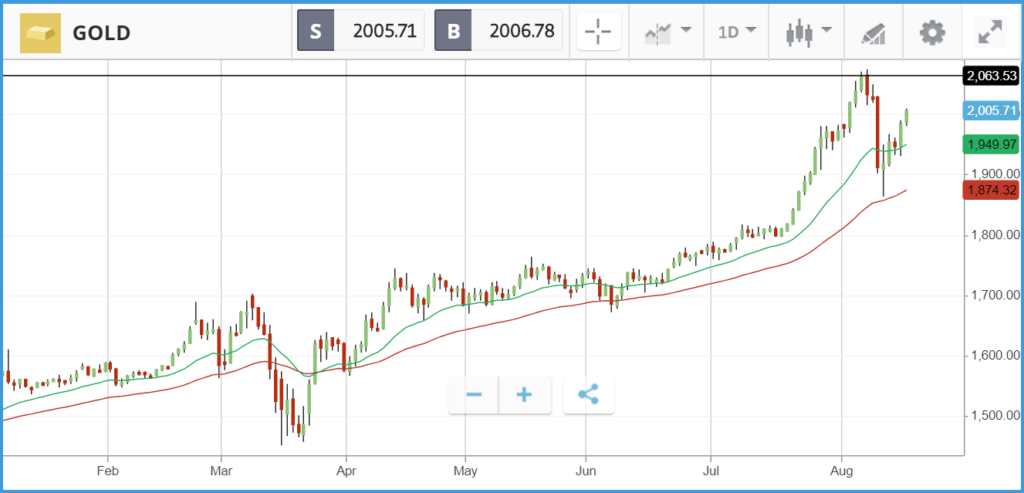

Markets have cooled somewhat after yesterday’s tech-fuelled rally as European shares open in the red and US futures sit just the wrong side of flat. London stocks are being pulled down by losses in the financial and energy sectors. The stand out mover of the morning is Gold, up nearly 1.2% on the day as it continues its recovery from last week’s sell-off. It is being helped by continued USD weakness and as real rates get pushed down, investors seek out an inflation hedge.The red line on the chart below shows the 50 day moving average on gold, which has provided support on a number of occasions over the last 6 months.

Yesterday, where tech stocks climbed across the board, Tesla stood out with an 11.2% gain that took its market cap to $342bn and made CEO Elon Musk the world’s fourth richest person. Tesla stock is now up 125% over the past three months and more than 300% year-to-date. Once again it was an upgraded analyst rating that sent Tesla stock higher; Wedbush’s Daniel Ives increased his 12-month price target on the stock from $1,800 to $1,900, citing accelerating demand for electric vehicles in China.

There were further developments in the continued US-China tensions on Monday, as the US Commerce Department issued new rules limiting access to Chinese telecoms firm Huawei Technologies access to chips made with US technology. President Trump again claimed that Huawei equipment could be used to spy on Americans, something Huawei vehemently denies. Some US chipmakers, such as Qualcomm – which fell 1.4% on Monday – have been lobbying to ease restrictions amid concerns that Huawei will be driven to foreign competitors.

Nasdaq Composite continues to add gains

Of the three major US stock indices, the Nasdaq Composite was the winner on Monday, adding 1% to take its year-to-date gain to 24%. The S&P 500 was also in the green, but the Dow Jones Industrial Average fell 0.3%, dragged lower by 2% plus losses from names, including finance giants JPMorgan and Goldman Sachs, plus Boeing and others. It was a bad day for travel and airline stocks all round, with American Airlines, United Airlines and Alaska Air Group sinking 5.3%, 4.9% and 3.8% respectively. The sell-off appeared to be prompted by a number of states reporting that the Covid-19 situations had worsened over the past week, even as the number of new daily cases nationwide slowed. To-date, the US case count has topped five million, with more than 170,000 deaths. United Airlines stock has rallied 43% over the past three months, driven by a partial recovery in traveller numbers.

S&P 500: +0.3% Monday, +4.7% YTD

Dow Jones Industrial Average: -0.3% Monday, -2.4% YTD

Nasdaq Composite: +1% Monday, +24% YTD

Airline stocks suffer as Ryanair cuts flights again

Airline stocks were also some of the biggest losers in the UK on Monday, although the FTSE 100 and FTSE 250 both made gains overall. International Consolidated Airlines Group, TUI, easyJet and Wizz Air all finished lower, with losses ranging from 3.5% to 5.3%. Ryanair fell furthest of all, ending the day 5.9% down after it anounced that it is cancelling one-in-five flights due to the latest wave of quarantine restrictions that have been placed on European travel. Housebuilder Persimmon, plus miners Polymetal International and Anglo American, led the FTSE 100 higher. The index finished up 0.6%, with its year-to-date loss standing at 18.8%. In the FTSE 250, which added 0.2% on Monday, food producer Cranswick and gambling firm Rank Group were among the top performers – climbing 6.6% and 4.5% respectively. Cranswick’s share price is up 20% year-to-date, a wide margin of outperformance versus the broader market, after reporting a 25% jump in revenue driven by consumers being forced to eat at home.

FTSE 100: +0.6% Monday, -18.8% YTD

FTSE 250: +0.2% Monday, -18.8% YTD

What to watch

Walmart: Retail giant Walmart, the largest private employer in the US, has gained 14.1% year-to-date. The company reports its second quarter earnings on Tuesday before the bell, where analysts are anticipating a solid quarter as shoppers spent stimulus payments on high cost items, and demand for services such as same day delivery and curbside grocery pickup remained high. Currently, 26 Wall Street analysts rate the stock as a buy or overweight, six as a hold and two as an underweight or sell. Analyst expectations are for an earnings per share figure of $1.25 for the quarter, versus $1.18 in Q1.

Home Depot: DIY supply company Home Depot has been a beneficiary of consumers being stuck at home, which has spurred a surge in home renovations. The company’s share price is up 32% year-to-date, including a 17.5% rally over the past three months. Home Depot reports its Q2 earnings on Tuesday, where analysts have high hopes. Wall Street analysts’ aggregate expectation for the quarter has climbed over the past three months, with an earnings per share figure of $3.68 anticipated, versus the $3.13 analysts were predicting three months ago. Currently, analysts are split between a buy and hold rating on the stock.

Agilent Technologies: Research and development firm Agilent reports its latest set of quarterly earnings on Tuesday, after a year that has seen its share price increase 14.3% – with much of that coming from a 16.6% rally over the past three months. The company provides instruments, software and more for laboratories, including probes, mass spectrometry instruments and vacuum technology. Currently, seven analysts rate the stock as a buy or overweight, six as a hold and two as a sell.

Crypto corner: Bitcoin farmers arrested for stealing $1.5 million electricity

Two Bitcoin farmers in Bulgaria have been arrested after siphoning off $1.5 million-worth of electricity, according to Cointelegraph. According to Bulgarian authorities the men were siphoning off electricity in order to mine Bitcoins, a notoriously electricity-heavy process. Authorities believed the pair, aged 31 and 38 respectively, were siphoning electricity for between three and six months.

A deputy director of the local electricity firm, CEZ, Philip Yordanov said it was the biggest ever theft the company had experienced. The firm added the pair had stolen enough electricity to power the entire nearby town for a month.

Elsewhere, Bitcoin has surged through the $12,000 mark reaching a year-to-date high of $12,486, and is now trading around $12,298 at the time of writing.

All data, figures & charts are valid as of 18/08/2020. All trading carries risk. Only risk capital you can afford to lose