Hi Everyone,

Just in the final minutes of the weekend bitcoin managed a strong rally bringing us to the highest point in more than a year.

What I found most incredible about the rally was that the bulk of the movement happened at around 5:00 AM in Japan, while most of the Asian traders were still asleep. So they had a nice surprise when they woke up. The question is, who drove the breakout?

Well, whoever it was, the surge definitely occurred with high volume. Trading activity had been waning over the course of last week and it seems it’s back up at the moment. Not quite where it was during the all-time high levels of mid-May but still very much elevated compared to normal levels.

By now it’s very clear that the crypto winter is over and it’s now spring. However, there are still many bears out there calling for a larger pullback so always trade with caution. The level of momentum displayed last night, and the speed at which the consolidation range was broken, has me thinking that we might be headed into summer very soon.

Today’s Highlights

- Happy Holidays

- Not Buying it

- Bitcoin Use Case

Traditional Markets

Just not buying it

If you have a WSJ subscription feel free to read it, but for those who don’t I’d like to summarize a bit because this is important.

In short, the author is trying to understand why tech stocks going public these days are not doing so well. This is a trend that simply cannot be explained by market conditions alone. Rather, it’s more of a reflection on the companies themselves and a growing trend of general unprofitability.

It’s well known that when Amazon and Facebook went public they were not profitable. So the model has been copied by many startups who first want to reach critical mass before taking time and energy to worry about profits.

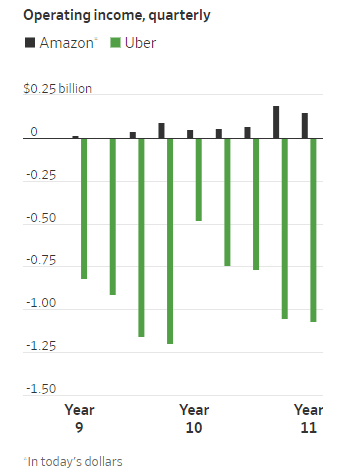

Well, it seems that the latest round of startups have been pushing the envelope. In a key graph of the article, the author demonstrates just how poor Uber’s balance sheet looks in comparison with where Amazon was at this stage in its lifecycle.

Though companies might be able to get away with burning cash in order to gain market position, what’s become clear is that General Joe Public wants to see profits when he’s buying a stock.

Bitcoin Use Case

Things are definitely heating up in crypto land. As we mentioned above, last night’s breakout was a clear testament to the amount of momentum this market currently has and though we certainly might see a wider pullback, there are many who still think we’re just getting started on the next parabolic move.

This morning I was surprised to see this article from the Financial Times.

\

\

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.