Please feel free to sign up to watch this month’s live Platinum webcast here.

View the eToro Club Benefits or speak to your account manager for more details on how you can join the next live discussion!

Let’s take a look at the markets from the unique perspective of our senior market analyst, Mati Greenspan, who will review with you the latest trends of stocks, commodities, currencies and cryptos.

1:02min | What was covered:

- Battle of the Traders

- Crashing Faangs

- Bonds are Inverted

- South African Situation

- Bitcoin Technicals

- Smart Portfolios: Travelkit & Crypto Takeover

1:37min | Battle of the Popular Investors

OmarETSA – This Popular Investor from Spain has been with eToro since early 2017. According to his bio, he is a student, earning his income exclusively from online trading. He focuses mainly on the currency market, aims to keep a relatively low risk score, and encourages his copiers to interact with him.

tradefx525 – This Popular Investor from the United Kingdom has been with eToro since early 2018 and trades mainly currencies and stocks. According to his bio, his strategy combines both fundamental and technical analyses. He holds trades for 2 weeks on average and recommends copying open trades.

13:10min | Crashing Faangs Review of Facebook, Amazon, Apple, Google, Microsoft As we can see, these tech giants aren’t only disrupting tech. They’re pretty much disrupting all investments on the planet.

17:39min | Bonds are inverted

20:03min | How to diversify

20:30min | Sharpe Traders Portfolio reviewed; This investment strategy bundles investors with risk scores ranging from 2 to 7 in descending order. It is rebalanced quarterly and comprises only investors with high sharpe ratio results and significant gains, and is up almost 50% over the past 12 months.

In the world of investments, things are a lot more quantifiable, which makes the level of risk and potential return much easier to calculate. One of the most common ways to measure risk premium is the Sharpe Ratio.

25:30min | Questions from our Platinum clients

Question: When will the recession happen and does it depend on the FED’s policy?

Answer: Review of how the FED is throwing money at the market

Question: Is there a way to invest in bonds on eToro?

Answer: Review of the ETF’s on eToro: BND BND, TLT, BOND, BSV

28:25min | South African Situation

32:00min | Questions from our Platinum Clients

Question: Any views on the bottom for Copper and can Mati see a correlation between Copper and the China-US trade deal?

Answer: Correlation of China50 and Copper reviewed

Question: Do you think that crypto is the pressure valve that has managed to shift some of the risk and thus, inflation pressure?

Answer: Discussed in depth

42:40min | Bitcoin Technicals

50:11min | Crypto spread discussed

54:13min | Questions from our Platinum clients

Question: What happens when the Fed raises interest rates and large companies that are overpaid can no longer repay the interest because money is simply not available …. will Cryptos be like a safe haven in this case?

Answer discussed if the FED is backtracking on its policy

56:00min | TravelKit portfolio has performed extremely well despite poor market conditions. It finished 2018 flat despite NSDQ and S&P500 being negative and is currently in profit 17% for this year.

Diversification is a key factor in personal wealth management.

CryptoTakeover– Long Crypto Short Banks – This portfolio is long on crypto assets and shorts large-cap global banking stocks.

60:15min | Final question: Why aren’t institutional investors really full on crypto and when do you think this will happen?

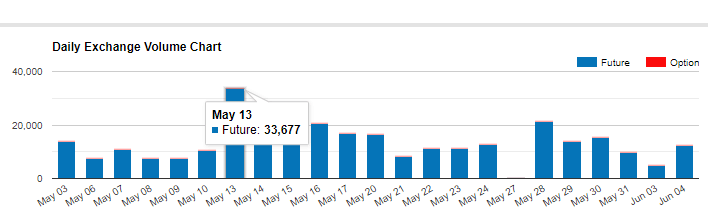

Answer: Review of BTC volume and discussion of CME group as institutions don’t really have the option to invest freely in bitcoin right now.

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, Twitter, LinkedIn.

eToro is a multi-asset platform which offers both investing in stocks and crypto assets, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short time frame and, therefore, are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and, therefore, is not supervised by any EU regulatory framework. Your capital is at risk.

Past performance is not an indication of future results

Data presented during the webcast is accurate as of June 4th, 2019.