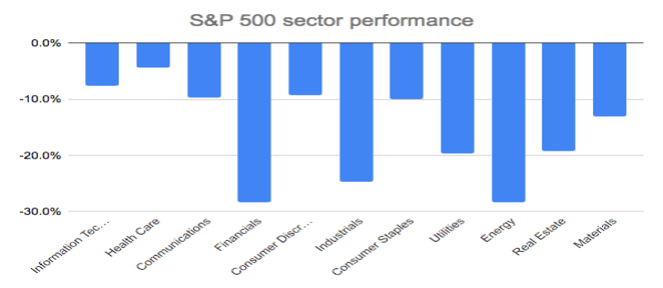

2020 has been a challenging year for equity investors so far. As a result of the coronavirus (Covid-19) outbreak, many stocks have experienced double-digit declines.

One sector that has been hit hard is Industrials. Since mid-February, the S&P 500 Industrials sector has declined roughly 25% — the third-worst sector performance after Energy (which has tanked due to the spectacular collapse in oil prices) and Financials. Plenty of well-known industrial stocks such as Caterpillar and 3M have experienced substantial share price falls.

Source: Bloomberg. Data: 19/2/20 to 11/05/20

For investors with a longer time horizon, this weakness across the Industrials sector could be an opportunity. Below, we look at why the sector has underperformed recently and explain why it could be set for a rebound in the not-so-distant future. We also highlight five top industrial stocks that appear well placed to benefit as the world comes out of lockdown in the months ahead.

Industrial production “fell off a cliff” in March

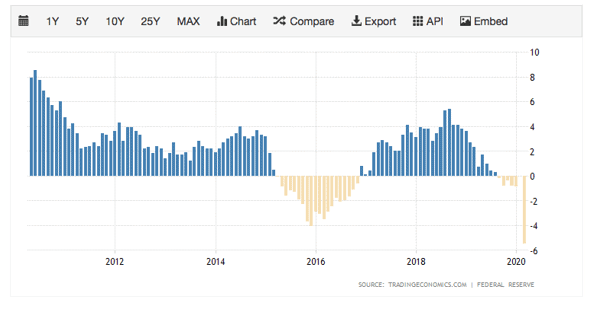

It’s not hard to see why the Industrials sector has underperformed during the Coronavirus pandemic. The combination of supply chain disruptions, factory closures, and lower customer demand has impacted the sector significantly. Around the world, industrial production — a measure of manufacturing, mining and utility output — has literally “fallen off a cliff” as the world has gone into lockdown mode.

In the US, for example, industrial production fell 5.4% in March. This represents the steepest decline since early 1946, when production was slowing down after the end of World War II. The US automotive sector was hit particularly hard in March, with production of motor vehicles and parts declining 28%.

US industrial production over the last decade

Source: Trading Economics

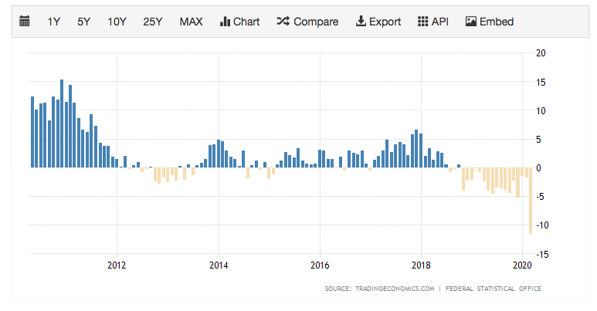

Similarly, Germany — the Eurozone’s largest economy — also experienced a dramatic drop in industrial production in March. According to Germany’s federal statistics office, German industrial production fell a record 9.2% in March as the pandemic forced factories to shut and kept consumers across Europe at home. The automotive industry was hit the worst, recording a 31.1% year-on-year slump in production.

