UPDATE: After 3 weeks in demo, it is time to introduce Copy Stop Loss to the real trading environment. Please read the post below to understand exactly what that entails for your copy trading activity. Please note that this is the preliminary version of the CSL mechanism mentioned in the post (automatic CSL at 95% loss). Keep an eye out for further updates to follow.

We at eToro are now working tirelessly to improve CopyTrader, largely based on the feedback that we’ve been getting from you, our community members.

We are currently focused on an initiative we call “CopyTrader 2.0”, which aims to redesign some of the core logic in our system in order to significantly improve your user experience and the quality of our offering. This initiative is already underway, and our developers are hard at work striving towards a 100% accurate, “rock solid” system, that still retains the simplicity and usability that you know and love.

Today we are happy to announce the launch of a core part of this effort – the Copy Stop Loss or CSL for short.

Copy Stop Loss

CSL is a new feature that will give users the ability to effectively manage CopyTrader by providing risk management across each copy relationships based on real time Profit/Loss values. It is essentially an automated risk control system that will allow you to set controls for the entire copy relationship, as a dollar value.

For example:

Trader A is copied by Trader B with $100 and a CSL set at $50 – meaning Trader B does not want the copy relationship to lose more than $50 before CSL triggers. Trader A has 2 positions: one that has gained $10, another that just dropped to -$60. At that point, CSL triggers and both positions – the losing position, and the gaining position are closed and the CopyTrading relationship with that trader is disconnected.

We are currently launching a preliminary version of this feature which does not have user setting options. The system will automatically set the CSL at 95% of the your copy balance with any one copy relationship. Therefore, you will now be able to assume that when the copy balance is been almost completely depleted, the CSL will trigger and terminate that copy relationship. The 95% value is a true ‘safety net’ that should only trigger when nearly all the money in that CopyTrade is gone.

So, what happens when CSL triggers?

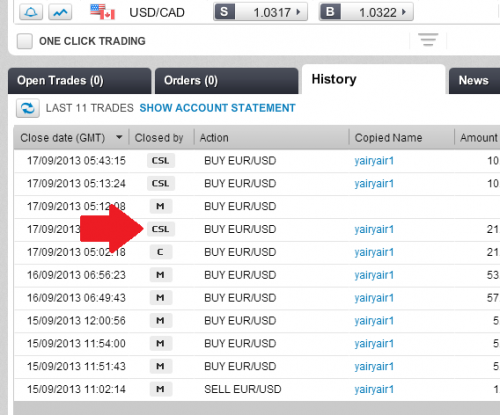

If your copy relationship has lost 95% of your allocated funds, the CSL will trigger and all the positions in that relationship will close. In the WebTrader, the history tab contains a “Close By” column. The closed trades will be labeled in this column as “CSL”.

Keep in mind that the CSL value will change if you change your copy amount. Money in/out operations will trigger a recalculation of the CSL value. Say for example, you’re copying a trader with $100. Your investment in this trader has lost $-90 of its value but you still believe in this copy relationship. When you allocate another $100 to that trader – the CSL value will now be updated, and calculated off the new $110 of value.

The ability to set and monitor the CSL values will also be introduced in the near future. This will enable you to edit your Copy Stop Loss and set it to the dollar value of your choice.

CSL acts as a safety net by monitoring the account value in real-time for unrealized portfolio values across all copy relationships. It will therefore:

– Allow you to invest greater amounts as risk can now be controlled

– Improve your ability to expand CopyTrading useage: manage a greater number of more diverse traders

– Implement protection from traders who move SLs and unexpectedly encounter great losses

– Provide the basis for further automation tools and for the full scale CopyTrader 2.0 project

We believe this is a powerful function that will allow you to manage your CopyTrader relationships better (in addition to simply reviewing individual positions). Upcoming versions will allow you to set this value manually, and view the ongoing risk per copy relationship. By introducing advanced risk management to Copy Trading, we will be able to deliver a wide variety of additional people-based portfolio management tools that will enhance the user’s oversight at a portfolio level.

This feature is part of a larger effort in our project to upgrade the CopyTrader – where the CSL logic is central to our design.

UPDATE: As part of the CopyTrader 2.0 project, we have recently modified what happens when you close a copied position manually. Previously the funds from that position were being returned to your balance. However we’ve decided that in order for the relationship between trader and copier to remain synched, these funds need to be returned not to the copier’s balance but to the allocated Copy amount. Nevertheless, if and when you’d like to access these funds, you can simply modify your Copy amount.

As the CopyTrader 2.0 project moves along, we will keep you up to date through additional blog posts that will explain the full scope of the entire CopyTrader 2.0 project and what it will mean to your user experience. Let’s just say that the future is looking bright!

But for now, we would really appreciate your feedback about the upcoming introduction of the CSL. Tell us what you think in the comments.