The cord-cutting trend, in which consumers opt to view content using online services, rather than using cable TV/satellite providers is increasingly becoming widespread. With players such as Netflix and Amazon Prime offering quality on-demand content at low prices, a growing number of users around the world are switching to these services. Now, the cord-cutters have a new way for content consumption, with Google launching a TV streaming service, which rivals traditional cable TV providers such as Comcast.

All trading involves risk. Only risk capital you’re prepared to lose. This is not investment advice.

Available only in select cities in the US at the moment, YouTube TV offers 40+ popular American channels streaming live to a variety of devices. While the service’s price tag of $35 a month is significantly higher than Netflix’s, it is a bargain compared to the $103 the average American household pays for cable TV services (Leichtman Research Group, 2016). This move by Google is obviously an attempt to take a bite out of the dominance of cable TV providers in the US, but is also a new battleground, pinning the tech giant against other online streaming services.

While there’s no date yet for a UK rollout, it is likely that Google will also try to compete with providers such as SKY and BT. However, while Netflix offers a flat rate internationally, it is likely that Google will be adjusting their prices to compete with cable providers in the British market.

Google vs. Netflix

While not offering direct competition, from a broader perspective, YouTube TV will rival Netflix for several reasons. The first reason is that it now offers another solution for cord-cutters. Up until now, most popular solutions offered content on-demand with no live TV – a solution that didn’t fit everyone’s needs. YouTube TV could present an alluring alternative and some viewers will most-likely prefer such a solution over other online streaming services.

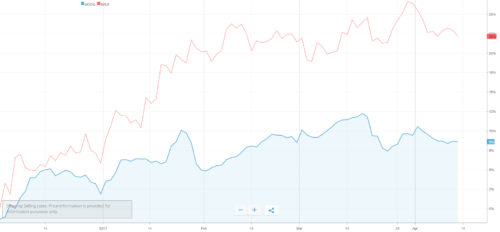

Alphabet Stock vs. Netflix Stock, 2017 | Source: eToro

Another reason is that YouTube TV is at a very early stage from a consumer-facing standpoint and is likely to grow and expand its offering. Moreover, the resources Alphabet Inc. (Google’s parent company) has are immense, and it is likely that it will begin creating its own original content. If that does happen, it will be in direct rivalry with Netflix, which has established itself as the number one TV content creator in the US.

Fighting over market share

When it comes to how Google’s move will affect the GOOG stock price, or the NFLX stock – some time will pass before that could be determined. The Netflix stock price is driven by two main factors: Revenue and subscriber numbers. Judging by the Netflix stock history, whenever the company reports an increase in both, its share price goes up. With the Alphabet stock it is not that simple, since Google operates within a much broader spectrum of services and activities.

On the one hand, this gives Netflix the advantage, because it has very clear goals and means of keeping its share price afloat, while the Google stock could be affected by factors that have nothing to do with its YouTube TV division. On the other hand, Alphabet’s size presents an advantage, since it leaves a wider margin for error and experimentation. For Netflix, a failure in the online streaming market could be catastrophic, while for Google, it could be just a failed aspect of an otherwise incredibly successful company.

The bottom line: There’s enough for everyone

The online streaming space is getting crowded, with many players entering the field in recent years and more likely to join. However, it is important to remember that the majority of the TV industry is still dominated by cable, satellite and network television. Therefore, while the industry has been disrupted by companies such as Netflix, the real transition is still taking place – and it is a fight between cord cutters and traditional providers. Essentially, this puts many of the tech companies on one side of the map in a battle against the traditional providers. However, as online content offerings continue to become more inclusive, with additions such as YouTube TV, the balance could shift in favor of the online content providers – and then the battle between them will take center stage.

All trading involves risk. Only risk capital you’re prepared to lose. The information above is not investment advice.