eToro is proud to partner with TipRanks, a leading financial analysis company. TipRanks gathers financial information from leading market influencers, and follows the public filings of top investors around the world. TipRanks has a unique ranking system, which rates hedge fund managers, bloggers, corporate insiders, and analysts according to their success rate and prediction accuracy. As part of eToro’s Partner CopyFunds, TipRanks has created some great financial instruments, based on the portfolio of world-famous investors.

Check out TipRanks’ CopyFund CarlIchan-CF

Multi billionaire Carl Icahn may have made the right bet on President Trump’s election but his fund still plunged by 20.3% in 2016. The $22.37 billion fund has now lost money for three years in a row. Will Icahn’s Q4 moves improve the fund’s performance? Based on the most recent 13F forms submitted to the SEC and released on Feb 14, we can investigate Icahn’s latest stock activity which include additions to his controversial Herbalife holding and a reduction in his billion-dollar stake in online payment provider PayPal.

Investment Strategy

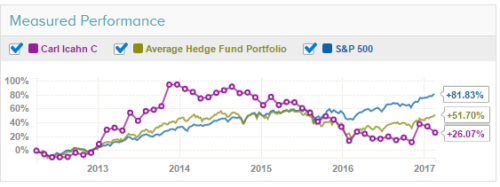

80-year old Icahn, who made almost $2 billion from a 3-year Netflix investment, famously stated “My investment philosophy, generally, with exceptions, is to buy something when no one wants it.” He then seeks to turn the company’s fortunes around through drastic management and strategy changes. The strategy worked until 2014 when the performance of his energy-focused portfolio began to slip – hurt by investments in stocks such as Chesapeake Energy and Transocean. The fund rose sharply on Trump’s election in November 2016 but now lags considerably behind the measured performance of both the average hedge fund portfolio and the S&P 500.

Added: Icahn Enterprises (IEP), Herbalife (HLF), Herc Holdings (HRI),

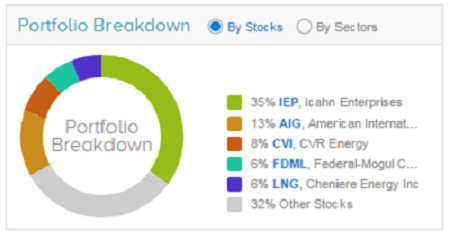

Icahn increased his holding in conglomerate Icahn Enterprises by 2.3% to $7.79 billion making it the fund’s largest holding as the portfolio breakdown shows. The holding has so far taken a loss since the last filing of 6.58%. Icahn Enterprises, which is controlled by Carl Icahn has investments across 10 different business sectors through its interest in companies such as Federal-Mogul, PSC Metals, American Railcar Industries and Ferrous Resources.

Icahn similarly upped his holding in equipment rental company Herc (formerly Hertz) by 94.63% to $1.35 billion and in global nutrition and weight management company Herbalife by 15.36 to $1.08 billion. Herbalife, which gained 27.19% since the last quarter, has been tussled over by Icahn and rival hedge fund manager Bill Ackman. According to Ackman, who has a $1 billion short bet against Herbalife, the company is an illegal pyramid scheme with no intrinsic value. But by repeatedly increasing his Herbalife holding, Icahn continues to demonstrate his unwavering support for this controversial company.

Reduced- PayPal (PYPL)

In Q4 Icahn reduced his holding in PayPal by 1.48%, leaving him with close to 33.4 million shares worth $1.32 billion. Since the last filing, the holding which makes up 5.89% of the portfolio, has gained 6.31%. In fact, the market is very bullish on PayPal which has a strong buy sentiment from analysts, bloggers and hedge fund managers.

PayPal recently announced the acquisition of Vancouver-based bill payment processor, TIO Networks, for $233 million in cash. PayPal is looking to integrate itself into the everyday life of consumers by pushing into the valuable bill payment category. Top BTIG analyst Mark Palmer reiterated his buy rating on the stock with a $48 price target saying “One of the factors driving our bullish thesis on PayPal Holdings has been the company’s ability to deploy the $6.5 billion of cash it had on its balance sheet as of YE16 through acquisitions that would further expand the functionality and ubiquity of its payments platform.”

Significant other holdings: CVR Energy (CVI)

Icahn retained significant holdings in the following companies: American International Group (AIG), CVR Energy (CVI) and Federal-Mogul Corp (FDML) and Cheniere Energy Inc (LNG). His $1.81 billion shareholding in CVR Energy has been the subject of controversy due to his appointment as special advisor to President Trump in overhauling federal regulations. Critics of the appointment, including Senate Democrats point out that stocks, such as CVR Energy, create a conflict of interest. CVR Energy shares spiked 10% following Trump’s election on the expectation that renewable energy rules will be relaxed.