Good morning everyone,

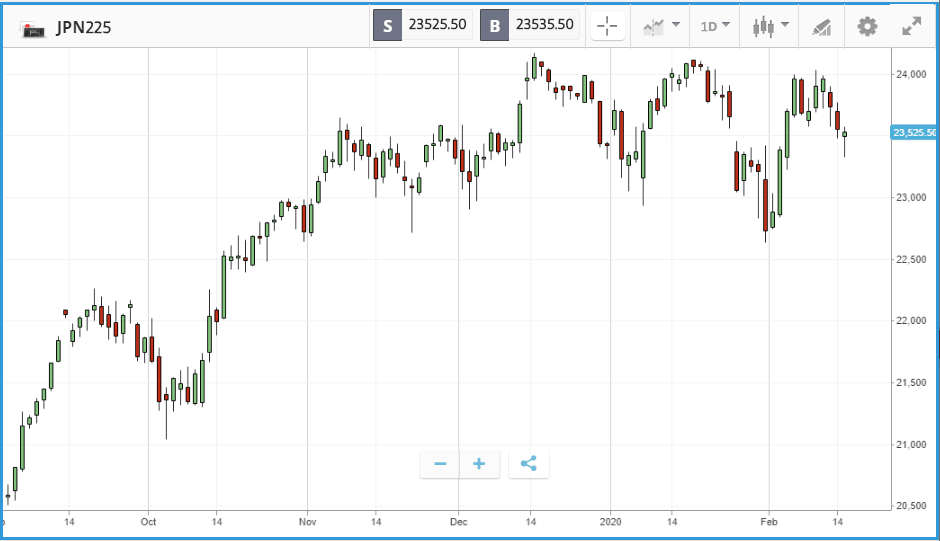

Japanese shares were rocked this morning after the country revealed its GDP has shrunk by 6.3% in the last year, much worse than forecast.

The consumption tax – which has seen the consumption rate fall 11% in the last year – was the big driver of the sharp fall, having come in at double what economists had expected. In response, the Nikkei was down 0.7%

Investors will now be hoping for a policy response from the Bank of Japan following the news, with the coronavirus already impacting the region. However, it is difficult to see how much room for manoeuvre the BoJ has, considering all the policy easing that they have already implemented. This makes a recession for Japan a very real possibility.

Elsewhere, markets have opened positively as Beijing signalled it would ramp up stimulus to offset the continued economic damage the coronavirus outbreak has caused. They have cut medium term interest rates and will inject more liquidity. The FTSE and DAX have both opened around 0.25% higher. US Markets will be closed for the President’s Day holiday today and as such volumes will be thinner although index futures are showing gains of 0.2% for the Dow and as much as 0.4% for the Nasdaq.

Last week roundup

US stocks posted gains last week, with all three of the major indices climbing more than 1%. Gains came despite company earnings starting to reveal details of how the coronavirus epidemic is likely to feed through into corporate bottom lines and economic growth.

On its Wednesday Q4 earnings call, MGM Resorts CEO Jim Murren said that the company’s Macau casinos are closed, with the firm incurring $1.5m in operating expenses daily. MGM’s stock fell by around 7% in the second half of the week after the earnings call, which included a significant earnings miss.

On Friday, on UK pharma AstraZeneca’s earnings call, executive vice president Leon Wang highlighted that its salespeople cannot easily visit hospitals or access healthcare professionals. The company has since updated its guidance to include impacts from the epidemic. Also last week, Alibaba CEO Daniel Zhang predicted the virus will impact the global economy, and that its own logistical operations have faced serious disruptions.

Lastly, Federal Reserve chairman Jerome Powell warned that it is too early to speculate on the impact of the virus, and that the Fed would want to see evidence of material impacts on the US economy before it would consider cutting interest rates.

Tech sector accounts for majority of US earnings growth in Q4

The technology heavy Nasdaq Composite once again led the way last week, closing 2.2% higher driven by a strong earnings season from the tech sector. For firms that had reported Q4 earnings by February 13th, the IT sector accounted for 63% of all earnings growth, according to investment firm John Hancock. On Friday, for example, Nvidia stock soared 7% to hit a record high after beating Q4 earnings expectations on the back of a 40% increase in revenues year-over-year. More broadly, investor optimism around the prospects for containing the coronavirus helped push stocks higher, with the S&P 500 gaining 1.6% over the course of the week. Advice firm Edward Jones noted that it is expecting global growth to slow down noticeably in Q1, highlighting that while China accounts for less than 3% of global exports, it is responsible for more than 13% of global oil demand, over 50% of commodity consumptions and more than a third of smartphone and car sales. Travel booking firm Expedia was another big winner at the end of the week, gaining 11% on Friday after beating earnings expectations, with management detailing turnaround progress to get away from “wasteful activities that weren’t core to our business.” However, investors will have to wait to see the impact, with the US shut today for Presidents Day.

