On Sunday evening, a Senate vote on a huge stimulus package to bolster the US economy failed. The vote came in at 47-47, well short of the 60 votes required. Democrats voted against the deal on the basis that it favours bailouts for corporations over support for individual workers. Republican senators drafted the text of the trillion dollar plus package — which includes direct payments to individual Americans and loans for small businesses — without locking in a deal with Democrats. Sticking points where progress has already been made on Democrat demands include funding to expand the unemployment insurance program, and funding for hospitals and healthcare providers. After the vote failed, stock futures fell more than 4% and touched their 5% ‘limit down’ thresholds (trading shuts off when these are exceeded), indicating that Monday morning could get off to a rough start. It comes after Goldman Sachs put out one of the most dire predictions for the impact of the virus on the US’s second quarter economic growth. In a research note on Friday, the bank projected that Q2 could see a 24% decline in economic activity based on the fact that economic data for the period before many Americans were locked down at home is already missing estimates.

Over the weekend, many of the world’s largest hotel companies revealed that they are furloughing tens of thousands of workers and shutting hotels. Asset managers, including Goldman Sachs and BNY Mellon, have stepped in to shore up some of their money market funds to meet liquidity requirements brought in following 2008’s global financial crisis, when a $65bn fund was forced into liquidation after a portion of its assets became worthless when Lehman Brothers folded.

In the UK, Prime Minister Boris Johnson warned on Sunday that stricter measures could be brought in to enforce social distancing if people fail to obey rules, after a weekend that saw parks across London packed with groups of people. These scenes were echoed in New York, where Governor Andrew Cuomo has given New York City 24 hours to come up with a plan to reduce public gatherings.

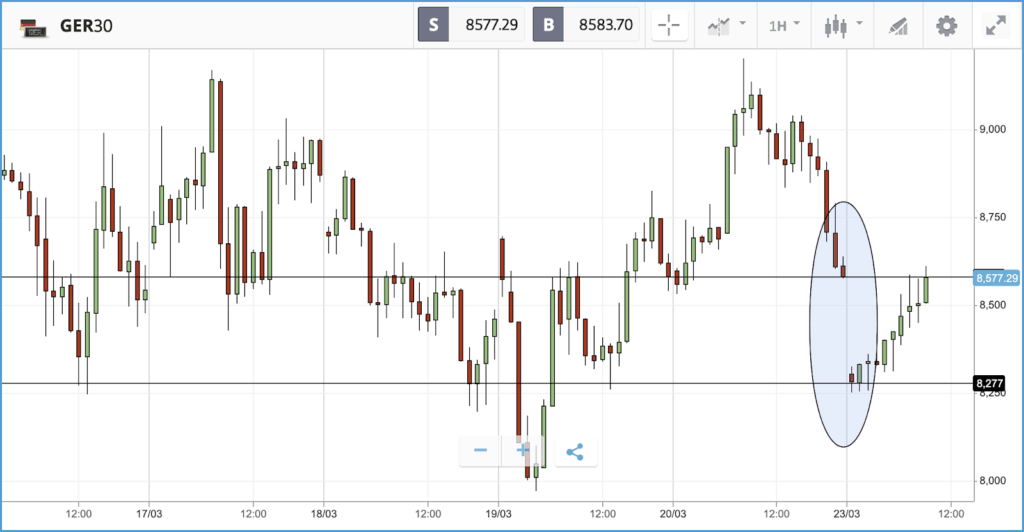

Whilst still a sea of red, European markets have made up some ground, having been down more than 8% overnight — Germany’s Dax being down a mere 3% seems almost like a win. One of the reasons the Dax may have been hit so hard was the news that Chancellor Angela Merkel is in quarantine due to contact with an infected doctor. Since then, the Dax has almost filled the overnight gap.

Friday afternoon selloff caps dire week for US stocks

Last week was a dismal one for US stocks, with all three major indices posting double-digit losses despite the Federal Reserve slashing interest rates to near-zero and announcing the restarting of quantitative easing. The Dow Jones Industrial Average is now down 32.8% year-to-date, after a Friday trading session that saw the index swing from a 2% daily gain at the 11am mark to a 4.6% loss by the close of play.

In a Friday note, investment firm T. Rowe Price cited President Trump’s Monday statement that the virus might not be contained until late summer, economists slashing growth forecasts, automakers shuttering factories, oil prices hitting two decade lows and strains in corporate credit markets as the most prominent events that helped drive last week’s selloff. Factors that supported the periodic rallies over the week included the Fed setting up very short-term lending facilities, progress on the stimulus package and China’s progress in containing the virus, according to T. Rowe.

