Good morning everyone,

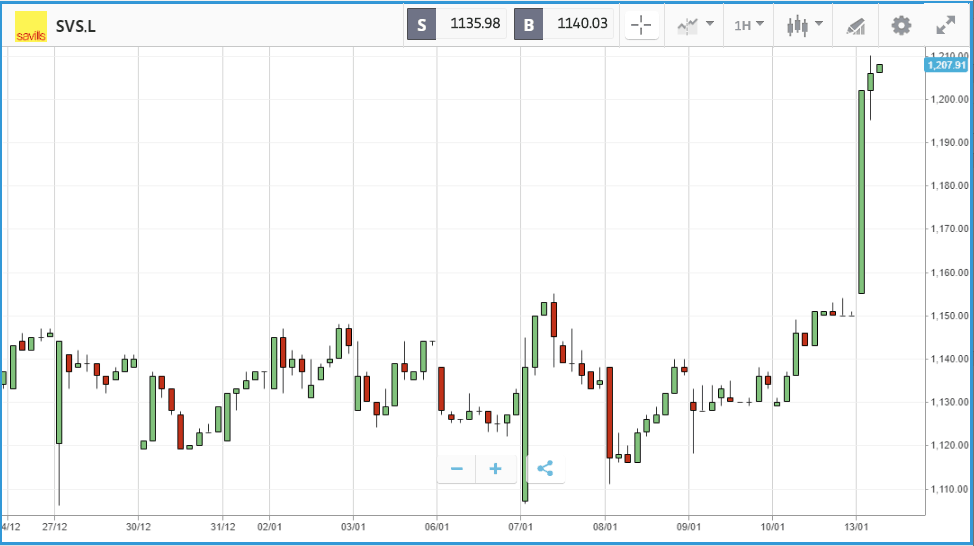

Real estate firm Savills delivered a positive year-end update this morning, noting a boost from the election result had helped its business in the UK in particular.

The group, which counts the UK and Hong Kong as two of its key markets, said that thanks to an “excellent performance” in the UK and significant growth in the US, it anticipates its full year 2019 numbers will be at the upper end of the board’s expectations.

It was broadly positive on the year ahead for real estate markets as well, adding: “Increased political stability in the UK should maintain improved sentiment in real estate markets. Global investor demand for secure income, restricted supply and expectations of continued low interest rates suggest that the medium and long term dynamics of the UK real estate market should remain largely positive. Nevertheless, some caution may remain until the full impact of Brexit is better understood.”.

This has in turn seen a read across to some of the UK housebuilders, in particular Taylor Wimpey (TW.L) whose shares are trading 3% higher at the time of writing. They will release an update of their own tomorrow. The stock currently has one of the highest dividend yields within the FTSE100 according to analysts estimates for the year.

US-China deal signing

All eyes will be on Washington this week, where it is expected that the phase one trade deal with China will be signed on Wednesday. President Trump said that he would then travel to China to begin talks on the next stage. Inevitably, once phase one is out of the way, attention will turn to what the deal hasn’t yet managed to solve. The deal being signed reduces some US tariffs on Chinese goods, increases Chinese purchases of American agricultural and manufactured goods, and partially deals with US concerns about intellectual property theft. The points of contention that remain may be more challenging to solve. They include China subsidizing state-owned businesses, forced technology transfer (where firms are forced to give up their intellectual property for market access), data controls and cross-border data flows, and more. Investors should expect markets to move on phase two headlines, especially if negotiations descend once more into a tariff battle.

Tech stocks dominating the start of 2020

The tech-heavy Nasdaq Composite continued to outpace the S&P 500 and Dow Jones Industrial Average in the second trading week of the year. It climbed 1.8% over the course of the week, versus 0.7% for the Dow and 0.9% for the S&P. The index is now up more than 2% in 2020 so far, with Apple – and its $1.4 trillion market cap – a major driver. Apple stock gained more than 4% last week, with its share price breaching $300 for the first time, whilst Facebook also hit a new all-time high. Nonetheless, all three of the major indices posted a negative day on Friday, after December’s jobs report came in below expectations. Motorcycle manufacturer Harley-Davidson found itself at the bottom of the S&P 500 with a 3.9% drop. It was joined at the bottom of the table by other automotive brands, including Advance Auto Parts and Aptiv. Also of note last week as US-Iran tensions subsided was a reduction in market volatility. Investment firm John Hancock highlighted that the Cboe Volatility Index fell by around 10% for the week.

S&P 500: -0.3% Friday, +1.1% YTD

Dow Jones Industrial Average: -0.5% Friday, +1% YTD

Nasdaq Composite: -0.3% Friday, +2.3% YTD

Sluggish start for UK stocks as big supermarkets run into Lidl and Aldi

UK stocks have had a sluggish start to 2020 versus their American counterparts. The FTSE 100 index fell 0.5% last week, but remains positive for the year so far, while the FTSE 250 index of mid and small cap firms is down 1.5% year-to-date. Supermarket updates on Christmas trading made headlines throughout the week. Morrisons, Sainsbury’s, Asda and Tesco all posted sales declines in the 12 weeks to the end of December, as they lost market share to the discount supermarkets. Lidl posted an 11% sales jump in the four weeks to December 29, and Aldi reported a 7.9% sales increase in the four weeks to December 24 (neither firm is listed). However, airlines provided some cheer after Ryanair upgraded its profit forecast for the year, with its stock closing 5.7% higher on Friday. Budget rival easyJet also climbed 4.2%, while International Consolidated Airlines, which owns British Airways, gained 4.6% at the end of the week.

