In a period of market panic, such as we are seeing right now with the impact of COVID-19, investors who have never experienced such wild moves may want to wait for calmer waters before looking at their portfolio.

But while volatility – the rate at which markets go up and down – is inherently unpredictable, investors can use it as a learning opportunity. So we’ve put together a list of essential dos and don’ts for investors in the current tumultuous climate.

- Do your research

Now is the perfect time to read up on companies and identify which should perform in the long term. While markets will move up and down, dragging the majority of companies with them, those with strong fundamentals should be the best positioned to weather this storm. Scrutinize company accounts, read their regular reports and use the resource of our Popular Investors, who forensically examine balance sheets and statements to sort the wheat from the chaff. - Do go global

In times like this, we’re all looking around the world for answers and while we’re doing it, we’re hearing unfamiliar brand names that might offer an investment opportunity. Across the sea in Europe, North America and Asia, there is a huge array of companies that will appear on our radars as they assist in or benefit from the current crisis. Don’t be confined by your own borders. Find new, international companies and go back up to point one (above). - Do think about the long term

It might seem like 12 weeks of social distancing is going to be an eternity, but in terms of investment horizons it really isn’t. While you are confined by your own four walls, try to think what we will all be doing or buying 12 months from now, where we will be visiting and how, and put together a plan of what might be a winner in 2021 and beyond. - Do set limits

In the 1930s depression, economist John Maynard Keynes warned: “The market can stay irrational longer than you can stay solvent” and it stays true today. Don’t believe that even against the odds things will eventually go your way. Use our risk management tools to set limits – and stick to them. - Don’t obsess

No one knows how Covid19 will ultimately play out, nor what will be its lasting impact on the global population, economy or financial markets. One thing we do know, however, is that obsessing over it won’t help anyone. Stay informed, check in regularly, but do not stay glued to social media, the second-by-second moves of the FTSE or anything else that is going to wear and freak you out. There is plenty of opportunity, but plenty of pitfalls ahead, too, so having a clear, objective, informed view is vital for investors – and for us as humans, too.

Sign up for a free $100k demo account today

- Simply register for free through the button below.

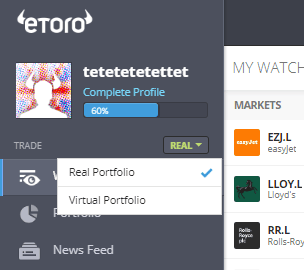

- Once registered, in the top left-hand corner of your account you will see the word ‘Real’. Click this and change it to ‘Virtual Portfolio’.

- You now have $100k of virtual money to trade and invest. Everything you do in this section is not real but follows the live markets as if you we’re investing and trading for real. You will not be charged.

Sign up for a free demo account

Your capital is at risk.