Good morning everyone

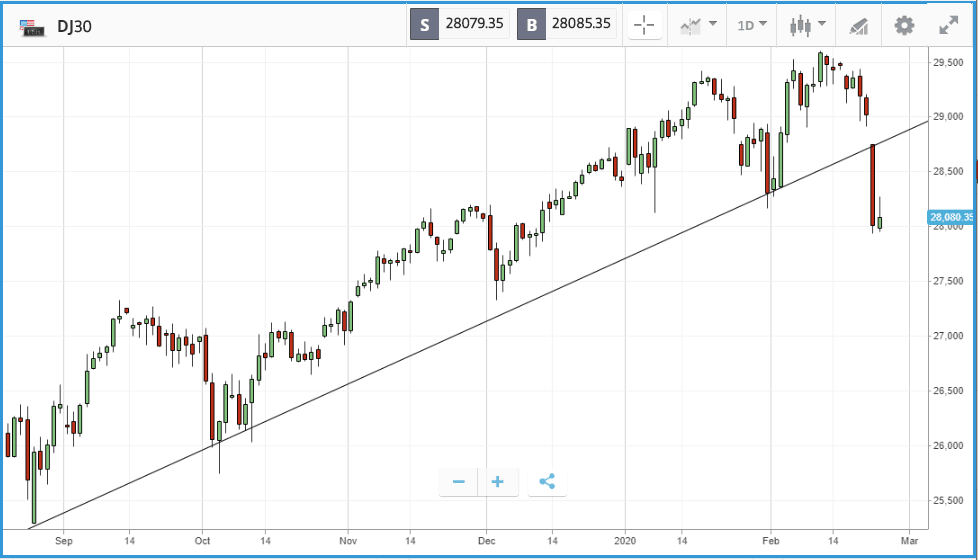

Yesterday marked the worst sell-off of the coronavirus epidemic so far, with the Dow Jones Industrial Average sinking 3.6% – its biggest point decline in almost two years . Until now US stocks had held up relatively well in the face of the crisis, with investors choosing optimism in the absence of hard data on the impacts. However, a surge in cases outside China over the weekend, following a week in which multiple companies warned about how virus-linked disruption is hurting their operations, pushed investors over the edge yesterday. Monday’s drop sent the S&P 500 and Dow Jones Industrial Average tumbling into negative territory for 2020 so far, with the S&P now down 0.2% year-to-date, and the Dow down 2%. It was the energy and IT sectors which were hardest hit in the S&P on Monday, with both sinking more than 4%, while the utilities sector held up best with a 1.2% drop.

The number of coronavirus cases has passed 79,000 worldwide, including more than 2,000 outside of China. It is not just travel firms and those who sell goods in China who face disruption. The nation is a massive supplier of components to manufacturers worldwide, and a huge number of global companies have their own manufacturing operations there.

Asian stocks followed suit overnight, with China’s CSI 300 index off 0.2%, and Japan’s Nikkei off 3.3%. Japan fell particularly hard after the country became the next focal point for the virus. It warned overnight that it now has 160 confirmed cases spread across the whole country.

Few assets were able to shrug off the downturn except gold. Amid the chaos the precious metal surged to a new seven-year high, peaking at close to $1,690 an ounce in the early hours of Monday, before dropping back to $1,650 this morning. Three months ago, gold was below $1,500.

It seems the bleeding has stopped at this morning’s European open, despite the FTSE and DAX being slightly off, US futures are pointing towards a firmer open around the 0.5% mark. Markets are now placing bets on a response from the Fed. The federal funds futures contract tied to the July policy meeting reflected an 85% probability of at least a 0.25% cut, this was 50-50 only a month ago.

Every stock in the Dow ends in the red

Every single one of the 30 names in the Dow Jones Industrial Average fell yesterday, with UnitedHealth, American Express and Cisco sinking farthest at 7.8%, 5% and 5% respectively. Apple, which said last week the virus would cause it to miss sales targets, fell heavily too, finishing 4.8% lower.

