Good morning everyone,

In the UK this morning Vodafone stood out amongst the announcements after it said it was working with Amazon’s cloud business Amazon Web Services to roll out a new 5G network service.

Known as Wavelength, the service aims to improve the speed at which customers do business online. Vinod Kumar, CEO of Vodafone Business, said: “With Europe’s largest 5G network across 58 cities and as a global leader in IoT with over 90 million connections, Vodafone is pleased to be the first telco to introduce AWS Wavelength in Europe. Faster speeds and lower latencies have the potential to revolutionize how our customers do business, and they can rely on Vodafone’s existing capabilities and security layers within our own network.” Vodafone is one of the components in eToro’s 5G Revolution Smart Portfolio.

Meanwhile, the big news moving markets was a statement from President Trump yesterday. Trump suggested a trade deal with China might wait until after the US presidential election next November. It was the third straight day of losses for the major US stock indices, although all are still close to record highs.

The news came a day after the President said he would impose tariffs on Brazilian and Argentinian metal producers and the US government floated the idea of tariffs of up to 100% on billions of dollars in French luxury goods imports. Optimists have suggested that the recent bluster from the President is a negotiating tactic and that he will want to go to the ballot box with a trade deal under his belt. If negotiations fall apart, markets will likely react severely, given that optimism around a deal has been a significant factor driving them higher in recent weeks.

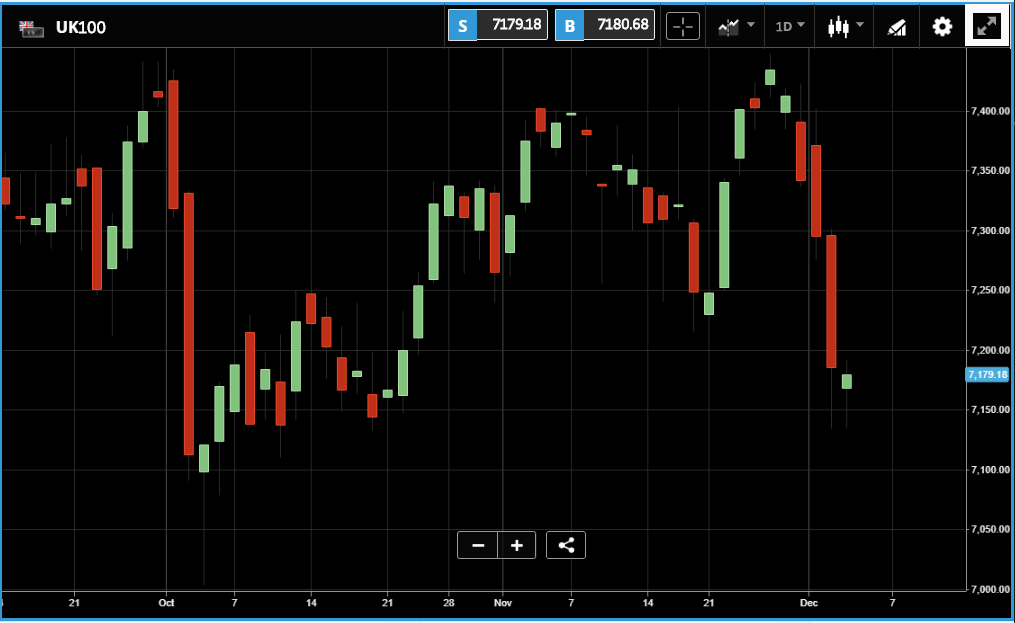

The FTSE 100, which derives more than 70% of its revenues from overseas, would be a particular casualty. Clear signs of what could be to come could be witnessed yesterday by its reaction to this latest trade war twist, as the index fell by 1.75%, more than double the fall posted by the S&P 500.

Who got caught up in the trade war storm?

In terms of the individual losers on Tuesday, Intel – which generates billions of dollars in revenue from sales to China – dropped by 2.8%. Overall a third of the names in the Dow Jones Industrial Average, which represents 30 US stocks with a combined market cap of more than $6trn, fell by more than 1%. Goldman Sachs, which applied earlier this year to take majority control of its joint venture in China, fell by 2.5%. Machinery firm Caterpillar, which counts the Asia Pacific region as its third biggest market, fell by 2%. Nasdaq 100 constituent Fedex, which filed a lawsuit against the US Department of Commerce over the trade war earlier this year, fell by 4.4%. In other market news on Tuesday, Twitter announced that it will be issuing its first high yield bond this week in order to raise $600m. The social media firm has far more cash on its balance sheet than debt and is likely aiming to prove a point about its ability to raise capital after a sharp share price fall following a disappointing set of Q3 earnings. Early guidance indicates that the eight year bonds may have an initial yield of 4.5%.

