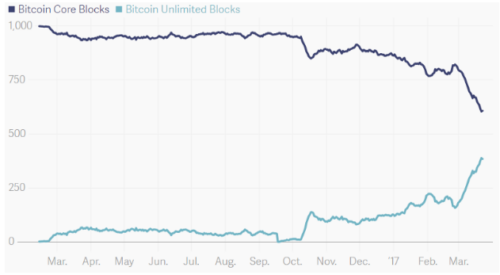

For the last year, miners and developers have been arguing over how to adapt the blockchains protocol to allow it to handle more transactions and meet the increase in demand due to Bitcoin’s massive success. The argument introduces us with two options: Bitcoin Core and Bitcoin Unlimited.

Source: CoinDance | March 2016 to 2017 — Total Blocks Mined

The Bitcoin Core group wants to solve the excessive increase in daily transactions by implementing a protocol called ‘Segregated Witness’, or SegWit, that will drastically increase the block size from its current 1 Megabyte to 2 Megabytes.

Bitcoin Unlimited (BU) team wants to implement a solution by removing any restrictions on block size protocols, thus increasing the daily transaction capacity. BU is currently being backed by entrepreneur Roger Ver, an early Bitcoin adopter who has recently stirred the pot in the Bitcoin community. BU is also backed by major mining pools like Antpool, one of the largest mining pools siding with the new protocols Bitcoin Unlimited is proposing.

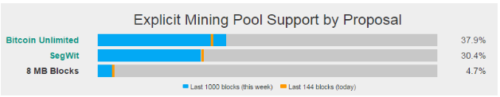

Source: CoinDance | January 2017 — Users / Miners that are signalling for either SegWit or Bitcoin Unlimited

In order for Bitcoin Core’s proposed protocol SegWit to be adopted, 95% of its hashing power has to be devoted to it, according to its protocols set by the developers. Bitcoin Unlimited doesn’t have a fixed set protocol. Instead, it can only be adopted if the miners decide to admit blocks larger than the current Bitcoin Core’s 1MB, but miners would only be rewarded with incentives if every miner follows along.

Earlier this month, close to twenty Cryptocurrency exchanges had published contingency plans for a possible hard fork. The Cryptocurrency exchanges are now planning to list Bitcoin Unlimited (BU) as they would an alternative cryptocurrency, according to the statement. While Bitcoin Core’s SegWit is prepared and ready to go, developers are looking for a threshold of 95% of the community to agree before they pull the trigger — a very high threshold. So far only 30% of users have signalled support according to Blockchain.info. BU needs only a little over 51% of its users to signal.

Fundamental Challenge of Transaction Volumes

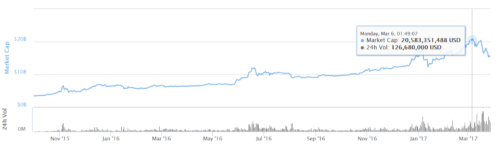

When we look at the data from April 2015 to March 2017 we can easily see the drastic increase in confirmed daily transactions, total market capital, and USD value. Just in the last two years, Bitcoin has seen an increase of 100,000 (April 2015) to 256,000 (March 2017) confirmed daily transactions. That’s 250% increase over two years.

Source: Blockchain.info | Confirmed Daily Transactions from March 2015 — March 2017

On an average day, we see Bitcoin twenty-four hour volume exchange $100m — $200m USD between the markets. Today we are starting to see the gap increase by about 250%, which comes out to be $100m — $500m USD every twenty-four hours.

Source: Coinmarketcap.com | Total Market Capital & 24hr Trading Volume (USD)

Who’s Going to Win?

While nothing in the world of Bitcoin is ever simple, nor will the outcome be to the year-long debate. It is possible that Bitcoin could fork and that both rival currencies will continue to coexist side-by-side, competing for users legitimacy. A difficult hard fork for bitcoin could mean a serious amount of disruptions for miners, who operate multiple industrial-scale facilities around the world, the well-funded exchanges, and the startups who have raised $1.5B in venture capital collectively since of 2012. A lot is riding on the question on how we should scale Bitcoin.

The question in hand still remains: Will this be a good thing for bitcoin’s future? One of Bitcoin’s biggest downfalls is the current organisation structure that is controlling the future developments for its Blockchain. With the sudden increase in popularity within the blockchain, we only have two options to pick from. One being, to stay as we are, unable to evolve with the growing success of Bitcoin. Or two, we fork from Bitcoin creating a whole new blockchain and development team who can solely focus on Bitcoin evolving with its surge of popularity. At the end of the day, we really need to remove our emotions and lay out the facts. Bitcoin is getting more and more popular by the week, thus we see an excessive increase in daily transactions which also correlate with transaction confirmation delays and fee increases.

Read what other Bitcoin traders are talking about

Cryptocurrencies can fluctuate widely in prices and are therefore not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Your capital is at risk.