Hi Everyone,

It wasn’t so long ago when the pain of the European debt crisis brought about a new populist Greek government. When elected in 2015, Prime Minister Alexis Tsipras vowed to fight the austerity of the Union and either bring change or leave.

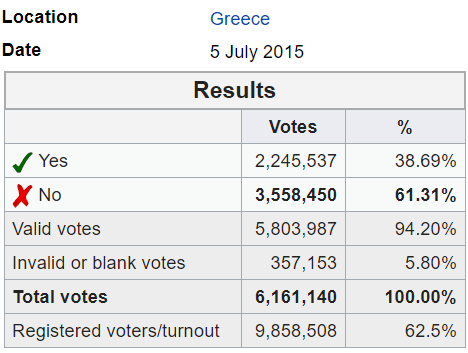

Well, that didn’t exactly happen. Several months after his election, Tsipras held a nationwide referendum to ask the people if they should accept the EU’s bailout proposal. The answer was a resounding NO.

Yet somehow, a few months later, Tsipras signed an even worse bailout agreement with harsher terms and the country has been in deep austerity every since.

This weekend, Greece will once again go to the polls. With youth unemployment still above 40%, polls are indicating a landslide victory for the opposition.

Kyriakos Mitsotakis and the New Democracy is set to deliver an aggressive tax reduction “within the first month,” and to renegotiate the terms of their massive debt.

We wish them a lot of luck with that.

eToro, Senior Market Analyst

Today’s Highlights

- NFP Day

- XRP & ECB

Please note: All data, figures & graphs are valid as of June 5th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

US traders will need to come back from their 4th of July celebrations at peak performance. One hour before the opening bell the Buro of Labor Statistics will release the highly anticipated NFP report.

Expectations are that the number will come out moderately low today and show that the US added about 160,000 jobs in June. As we can see, last month was a miss, and there was an even bigger miss in March.

Traders want to know how strong the economy is, but the main focus for analysts in the moments succeeding the announcement will be how will the Fed react to this data?

At the moment, they are largely expected to cut interest rates at the end of the month by 0.25%. Some analysts are even calling for a 0.5% cut. A miss today could certainly strengthen that case. A strong report, on the other hand, might convince the Fed to exercise a bit more caution and patience.

Lagarde on Crypto

One thing that several people have pointed out to me already is that the next ECB boss is incredibly crypto friendly. Indeed, Christine Lagarde who is set to replace Mario Draghi on November 1st is extremely pro digital assets.

Not bitcoin, of course, but she has advocated already for state-backed cryptocurrencies as well as settlement tokens like XRP and JPM coin. In this video, we can see her taking notes while listening to Ripple’s CEO Brad Garlinghouse.

Of course, Largarde’s main job will be to bring unity and prosperity to the various EU States and QE will probably take precedence over the digital landscape. Sill, we can expect that someone so crypto friendly in such a position will be good for the industry as a whole.

However, it seems that the price has yet to react to what would seem like a very positive progression. Here we can see that XRP is currently testing the bottom of its current range.

Not that this is an issue. If it does break below, we could finally get a capitulation phase, something that XRP has yet to experience. For day traders though, this could provide a nice risk/reward ratio for a quick trade.

Testing 12k

Bitcoin continues to test $12,000 as an interim resistance level. It did pop above there for a few moments yesterday but failed to hold.

The range we’ve been tracking (blue square) remains unchanged, as does the trendline (yellow) which is still very strong. What’s really great about the current bull run is that it did happen a bit more gradually than in 2017 and therefore had more time to build in solid levels that could support this incline.

This weekend, I highly recommend finding the time to listen to this keynote speech. Really don’t want to call it weekend entertainment though. Edward Snowden is more like essential knowledge for navigating life in our techno-society. In this talk, he really gives us a glimpse of several possible futures and end game scenarios for crypto and governments.

Enjoy: https://youtu.be/UDydB3z-6Y0

Have a fantastic weekend!

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.