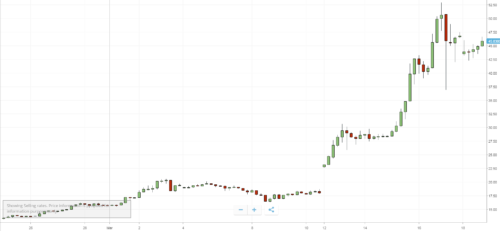

Ethereum has recently attracted international attention from tech industry investors due to a higher potential for growth and more scalability than Bitcoin. The recent increase in Ethereum price from $17.10 to $51.76 (255%) is the result of many different variables but can be largely attributed to Bitcoin investors looking to diversify their portfolio into different Blockchain projects.

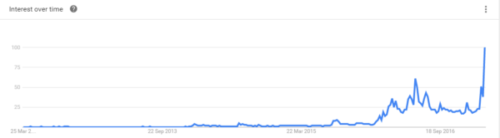

Google Trends is revealing a significant spike in organic search traffic on Google for the term ‘Ethereum’ starting in just this month, March 2017.

Source: Google Trends — March 2017

As Ethereum’s price started to grow organic search traffic for Bitcoin declines. This indicates a shift in investor interests from those who are already currently involved in the Bitcoin.

Source: Google Trends — March 2017

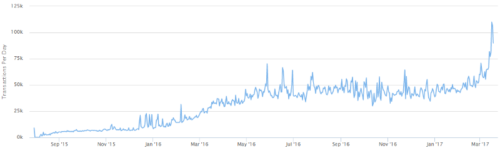

Another major indicator that Ethereum is currently being adopted by new users is an increase in transactions vs. new unique wallets. During the period between March 9th (64,266 transactions) to March 17th (106,635) transactions increased by 60%. This is a huge increase in transactions in a short period of time, over doubling the daily highs. We are also seeing about 6,610 unique addresses being made (new users) on the 9th and roughly 15,000 on the 17th which is also indicating that a lot of these transactions could be coming from these newer unique addresses.

Source: etherscan.io — Ethereum Transaction Chart — March 2017

The rise in Ethereum price also correlates with certain partnerships and developments within the Ethereum space. CEO and Founder at ether.camp, Roman Mandeleil, believes the rise in Ethereum prices are more of a reflection of industry adoption.

“I don’t think any specific development is the cause of the rise in the price of Ethereum. In my opinion, the surge in price is a reflection of increased adoption of the technology in the industry for Bitcoin development.”

Though one of the notable developments is Ethereum Harmony. Released in its trial version in September 2016, Ethereum Harmony is an independent Ethereum peer capable of managing Ethereum funds using RCP API, providing full support and provisioning to smart contracts, and can also be used by developers to monitor the integrity of the Ethereum network.

Almost 1 year ago Ethereum prices surged to new highs with the introduction of the DAO but slumped after the resultant hard fork. The event saw the community split into two. Ethereum price remained quite stable in its low state until the recent surge that has seen it rise above $51.

Ethereum’s Market Cap is sitting at $3.9b as of March 17th which is 22.2% of Bitcoin’s Market Cap of $18b. This definitely shows a lot of positive adoption for Ethereum. As the gap between Bitcoin & Ethereum’s market cap starts to tighten, we will see a lot more bitcoin investors starting to look over at Ether. The crazy thing is that Ethereum’s daily Market cap on March 9th was only at $1.5m USD. On March 17th, the daily market capital increased to $4.9m. That is a 226.7% increase in only 8 days, that’s a huge.

At the end of the day, we have a few options to go with when looking at investing into Blockchain projects. Bitcoin had a great run this year and is holding up a solid value, though when looking at its transaction history it is clear that Bitcoin holds a few risk factors in its current platform. While Ethereum has already in place protocols to decrease the transaction delays, lowering the risk of long-term investments.

Cryptocurrencies can fluctuate widely in prices and are therefore not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Your capital is at risk.