Dogecoin and ApeCoin add 20%

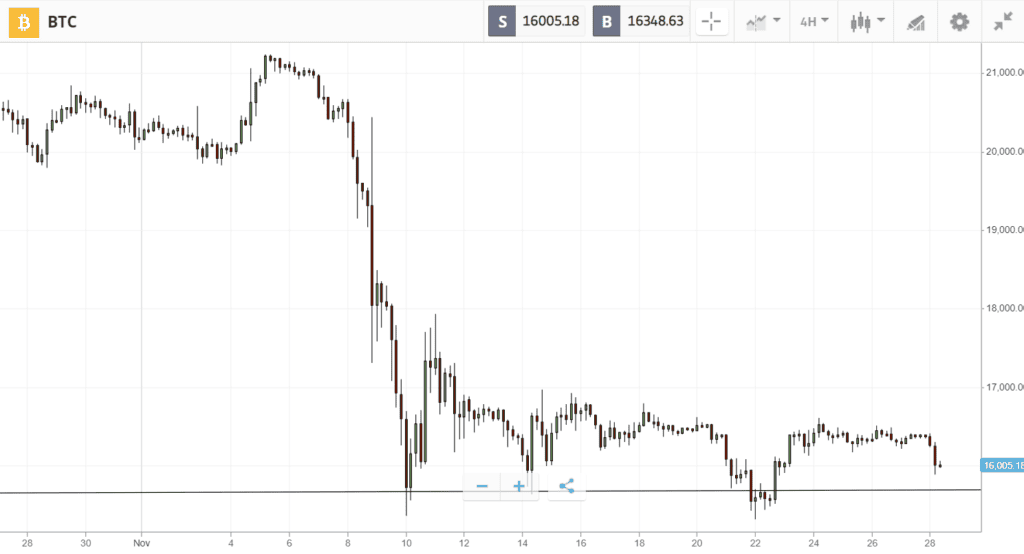

Altcoins are dominating the action as Bitcoin drifts sideways in a post-Thanksgiving slumber.

The largest cryptoasset moved up slightly on Wednesday, after the Federal Reserve revealed plans for smaller rate hikes, and America’s biggest bank won trademark approval for “J.P. Morgan Wallet“. Yet any optimism generated by the good news was offset by widespread uncertainty, as one of the largest crypto companies revealed that it is $2 billion in debt.

As Bitcoin slumbered, altcoins were feeling the holiday cheer. ApeCoin swung 26% higher on news of an NFT marketplace, followed by DeFi favorite Curve which climbed 25%. Close behind, Dogecoin jumped 23% on Black Friday and digital silver Litecoin added 20%.

This Week’s Highlights

– Pre-halving rally lifts Litecoin 20%

– Curve climbs 25% on stablecoin news

Pre-halving rally lifts Litecoin 20%

Shrugging off the concerns of the broader market, Litecoin bounced sharply higher last week to briefly touch $80.

The rally has been widely attributed to Litecoin’s third halving, which is due in August 2023. This pre-programmed event will halve the rewards paid to miners for recording transactions on the Litecoin blockchain, reducing the supply and making the cryptoasset more scarce.

Just like Bitcoin’s halving event, Litecoin’s halving is typically seen as bullish and has historically been preceded by multi-month rallies.

Curve climbs 25% on stablecoin news

DeFi darling Curve, one of the most popular decentralized exchanges, has risen 25% over the last week.

The gains were likely driven by the release of details about its upcoming stablecoin, crvUSD, which is backed by crypto and will use a unique lending-liquidating AMM algorithm (LLAMMA) model to mitigate collateralization risks.

Curve may also have attracted attention last week for its role in a failed attempt to manipulate DeFi lending protocol Aave.

Week ahead

The week ahead could prove to be decisive for the market’s direction, as persistent concerns about industry stability collide with data revealing the state of the broader economy.

Friday’s US jobs report will be the main highlight, with investors hoping for a weak reading that would indicate the Federal Reserve will soon slow the pace of rate hikes.

In addition, more inflation data is due on Thursday in the form of Personal Consumption Expenditures (PCE). This is the Fed’s favorite inflation indicator, and the data is also likely to inform future monetary policy.