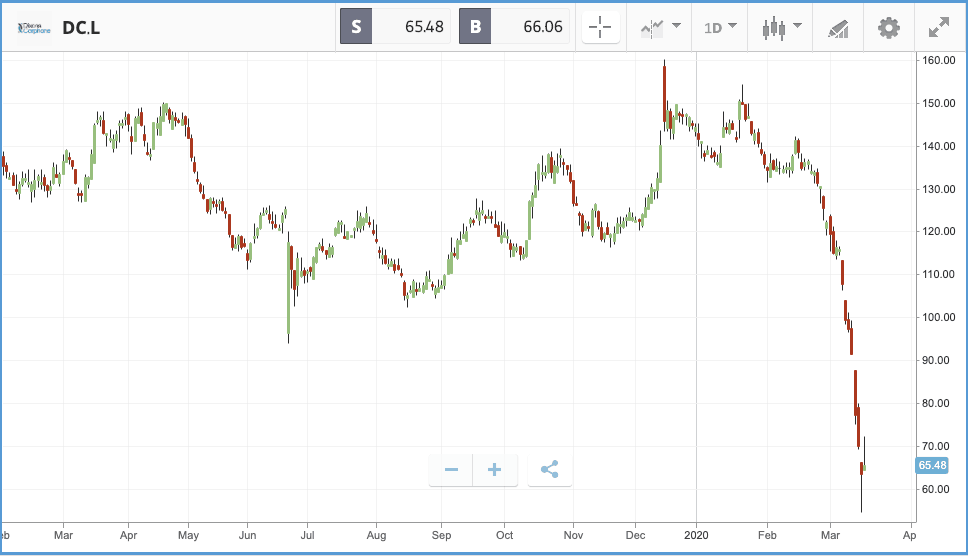

Yesterday we learned Primark’s parent company, Associated British Foods, planned to close a number of stores across Europe due to the Coronavirus outbreak. This morning we are also seeing further upheaval on the UK high street, Mobile phone stalwart Carphone Warehouse has announced the closure of its 500 standalone stores, leading to almost 3,000 job losses. Carphone Warehouse blamed the “tough decision” on changing consumer behaviours, and while the group says it hasn’t seen any material impact from Covid-19, it clearly feels its hand has been forced in difficult trading times. It’s in-store presence in Currys PC World will remain for now. Dixons Carphone shares spiked over 10% on the news, but are now up 6% at time of writing.

FTSE 100: -4% Tuesday, -31.7% YTD

FTSE 250: -7.8% Tuesday, -34.4% YTD

What to watch

FedEx: One firm finding itself in the middle of both virus-related logistical challenges and the shift to online shopping as consumers self-quarantine is delivery giant FedEx, which reports its latest set of quarterly earnings after market close on Tuesday. The stock has fallen harder than the broader market so far, sinking close to 50%, and investors will be watching closely for any inkling that the firm might benefit from increased online shopping volumes. In January, Amazon lifted a ban on its third-party marketplace sellers using FedEx to ship items, which had been put in place by the e-commerce giant a month prior due to “delivery performance”. FedEx is also prey to international disruption given that its operation is global. Currently, 14 Wall Street analysts rate the stock a buy or overweight, and 13 a hold.

Baxter International: Health firm Baxter International has not been cushioned from the market sell-off like some of its pharmaceutical counterparts have and is down more 23.2% year-to-date. Baxter produces products to treat kidney disease, equipment for operating rooms and more. From the end of October to late February when the market rout began, the firm had successfully dug its share price out of a double-digit hole caused by the announcement of an internal investigation into accounting problems. The firm reports its Q4 2019 earnings on Tuesday, and analysts are split 10-7 between buy and hold ratings.

Economic data: On Tuesday a variety of US economic data will be released, including February retail sales, industrial production, and manufacturing production. The data doesn’t cover the most recent weeks where the US response and restrictions related to the pandemic kicked into high gear, but the releases will be closely watched for the first signs of trouble — especially given the negative data released by China yesterday.

Crypto corner:

Cryptoassets staged a mild recovery after racking up huge losses in recent days, as bargain hunters returned to snap up assets which have shed more than half (and in some cases around two-thirds) of their value in the last month.

Bitcoin, which has slumped 50% from a high above $10,000 is up 7.6% this morning, back above the $5,000 mark, while Ethereum is up 8.5% at $117. Meanwhile XRP, which has shed more than two thirds of its value in the last month, is up 6% at $0.148.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.