In its own Friday note, John Hancock Investments noted that the Cboe Volatility Index (the ‘fear index’) closed the week 14% higher. One index that has been faring better than the rest is the tech heavy Nasdaq Composite Index, which has fallen by a comparatively mild 23.3% year-to-date. Many information technology names have been faring well compared to other sectors, as a huge shift to working from home has bolstered demand for their services. Netflix, for example, is only down 12.4% over the past month, and is up 2.9% year-to-date. On Friday, airlines faced a hugely volatile day, with their share prices highly sensitive to any headlines about the progress on a potential bailout. United Airlines was up more than 40% at one point during Friday but fell back to a 15.1% daily gain. Delta Air Lines traded as much as 23% higher but sank to a 0.7% loss for the day.

S&P 500: -4.3% Friday, -28.7% YTD (-15% last week)

Dow Jones Industrial Average: -4.6% Friday, -32.8% YTD (-17.3% last week)

Nasdaq Composite: -3.8% Friday, -23.3% YTD (-12.6% last week)

Sterling collapse props up large cap stocks

Large cap and small cap London-listed shares diverged sharply last week, as the tumbling value of the pound provided a helping hand to the more global names that populate the FTSE 100. These make the majority of their money overseas, so benefit from those earnings being converted back into a weaker currency.

Markets also responded positively to the Bank of England’s second emergency interest rate cut in a fortnight, to an all-time low 0.1%, in addition to a £350bn financial package unveiled by Chancellor Rishi Sunak. The FTSE 100 fell 3.3% over the course of the week, while the FTSE 250 sank 12.7% despite posting a 6% rally on Friday. The FTSE 250 is now down by a whopping 37.8% year-to-date.

The currency dimension and time difference during a rapidly moving news environment also means the FTSE 100’s profile looked markedly different from its US counterparts last week. Airline stocks were particularly buoyed in the latter half of the week by the government action. After slumping earlier in the week, budget carrier easyJet gained more than 18% from Wednesday’s close to Friday’s close, while International Consolidated Airlines Group gained 10.9% on Friday. Late on Friday, the UK government announced that it will subsidise the wages of employees that businesses keep on their payroll for at least the next three months, for companies big and small. The announcement may dampen the chances of the UK airline industry seeking a government bail-out en masse — something US airlines have already resorted to.

FTSE 100: +0.8% Friday, -31.2% YTD (-3.3% last week)

FTSE 250: +6% Friday, -37.8% YTD, (-12.7% last week)

What to watch

Chicago Fed National Activity Index: All economic data points are being much more heavily scrutinised now because they feed into the economic forecasts being produced by the large banks, which can significantly affect market sentiment. The sole item on Monday in the US is the Chicago Fed National Activity Index, which intends to gauge economic activity and inflationary pressure. According to the Federal Reserve Bank of Chicago, a zero value is associated with the national economy expanding at its average rate of growth, with negative values indicating below-average growth and positive values above-average growth. The index pulls in data from several dozen economic indicators, which feed through with varying amounts of delay. Monday’s release covers February, so misses out the most serious period of the disruption caused by the virus so far in the US, but will still be watched closely for early warning signs of the economic damage to come.

New York Stock Exchange: There is no indication that anything will go awry but it’s worth noting that, for the first time in its history on Monday, the New York Stock Exchange will be operating entirely electronically — as all of its human traders have been sent home from their usual spots on the exchange floor. The NYSE has never remained open before with its trading floor closed, and experts have said that the stakes for the exchange are “very high.” Others have said that possible price dislocations should be watched for as the market opens; where opening prices diverge sharply from the prices of the first trades.

Comparing asset classes: One of the most telling signs of investor sentiment over the past week was that selling was apparent across almost every asset class. Investors fled all but the safest bond options, and the price of gold sank dramatically. In particular, investors appear to be wary of corporate debt in the face of a wave of potential bankruptcies and bailouts. In the US last week, bond funds posted a record $108bn in net outflows while money market funds that invest in government debt took in huge inflows. As a result of the flight from corporate to government debt, the performance of the two categories was starkly different last week. For example, the iShares US Treasury Bond ETF delivered a price return of 0.73% (NAV return of 0.3%), while the iShares iBoxx $ Investment Grade Corporate Bond ETF fell 13.3% on a price basis (-11.2% NAV return). The price of gold has been a victim of the same trend, with investors defaulting to cash over the precious metal, which is faltering in its reputation as a safe haven asset.

Crypto corner

Cryptoassets held firm, well above lows seen last week, but remain susceptible to big price swings as the huge uptick in volatility continues to sweep through markets.

Bitcoin is at $5,841 this morning, off 2.3% on the day but still holding near the crucial $6,000 mark. When it goes through this level, it has traditionally led to a surge in purchases, although whether this trend will be maintained this time around remains to be seen.

Bitcoin remains firmly in positive territory on a 1-year basis with a gain of 49.4%, such was the extent of its rally prior to the crisis, but the same cannot be said for its peers. Ethereum, down 1.5% today at $123, is now 7% lower on a 1-year basis, while XRP (off 1.2% today at $0.149) is looking at a 49.6% loss over the same one-year view.

All data, figures & charts are valid as of 23/03/2020. All trading carries risk. Only risk capital you can afford to lose.