In the S&P 500 only 11 names finished in the black yesterday, with the biggest fallers dominated by cruise lines and other travel firms. Cruise names Carnival, Norwegian Cruise Line and Royal Caribbean each sank by 9% or more. All three have been forced to cancel cruises due to the epidemic, and Norwegian’s CEO told investors last week that “people are scared to travel”. Among the major US airlines, American fell hardest, finishing the day 8.5% lower. All US carriers have suspended services to mainland China.

Among the three major stock indices, it was the tech heavy Nasdaq Composite that had the worst day, with a 3.7% drop, although it is the only one of the three to still be sitting on positive year-to-date gains. Chipmakers AMD and Nvidia, Tesla, Expedia and Marriott were among the firms which dragged the Nasdaq lower, all sank more than 5%.

S&P 500: -3.4% Monday, -0.2% YTD

Dow Jones Industrial Average: -3.6% Monday, -2% YTD

Nasdaq Composite: -3.7% Monday, +2.8% YTD

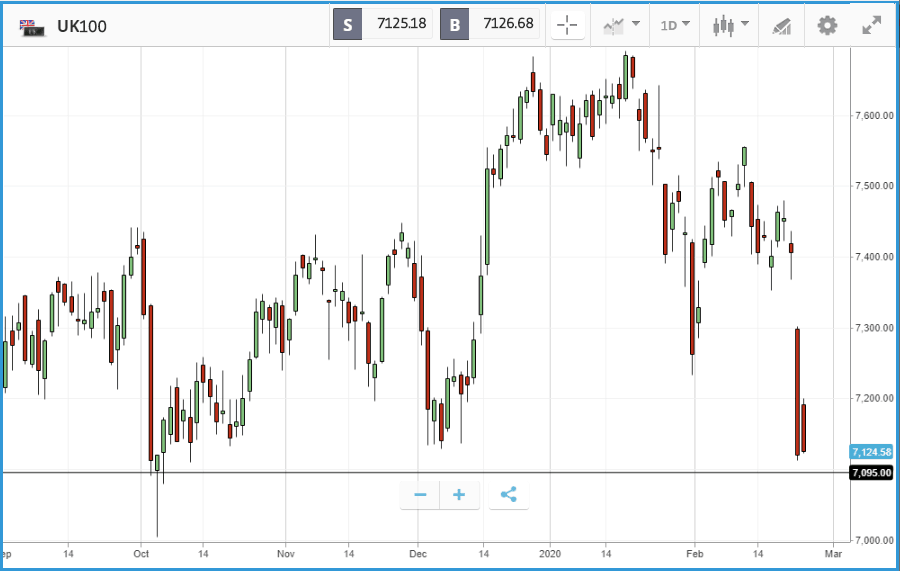

Worst day in almost five years for FTSE 100

In the UK, the sell-off also ran beyond 3%, the worst day for London-listed stocks in nearly five years. The FTSE 100 sank by 3.3%, with airlines the heaviest fallers, taking it to a 5.1% loss year-to-date – not including dividend payments. Budget carrier easyJet had a more severe reaction than its American counterparts, tumbling 16.7% due to a significant outbreak of coronavirus in Italy that prompted fears that travel in Europe may be restricted. There are now more than 200 cases in Italy, and a dozen towns are in lockdown. Tui and International Consolidated Airlines Group, which owns British Airways, fell by 9.8% and 9.2% respectively.

Miners, including Anglo American, Glencore and Rio Tinto also faced a painful day, as China is the world’s largest commodity buyer and there are fears that an escalation in the epidemic could harm demand. Overall 19 names in the FTSE 100 fell by more than 5% yesterday, while just three posted a positive day. The FTSE 250 also sank by 3%, led downwards by Wizz Air and PPHE Hotel Group, which both fell by 11.3%.

FTSE 100: -3.3% Monday, -5.1% YTD

FTSE 250: -3% Monday, -3.5% YTD

Stocks to watch

Rio Tinto: Mining giant Rio Tinto reports earnings at 6am London-time tomorrow morning, and will be one to watch after its stock plunged 5.6% during yesterday’s sell-off. Expect analysts to probe company execs on how they see the coronavirus epidemic feeding through into demand and impacting its supply chain. The firm’s share price was buoyed by the passing of the phase one US-China trade deal but has fallen double digits since the epidemic began. Last year, the UK-Australian firm started selling its iron ore in China’s portside markets for the first time.

