eToro is proud to partner with TipRanks, a leading financial analysis company. TipRanks gathers financial information from leading market influencers, and follows the public filings of top investors around the world. TipRanks has a unique ranking system, which rates hedge fund managers, bloggers, corporate insiders, and analysts according to their success rate and prediction accuracy. As part of eToro’s Partner Smart Portfolio, TipRanks has created some great financial instruments, based on the portfolio of world-famous investors.

Check out TipRanks’ Smart Portfolio WarrenBuffet-CF

Hedge fund guru and billionaire Warren Buffett has surprised the market by almost completely eradicating his $900 million Walmart holding while substantially adding to his Apple holding and his four airline stocks – an industry he used to call an investor ‘death trap’.

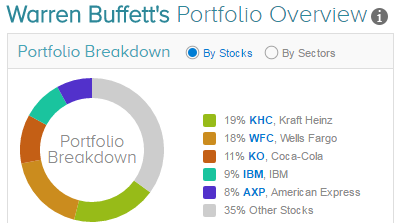

Known as the ‘Oracle of Omaha,’ Warren Buffett is CEO of Berkshire Hathaway Inc, one of the world’s largest hedge funds with a portfolio value of close to $148 billion. Buffett’s portfolio is generating impressive returns with a 26.27% return last year and an 8.92% annualized return over the last three years. In fact, so many investors seek to replicate the fund’s positions that the term “the Warren Buffett Effect” has been applied to how stock prices move when Berkshire Hathaway buys or sells shares in a stock.

What is the secret of Buffett’s investing wizardry? Based on the quarterly 13F forms filed with the SEC we can track the fund’s most intriguing Q4 moves. Let’s take a closer look:

Wal-Mart (WMT)

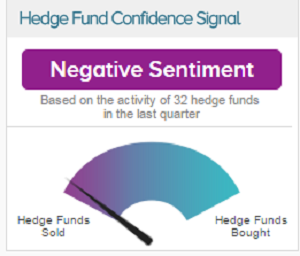

Buffett reduced the fund’s Walmart holding by a whopping 89.26% to just under 1.4 million shares worth $96.32 million. The holding, which was initiated back in 2005, now makes up just 0.07% of the fund’s portfolio. While the move was drastic, it is a reflection on the negative sentiment hedge funds hold towards the stock in general as this graphic shows:

And it is not just hedge funds that are worried – TipRanks records an analyst consensus rating for Wal-Mart of hold. Four-star BMO Capital analyst Wayne Hood put a sell rating on the stock on Feb 13 with a bearish 12-month price target of $63 (9.18% downside from the current share price). Following an assessment of Wal-Mart’s pricing actions, Hood concluded that “From mid-January to February, food average price reductions increased to 24% from 18%… the increase in food [reductions] leaves us wondering if traffic has slowed.”

The store is facing increased competition from online retail giants such as Amazon – and is quickly purchasing online stores to up its game. The chain store made its third acquisition in five months on 15 Feb with the $51 million purchase of outdoor goods retailer Moosejaw.

Apple (AAPL)

Apple is now Berkshire Hathaway’s seventh largest holding after the fund upped its position by 276% to 57.3 million shares worth $6.64 billion. Since the last filing the shares have already gained 17.69% in value. Buffett isn’t the only hedge fund manager buying AAPL shares- other big name fund managers such as Ken Fisher, David Einhorn and Philippe Laffont also increased their positions with holdings of $1.33 billion, $670 million and $369 million respectively.

Apple experienced a very strong fiscal 2017 1st quarter, recording the highest average smartphone selling price (ASP) ever of $695, and this has prompted the market to remain very bullish on this top stock. The analyst consensus rating on Apple is strong buy, although the average analyst price target of $141.21 only represents a 4.05% upside from the current share price.

Delta Airlines (DAL)

Buffett continued his return to the airline sector by upping the fund’s Delta Airline holding by 847% to 60 million shares worth $2.95 billion. In fact, Buffett radically increased the fund’s exposure to four airline stocks. He now has positions worth over $2 billion each in Southwest Airlines (LUV), American Airlines (AAL) and United Continental (UAL).

Buffett made headlines at the end of the third quarter when he initiated a position in three major airlines, changing his long-held stance to steer clear of the industry. In 1989, Buffett invested $358 billion in US Airways but the stock subsequently plummeted to 75% of its value. He ultimately managed to exit with profit but the experience left him a vocal critic of the industry due to its high competition, fuel price risk and expensive costs.

However, after airline stocks tanked following Brexit they are now quickly regaining strength as fears of a fall in demand proved overblown and unit revenue growth is expected to improve. TipRanks reveals moderate buy analyst consensus ratings for LUV, AAL and UAL and a strong buy rating for DAL.

Six Top Stocks

No change was recorded to the fund’s six biggest holdings which include a $28.4 billion holding in food manufacturer Kraft Heinz and a $26.4 billion holding in international bank Wells Fargo.