S&P 500: -0.66% Tuesday, +23.39% YTD

Dow Jones Industrial Average: -1.01% Tuesday, +17.9% YTD

Nasdaq Composite: -0.55% Tuesday, +28.41% YTD

FTSE 100 takes a beating

The FTSE 100 took the biggest blow on Tuesday from Trump’s trade comments among the major global indices, while the less internationally exposed FTSE 250 fell 0.96%. A bump in the value of the pound also contributed to the FTSE 100’s fall, as did data showing that UK construction output remains in contraction territory. Miner Glencore and insurer Prudential were two of the biggest losers on the day, both closing down 3.7%. Prudential recently spun off its investment management arm M&G in order to allow it to focus on its Asian and US business. One bright spot in the FTSE 250 was gold producer Centamin, which closed 14.8% higher after a £1.5bn all-stock offer to acquire the firm by rival Endeavour Mining. Canadian Endeavour took its deal public on Tuesday after Centamin declined to engage in talks; the offer was quickly rejected on the grounds that it did not offer enough value to shareholders. The potential deal is likely to evolve and follows several acquisitions in the gold industry over the past year. Prior to the offer being made, Centamin’s share price was around 25% off its 2019 high at the end of August, and at the beginning of October it was announced that CEO Andrew Pardey was retiring.

FTSE 100: -1.75% Tuesday, +6.4% YTD

FTSE 250: -0.96% Tuesday, +17.13% YTD

Stocks to watch

Slack Technologies: Corporate messaging service Slack’s summer 2019 public debut did not come with the fanfare of those of Uber and Snapchat, due to its decision to directly list on the New York Stock Exchange without the involvement of any banks (in a direct listing, the existing private shareholders effectively sell direct to the public). However, it has displayed similar characteristics since. The firm’s shares began trading at $38.50, well above its $26 reference price, but have since sunk below $23. Slack will report earnings on Wednesday, where investors will be watching for how big the company’s quarterly loss will be without the one-off cost of going public. The average 12-month analyst price target on the stock is $29.94.

Campbell Soup Company: American food company Campbell has been on a recovery tear over the past year. From 2016 to the end of 2018 its shares fell by more than 50%, but year-to-date they have climbed by 44% (although at $47.58 they are still trading well below their $65 plus peak). In a research note, Wells Fargo analysts said that they expect sales could come in under consensus estimates, due to the impact of the Thanksgiving holiday falling unusually late this year. Overall Wall Street analysts do not have a favorable view of the stock, with the number recommending holding or selling the stock outnumbering those with a buy rating. With an average 12-month analyst price target of $42.77, it is already 10% above that when it closed on Tuesday.

Synopsys: California-based Synopsys, which has a market cap of $20bn and sits in the Nasdaq 100, produces tools that aid in silicon chip design, software security systems and more. The company has delivered a relatively smooth ride upwards for investors over the past five years, and its share price rise has accelerated in 2019. When the firm reports earnings on Wednesday, investors will be watching for details on major contract wins, growth in key programs, and how the firm is tackling trade challenges including restrictions on dealing with Huawei. At present Synopsys’ trailing 12-month price-to-earnings ratio is roughly in line with the average for the software industry.

Crypto Corner

There were sharp falls for the major crypto currencies in the wake of yesterday’s ruling against Ethereum developer Virgil Griffith to trial.

At the time of writing, Bitcoin was down 2.65% at $7,114.03, while Ethereum was off 2.5% at $143.02, and XRP down 3.8% at $0.208.

Yesterday, the British Virgin Islands announced a partnership with blockchain startup LifeLabs to develop a digital currency – BVI~LIFE- pegged 1:1 to the US Dollar. This is with the intention to support innovation and grow the local fintech sector.

Link: Cointelegraph

WisdomTree Bitcoin ETP

ETF provider WisdomTree have entered the cryptocurrency space with the launch of a physically backed Bitcoin ETP (Exchange Traded Product). This will enable institutional investors to get exposure to Bitcoin without the need to hold the asset directly.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.