Hi Everyone,

On March 10th, 2017 the SEC in the United States took a decision to reject a bitcoin-backed ETF that had been desired by the crypto-community for some time. The price of bitcoin reacted with a short-lived sell-off followed by a face-melting rally and in the following nine months continued on to break new records.

On that day, Bitcoin made a statement, loud and clear, that it does not need Wall Street in order to thrive.

Yesterday, the first physically settled futures contracts opened on Wall Street. Judging solely by the volume, which totaled (71 BTC) less than $1 million, the launch was a total flop. Meanwhile, the CME futures contracts, which are cash-settled, saw a significant spike in volume trading (29,735 BTC) nearly $300 million.

Yesterday, Wall Street has shown us quite clearly that they still don’t understand bitcoin.

Today’s Highlights

- Unlawful PM

- Oh Greta

- Bakkt Into a Corner

Traditional Markets

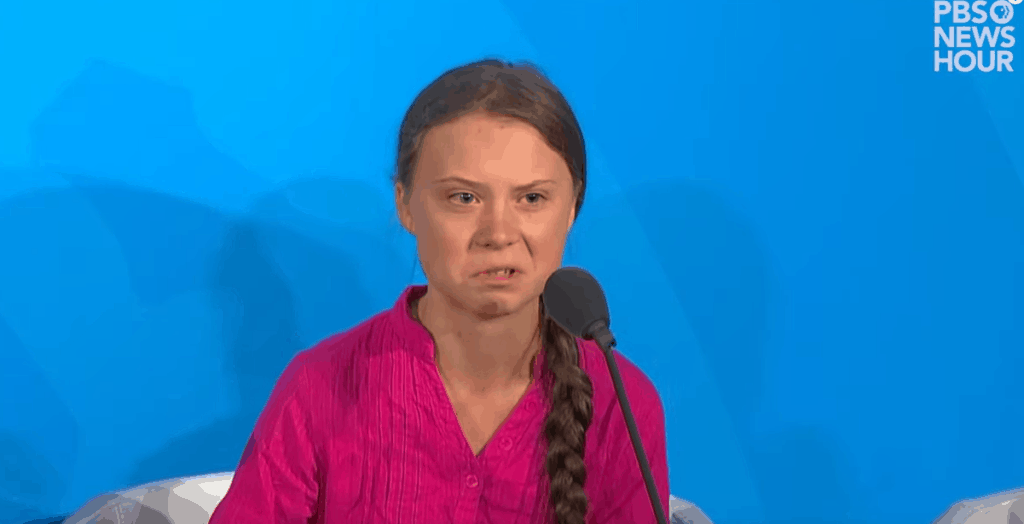

Greta on Climate Change

The speech was so dramatic that even notable liberals have criticized it for being a bit over the top but there’s no doubt that Greta’s words are now reverberating at the highest circles.

See, politicians may lack the political willpower to effect change but in our capitalist society, it’s the corporations making the big decisions that have the potential to affect change. The world is quickly changing and as investors, it’s our job to identify and shape these trends to the best of our ability.

The @RenewableEnergy (blue line) Smart Portfolio aims to do just that by including all the top companies that are acting to create the future of power, and it’s been performing quite well against the benchmark index (green line) over the last few months.

Bakkt into a Corner

It should be noted that the launch of these futures was one of the main narratives that spurred on the massive bull run at the start of the year, so what we’ve got here is a classic case of buying the rumor and selling the news.

As we’ve mentioned several times during this extended period of stability, if we do see a break of the lower yellow line, we can probably look to the blue line, the 200 day moving average to provide some support. So, the longer we stay stable, the more that blue line will come up to meet the price.

Of course, I could be wrong. As we know, past performance is not an indication of future results.

Have a wonderful day ahead.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.