Gold hit a new record high in the early hours on Monday and Bitcoin broke through the $10,000 mark whilst the US dollar took a hit compared to its peers.

With the prospects of a smooth recovery in the US economy continuing to diminish as coronavirus cases soar, the US currency — the most important currency globally and one which acts as the benchmark for most financial assets — continues to weaken.

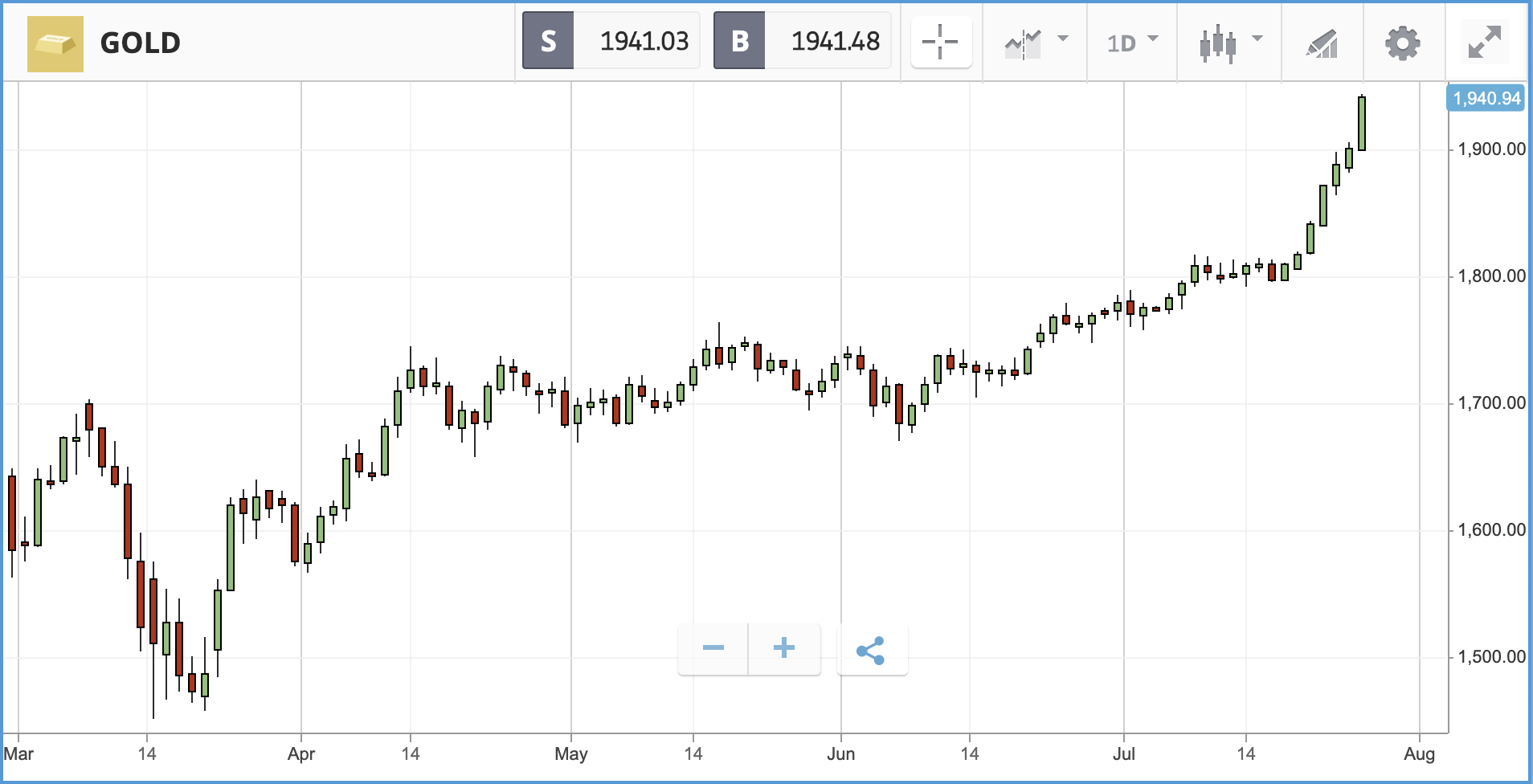

The knock-on effect was clear, with the price of gold hitting a record peak of $1,944 in trading in Asia before settling down slightly at $1,932. The precious metal has been one of the top performing assets since the pandemic began and is up more than 20% since mid-February alone.