German industrial production over the last decade

Source: Trading Economics

Clearly, it has been a challenging few months for industrial companies. With factories forced to close in order to protect their workers from Covid-19, many companies have experienced high levels of disruption. This is likely to impact near-term revenues and profits, which is why many investors have dumped industrial stocks.

Industrial production looks set to pick up

The thing is, though, industry conditions are unlikely to stay like this for long. Now that many countries around the world are slowly beginning to open up again, and people are going back to work, industrial production is likely to begin to recover. This means that the Industrials sector could potentially be set for a rebound.

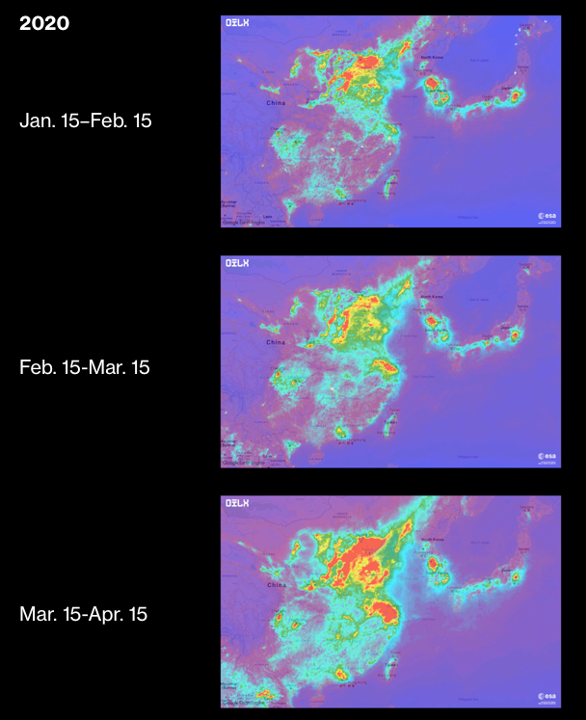

Already, many employees in China have returned to work, which means that Chinese factories — which were brought to a standstill when Covid-19 swept through the country in January — are humming again. Data shows that factory activity across China rose for a second straight month in April as more businesses reopened after lockdown measures were relaxed. This is good news for industrial companies, as China is a major player in global supply chains.

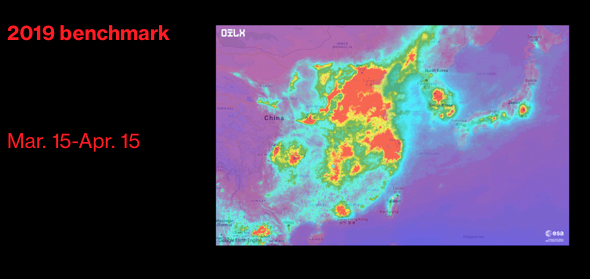

NO2 levels indicate that economic activity in China is picking up

Source:https://www.bloomberg.com/opinion/articles/2020-04-22/coronavirus-china-s-factories-are-waking-up-from-lockdown

Many factories across Europe and the US have also reopened recently or are set to reopen in the near future. For example, German automotive giant, Volkswagen resumed production at its largest factory in late April. Meanwhile, in the US, General Motors, Ford, and Fiat Chrysler Automobiles recently announced that they are planning to resume car production at their factories on May 18th. Having these kinds of manufacturing powerhouses back in production will be a major boost for the industry.

It is also worth pointing out that, after experiencing significant disruptions in recent months, many North American and European companies are now looking to bring production home. This could provide a further boost to the industry. Covid-19 has exposed the vulnerabilities of complex international supply chains. When China went into lockdown mode earlier in the year, many companies around the world were unable to source crucial products. Ultimately, the coronavirus has highlighted the need for stronger, smarter, domestic production and supply chains. This is particularly true in the healthcare sector, where the coronavirus exposed the risks of sourcing protective equipment from overseas. Going forward, we are likely to see more companies establish domestic production facilities, which could support the sector.

5 industrial stocks to watch

So, what are some of the industrial stocks that could benefit as activity across the industry picks up and the sector rebounds?