S&P 500: +0.2% Friday, +4.6% YTD

Dow Jones Industrial Average: -0.1% Friday, +3% YTD

Nasdaq Composite: +0.2% Friday, +8.5% YTD

Pound holds back FTSE 100

In UK stocks, the FTSE 100 and FTSE 250 diverged last week. The FTSE 100 sank 0.8% as the pound gained versus the dollar over the course of the week, which typically weighs on the index with such a large overseas-earning contingent. The rally was after Boris Johnson reshuffled his cabinet, installing Rishi Sunak as the new finance minister. The FTSE 250, which is more domestically focused, gained 1.4% over the week, although it remains in negative territory for the year. Royal Bank of Scotland was a major drag on the FTSE 100 on Friday, after it delivered a lower than anticipated dividend and management provided a pessimistic outlook. Chairman Howard Davies said that the continuation of the low interest rate environment “poses a challenge to income growth for all UK and European banks”. RBS stock fell 7.9% on Friday after the results. AstraZeneca also fell on Friday, closing 3% lower, after missing revenue estimates but beating expectations on earnings, in addition to management’s outlook on the coronavirus epidemic. In 2019, the pharmaceutical giant generated 21% of its revenues for the year, versus 33% generated in the US.

FTSE 100: -0.6% Friday, -1.8% YTD

FTSE 250: +0.5% Friday, -0.4% YTD

Stocks to watch

US markets are closed on Monday due to a public holiday, so the below are UK stocks reporting tomorrow.

HSBC: The market is largely expecting the confirmation of 10,000 further job cuts as part of a major restructuring at the bank. This will also include the exit of underperforming countries and focusing on boosting revenue by region where they are not so thinly spread. Analyst consensus has pre-tax profit coming in at £15.3m, up very slightly from last year. With its prominent Asia exposure, shares took a hit due to the coronavirus impact but have since gone on to pare losses for the year. Shares are currently trading 10% lower than they were 12 months ago.

Glencore: London-listed mining giant Glencore is due to post its full year results tomorrow. Shares have been sideways for a few months after having some issues in its African copper operations, which the company now says is under control. Despite this, the shares offer an attractive dividend yield north of 6%. Shareholders will be looking for continued revenue growth in tomorrow’s update as has been the case in the last few years, although questions have been raised regarding its involvement in coal with environmentally conscious investors may look for greener alternatives.

Domino’s Pizza: New-York based Domino’s reports its latest quarterly update on Thursday. We’re flagging it here as with more than 20 US stocks with a market cap over $10bn reporting that day, it’s one that might get lost in the crowd. The company’s stock price went on a tear in the years running up to summer 2018, but it has been highly volatile since despite winning market share and expanding globally. It is more the rate of growth that is important here and investors will be watching closely for any deceleration. Wall Street analysts favour a hold rating on the stock, with an average 12-month price target of $300.23 to its $291.60 Friday close.

Crypto corner:

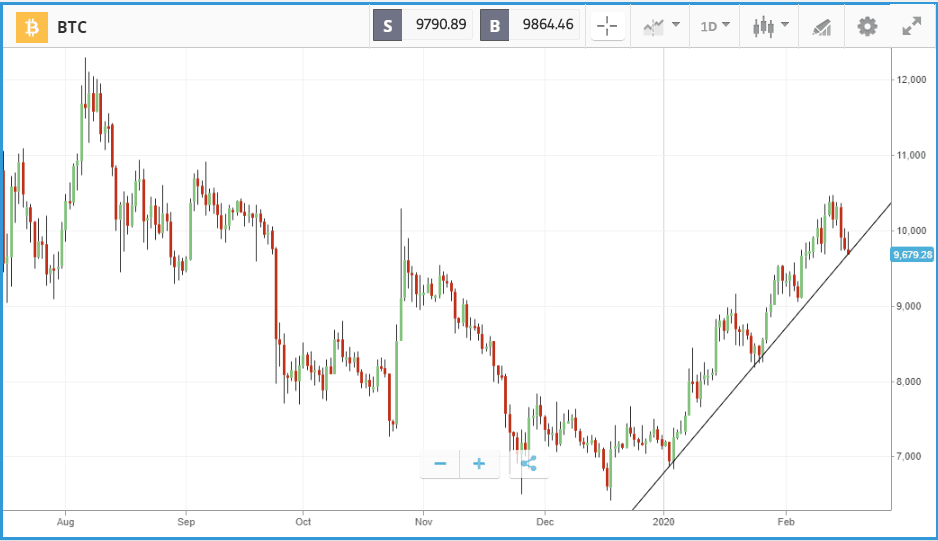

The major cryptoassets suffered a sharp setback over the weekend, with prices diving for major coins.

Bitcoin dropped from $10,309 on Friday to a low of $9,473, although it is climbing back this morning, back above $9,800. It appears this was mostly a technical sell off, due to some larger orders in the market. As it stands, the retracement is still in line with the 2020 uptrend, a break of this could be a trigger for further downside, alternatively, if it holds we could see the price bounce off the trend line and take another leg upwards.

Meanwhile, Ethereum and XRP also retreated sharply to $249 and $0.27 respectively, although both have seen significant gains so far this year despite the weekend sell-off.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 62% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.