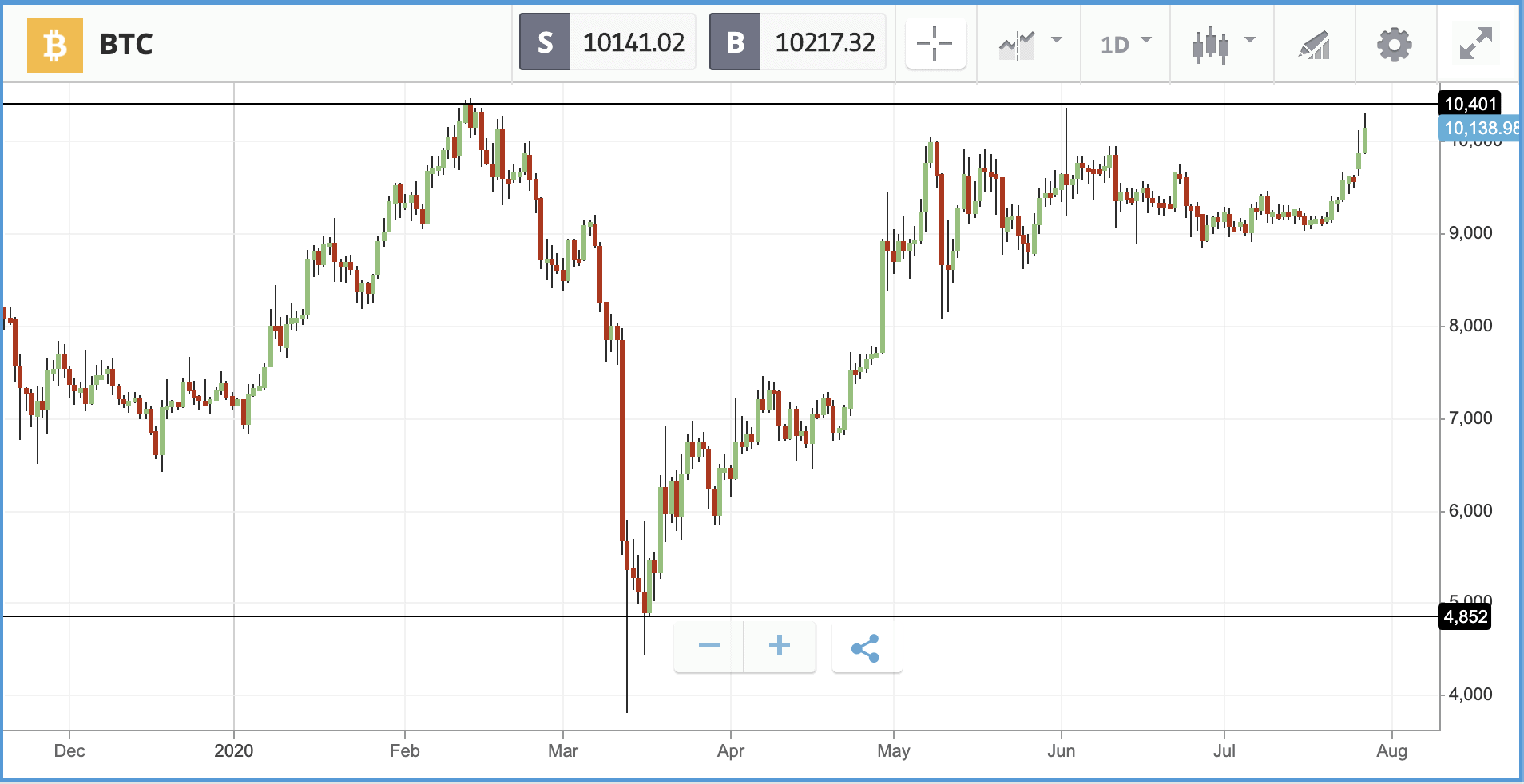

The gains for gold and other assets, including Bitcoin which also broke through the $10,000 resistance level to hit a near six-month high, come as Republican lawmakers prepare to reveal their proposal for what should be included in the next pandemic stimulus bill. Another round of cash payments to Americans is on the cards, and a key point of contention will be the extension of a $600 per week boost to unemployment benefits, with the FT reporting that Republicans will instead propose capping benefits at 70% of prior wages.