Well, one industrial stock that looks to have rebound potential is 3M Co. (MMM), which is currently down around 17% year to date. It is a diversified company that operates across four key sectors: safety & industrial, transportation & electronics, health care, and consumer, and has market-leading positions in a wide range of areas, including building safety solutions, highway and construction safety, and respiratory, hearing and eye protection solutions. In the current environment, 3M’s expertise in health and safety solutions is an advantage. Just recently, the company was awarded a contract by the US Department of Defense to expand production of its N95 respirators (high protection masks).

3M is a high-quality company with an outstanding dividend track record. It has now increased its dividend for 62 consecutive years (you can find out more about dividend growth stocks here). As the global economy picks up post Covid-19, demand for the stock is likely to increase.

Check Out 3M

Your capital is at risk.

Another stock that stands out currently is Honeywell International (HON). This is a leading industrial company that is focused on building technologies, performance materials and technologies, aerospace, and safety and productivity solutions.

Honeywell has taken steps in recent years to shift its strategy to focus more on the digital side of its operations. It looks well placed to succeed in an increasingly digital world. For example, its warehouse automation business should benefit as e-commerce continues to boom (find out more about the growth of e-commerce here), while its cybersecurity arm looks set to prosper as cybercrime continues to become more of a threat (find out more about cybersecurity here).

Honeywell is a well-run company with a solid long-term track record. As a result, it rarely trades at bargain levels. However, right now, the stock is down nearly 25% year to date. Given its track record, it is unlikely that the stock will remain at current levels for long.

Check Out Honeywell

Your capital is at risk.

US railroad company Union Pacific Corporation (UNP) also looks well placed to benefit from a rebound in industrial activity. It operates North America’s premier railroad franchise, the Union Pacific Railroad. This railroad covers 32,000 miles across 23 US states and plays a critical link in supply chains. In the US, railroad traffic is integral to the economy and Union Pacific provides value to its customers by delivering goods in a safe, reliable, fuel-efficient, and environmentally responsible manner.

In the short term, revenues at railroad companies are likely to dip due to the fact that less goods are being transported across the country. However, when economic activity picks up, it is likely that revenues will recover. Union Pacific Corporation shares have rebounded since their March lows, but still remain more than 10% below their 2020 highs.

Check Out Union Pacific Corporation

Your capital is at risk.

Another company that should benefit from a rebound in industrial production is United Rentals (URI). It is the world’s largest equipment rental company, operating at nearly 900 locations across North America. Demand for equipment rental should pick up as the world comes out of lockdown.

One reason that United Rentals could potentially outperform in the years ahead is that companies in the construction equipment rental business are benefitting as technology giants expand their data centres. According to analysts at Morgan Stanley, which recently took a deep dive into tech company capital expenditure and satellite imagery of build sites and expansions, companies such as United Rentals should benefit as the tech giants continue to expand their operations. URI shares are down roughly 30% year to date and currently trade at a low valuation. Now could be a good time to take a closer look.

Check Out United Rentals

Your capital is at risk.

Finally, industrial giant Caterpillar Inc. (CAT) could also have rebound potential. It is the largest manufacturer of construction and mining equipment in the world. While there is uncertainty in relation to the near-term outlook for Caterpillar, the outlook may not be as bad as some investors fear. In the US, construction has been deemed an essential service in the majority of states, meaning that construction activity has continued throughout the pandemic.

Looking beyond the near-term uncertainty, Caterpillar should benefit from the urbanisation trend. More people moving to cities is likely to create plenty of opportunities for the construction industry. This should support demand for Caterpillar’s machinery. Caterpillar also has significant exposure to Asia, which is a high-growth market. Caterpillar shares are currently down around 26% year to date. For those with a long-term time horizon, this share price weakness could be an opportunity.

Check Out Caterpillar Inc.

Your capital is at risk.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information. Your capital is at risk.