Good morning everyone,

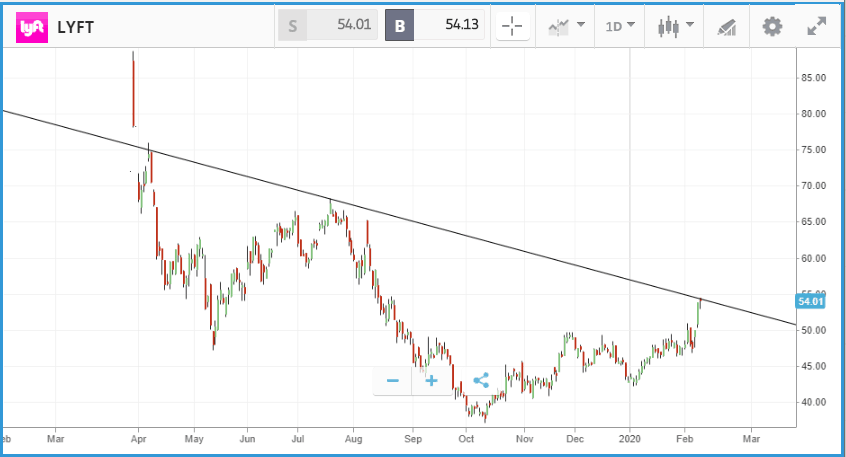

In US stocks overnight, the loss posted by Lyft in Q4 came in far lower than analysts had been expecting, and the ride hailing company passed $1bn in revenue for the quarter. Despite that, Lyft’s share price fell by more than 5% in after-hours trading thanks to a lack of comments from management on the company’s route to profitability. The disappointment was likely magnified by the fact that key rival Uber moved up the timeline on its expectations for profitability last week. Uber faced its own challenges yesterday however, as a judge rejected the company’s request to block a California law from being enacted which will make it harder for employers to classify their workers as independent contractors. Uber said it is considering routes for appeal, as it would likely have to provide higher pay and benefits to its drivers under the new law.

In the UK this morning retailer Dunelm, which specialises in selling homeware, reported profits had soared by 19.4% to £83.6m in the first half of its full year 2020 numbers. It said in the update it expects to deliver better profits than expected for the full year, but it added there remained a chance of a negative impact from the coronavirus epidemic. Nick Wilkinson, Chief Executive, said of the virus: “To date we have not assumed any material disruption to our supply chain or any financial impact in the year.”.

Flat day for US stocks as investors digest Fed chairman’s testimony

All three major US indices were close to flat yesterday, following testimony from Federal Reserve Chairman Jerome Powell in front of the House Financial Services Committee. Powell said that policymakers should use the strong economy to reduce the federal budget deficit so that there is dry powder to help with stabilizing the economy whenever the next recession hits. The Fed Chairman also noted that the impact of the coronavirus epidemic is a significant unknown for the economy at present.

Meanwhile, the anticipated confirmation of approval for T-Mobile and Sprint’s mega merger came through, with the combined firm set to provide services to around 100 million customers. T-Mobile stock finished the day 11.8% higher, while Sprint – whose future without the merger looked bleak – soared by 77.5%. Microsoft and Facebook found themselves towards the bottom of the pile, down by 2.3% and 2.8% respectively, after the Federal Trade Commission demanded information on acquisitions of smaller companies as part of a review into potential anti-competitive practices in the tech sector.

S&P 500: +0.2% Tuesday, +3.9% YTD

Dow Jones Industrial Average: 0% Tuesday, +2.6% YTD

Nasdaq Composite: +0.1% Tuesday, +7.4% YTD

Coronavirus hit stocks soar as investors bet reaction was exaggerated

The top performing London-listed stocks yesterday were a who’s who of companies that have posted major share price moves on coronavirus headlines, as the FTSE 100 rallied by 0.7%. International Consolidated Airlines Group, easyJet and cruise firm Carnival gained 4%, 3.8% and 2.7% respectively. Early in the day, hedge fund giant Ray Dalio said that he thinks the epidemic has likely had an exaggerated effect on stock prices. Airline Tui was the biggest winner yesterday among the UK’s largest companies, with its share price jumping 12% after reporting that a strong holiday period would help to counteract the ongoing cost of its Boeing 737 Max airliners being grounded. The FTSE 250 also gained 0.7%, led by gambling company William Hill which popped 7.8% following a substantial gain on Monday. Over the weekend, it was announced that the firm has agreed a partnership deal with TV network CBS.