In the FTSE 250, Aston Martin Lagonda has continued to face the market’s ire in the new calendar year. A profit warning sent shares down more than 20% earlier in the week, although it made up some lost ground on Friday rebounding 15.3%. Friday’s pop was driven by news that Chinese firm Geely Automobile Holding is in talks with the British luxury carmaker over taking a potential stake. It was also reported that Aston Martin has scrapped plans for an all-electric car.

FTSE 100: -0.14% Friday, +0.6% YTD

FTSE 250: -0.35% Friday, -1.45% YTD

Stocks to watch

Q4 earnings season really starts to gain traction this week with a lot of big names releasing updates.

US Banks: JPMorgan, Citi and Wells Fargo will all update the market tomorrow, followed by Citigroup on Wednesday. Increased consumer borrowing is expected to boost profits due to low interest rates and a strong jobs market with a cautionary note that credit mistakes could begin to occur as competition in the lending market heats up.

Levi Strauss & Co: Best known for its denim, Levis has been on a mission to diversify in recent years, pushing into a greater range of clothing items and reinventing its brand to appeal to a younger audience. The firm went public at $17 a share early last year, and is trading at $18.65, a long way off its near $24 peak after missing profit expectations in Q2. It then beat expectations in Q3, and investors will be looking for signs of stability when it reports its Q4 earnings on Tuesday.

Games Workshop: Gaming miniatures retailer Games Workshop has been one of the UK market’s great success stories in recent years. Since the start of 2017, its share price has risen by 800%, including a 100% gain over the past year. The firm is sitting on a hefty price-to-earnings ratio of around 30, but delivered an impressive set of earnings in November. A dedicated customer base has been key to Games Workshop’s success, which is worth any investor reading up on. The company delivers its latest quarterly earnings report on Tuesday.

2020 expectation setting

By all accounts, 2019 was a remarkable year in markets. The S&P 500’s 31.5% total return – including reinvested dividends – was its best since 2013, and the second best year in the past 20. That includes 2009, when the market was rebounding from the depths of the financial crisis. It was the tech sector that led the way, with the Nasdaq 100 Technology Sector Index climbing almost 50%. For 2020, the message from the largest wealth managers and private banks is not to expect a repeat. Goldman Sachs’ private bank has told its high net worth clients to expect a 6% gain in equities this year, and Wells Fargo’s Investment Institute has a 3,200 to 3,300 point target on the S&P 500, versus its current 3,265.

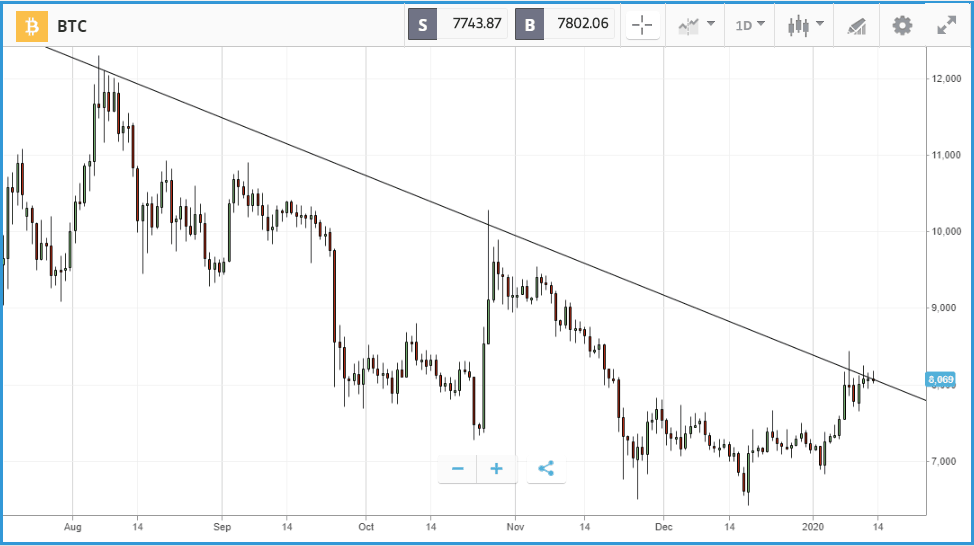

Crypto corner:

Bitcoin and other cryptoassets have started the week on firmer ground after a spike on Friday. Bitcoin rose as much as 7.3% to $8,128, the biggest one-day increase since mid-December and once again making an attempt at that key resistance level in the daly timeframe.

The jump came despite an easing of tensions between the US and Iran and was mirrored in smaller peers Ethereum and XRP. Having been as low as $135 late in the week, Ethereum is now back above $141, whilst XRP has moved up from $0.199 to $0.208.

Can you now own a piece of your favourite sports star?

NBA star Spencer Dinwiddie had said that his tokenized investment platform will launch today despite the threat of a ban. The proposal would see 90 tokens, known as SD8 coins, sold on an Ethereum powered platform giving the player instant access to $13.5 million of his $34 million three year deal. Token investors would receive monthly payments along with a fixed interest rate of 4.95%. Could this now open the floodgates for other athletes to do the same? Avid sports fans may well be more inclined to invest in their favourite player than for example the stock market. In Dinwiddie’s case, the third year of his contract is optional so therefore it’s possible investors could benefit even more via dividends if he went on to seek out a more lucrative deal elsewhere.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.