Home Depot: DIY retailer Home Depot has posted a solid 12 months, climbing by 26.2%, broadly in line with the wider market. Home Depot is viewed as a bellwether for consumer confidence, due to the discretionary nature of home improvement spending. The firm fell by more than 2% yesterday in the sell-off. Last year, speaking in relation to the trade war, one of the firm’s executives said that its suppliers have been moving manufacturing out of China. Global supply chains and the epidemic will almost certainly feature on the company’s earnings call today, but analysts will also likely probe management on the ongoing impact of lumber price movements. Currently, 20 Wall Street analysts rate the stock as a buy or overweight, 11 as a hold and one as a sell.

Salesforce: Business software provider Salesforce has faced a slow year for its share price, which has lagged the broader market with a 15.2% gain over the past 12 months. In its last quarterly update in early December, it beat Wall Street estimates, and analysts overwhelmingly favour a buy rating on the stock. On that earnings call, analysts probed management on the insights into product demand they had gained from the firm’s Dreamforce conference. The firm reports its latest quarterly update after the market close today, with analysts anticipating an earnings per share figure of $0.56. Last year, Salesforce announced plans to double its revenue by 2023 – a feat that will likely require it to continue an aggressive M&A campaign. Watch for updates on this today.

Crypto corner

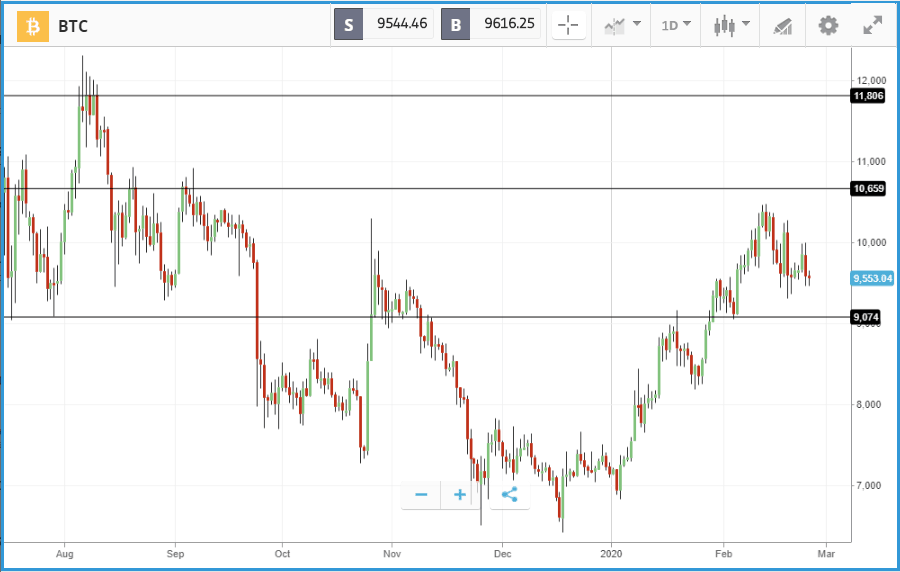

Cryptoassets were much more durable during the market sell-off and although not making any significant ground, Bitcoin has held just above the $9,500 mark. This time around we didn’t see a ‘safe-haven’ rally for bitcoin and investors made the more traditional move into gold. On a day where many markets had their worst day for several years, it’s encouraging to see that cryptoassets held relatively firm at least.

The price has been in somewhat of a consolidation phase since hitting highs well above $10,000 earlier in the month. Bulls will now want to see another leg upwards to challenge the previous high and August/September resistance around $10,659. Alternatively, a bearish shift in momentum could see the price retreat towards the $9,000 mark.

SEC to rule on another Bitcoin ETF proposal this week

Another bitcoin ETF proposal will be reviewed by the SEC this week. Many have gone before and failed and you’d be forgiven for thinking it will never happen. Nonetheless, Wilshire Phoenix, the company behind the ETF is confident, saying they wouldn’t have filed it if they didn’t think it would be approved. February 26th represents the final deadline after the SEC kept on delaying their final decision. The product has a mechanism which Wilshire says addresses concerns of market manipulation in that the basket will rebalance between bitcoin and US Treasury bonds in response to volatility.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.