FTSE 100: +0.7% Tuesday, -0.6% YTD

FTSE 250: +0.7% Tuesday, -1.1% YTD

Stocks to watch

Barclays: The UK bank will update the market with its full year results tomorrow and investors could well be hoping for something upbeat considering that the uncertainty surrounding Brexit is slowly fading and the deadline for PPI claims passed last August. A mainstay part of most UK banks’ results over recent years has been the provisions they have had to set aside each quarter for PPI claims – often in the billions, now that this has come to an end investors will hope that this extra cash can end up on the bottom line.

Cisco: Tech and telecoms giant Cisco’s share price has been essentially flat since a double digit fall in summer 2019, after management offered disappointing guidance. In November, management then warned on a broad slowdown in tech spending globally, and investors will be watching for any signs of increased optimism on the company’s Q4 earnings call post-market close today. Analysts are projecting an earnings per share figure of $0.76 and are currently split evenly between buy and hold ratings on the stock.

CVS Health: CVS has badly lagged the broader market over the past year, only gaining 10.2%, but has jumped 8.8% over the past five trading days ahead of its earnings report before market open today. As with other retail segments, how the pharmacy chain is making use of technology in the face of online rivals, such as digital prescription service Capsule, is a key long-term focus for investors. Wall Street analysts currently have an average 12-month price target of $81.71 on the stock, versus its $73.85 Tuesday close, with a range from $69 from $97.

MGM Resorts: Thanks to its exposure to Macau, casino operators MGM Resorts has found itself at the center of the coronavirus epidemic, with its share price down 1.7% year to date even after posting a gain over the past week. The potential impact of the epidemic on its bottom line will inevitably be probed by analysts on its post-market close earnings call today, although the quarter it is reporting earnings for ended before the virus struck. Given share price sensitivity to coronavirus news, expect a significant reaction if management offers a negative outlook for Q1 2020 due to the epidemic. Analysts are expecting an earnings per share figure of $0.24 for the fourth quarter, close to double what it posted in Q4 2018.

Crypto corner

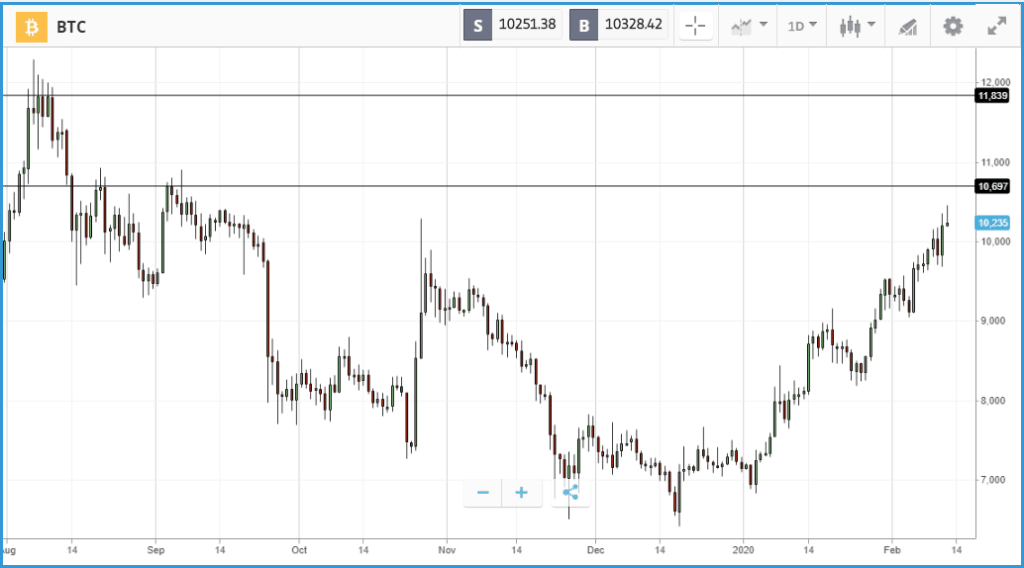

Fresh from the news that Federal Reserve Chairman Jerome Powell called for the need for privacy amongst digital currencies, cryptoassets have made another push higher. This adds to a convergence of factors including the upcoming halving, as well as continued use of bitcoin as an alternative safe haven which appear to be driving sentiment.

Simon Peters, our crypto analyst here at eToro, said: “There clearly seems to be more interest in bitcoin and other cryptoassets as potential safe havens for investors worried by the volatility of the stock markets as the coronavirus crisis continues.”

Bitcoin was back through $10,000 this morning, hitting a fresh high of $10,355 to leave it only marginally below its six-month peak.

Ethereum and XRP are also charging upwards. Ethereum is up 7% today alone, at $251.8, although it remains a long way below its record high of $1,250 set back in 2018. XRP is also firmer at $0.287, although it remains well below its year-high of $0.50.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.