The scope and scale of the package will be a key determinant in how well the US economy is able to weather the continuing pandemic, which has been escalating with cases on the rise; on Sunday, the US reported another 62,000 new Covid-19 cases. More than 30 million Americans are currently dependent on unemployment benefits, and a poorly handled stimulus package threatens to put a large dent in the financial health of consumers, who are by far the largest driver of the US economy. Democrats have not yet set out their thoughts on the Republican bill publicly, with negotiations to follow this week.

US-China tensions escalate

US stocks fell marginally over the course of last week, after a strong start buoyed by Covid-19 vaccine hopes ran into worrying weekly jobless claim figures, US-China tensions, and a tempering of investor enthusiasm for giant technology stocks. It was the second week running that many of the major tech names underperformed the S&P 500, with Netflix down 2.5% for the week and Apple 3.9% lower. Investment firm T. Rowe Price noted that the week was characterised by the continuation of a market rotation towards value and mid-cap stocks, which regained ground against the large cap growth names that have proven highly resilient this year.

Once again tensions between the world’s two largest superpowers flared up last week, adding to investors’ reasons to be wary. The US closed a Chinese consulate in China, and China responded in kind. Secretary of state Mike Pompeo also fanned the flames, delivering a speech in which he said that China will “erode our freedoms” and that a choice between “freedom and tyranny” is on the table.

S&P 500: -0.6% Friday, -0.5% YTD (-0.3% last week)

Dow Jones Industrial Average: -0.7% Friday, -7.3% YTD (-0.8% last week)

Nasdaq Composite: -0.9% Friday, +15.5% YTD (-1.3% last week)

New quarantine rules threaten British airlines

London-listed shares fell harder than their US counterparts last week, with the FTSE 100 ending 2.7% lower after sinking 1.4% on Friday. M&G and Vodafone were the two biggest losers on Friday, closing out the day 6% and 5.2% lower respectively. In addition to the factors that hurt US stocks over the course of the week, the FTSE 100 also had to contend with the value of the pound, which made gains versus the dollar over the course of the week — lowering the value of British companies’ overseas earnings. In headlines over the weekend, it was reported that Rolls-Royce is exploring an emergency sale of its Eurofighter jet division, with a number of major private equity firms interested in the billion dollar unit.

British airlines suffered a blow over the weekend, as the government announced a new 14-day quarantine for travellers coming into the UK from Spain. In response, tour operator Tui cancelled all holidays to mainland Spain until August 9, while British Airways said that the decision throws “thousands of Britons’ travel plans into chaos” and “cannot fail to have an impact on an already troubled aviation industry.”

FTSE 100: -1.4% Friday, -18.8% YTD (-2.7% last week)

FTSE 250: -1.3% Friday, -21.1% YTD (-0.5% last week)

What to watch

NXP Semiconductors: While many chip stocks have soared this year — Nvidia is up more than 70% — NXP is down 9%. The firm reports its latest quarterly earnings figures today with an analyst call to follow tomorrow. NXP is known for supplying chips to the automotive industry, for purposes such as keyless entry and car radios. Vehicle sales have been decimated by the coronavirus pandemic, and that has had a knock-on impact on the firm’s prospects. Wall Street analysts lean towards a buy rating on the stock, but their expectations for the company’s Q2 profit have fallen by around 20% over the past three months.

Principal Financial: Another US-listed name that delivers earnings figures on Monday, followed by an analyst call on Tuesday, is insurer and investment firm Principal Financial. Like many financial stocks, Principal has been beaten up this year, with its share price still down by close to 20% year-to-date. However, the stock has surged by 49.3% over the past three months and still offers a dividend yield of 5% despite the share price recovery. Security of the dividend will likely be probed by analysts on the earnings call, as will the impact of close to zero interest rates on the firm’s margins.

Reckitt Benckiser: Investors will be hoping that Reckitt can emulate fellow Anglo-Dutch consumer goods giant Unilever in its own quarterly earnings report on Tuesday. Last week, Unilever gained 6.9% after delivering its earnings numbers, propelling it to become the largest FTSE stock. Reckitt’s share price has gained 25.8% year-to-date. A month ago, UBS put a sell rating on Unilever shares and upgraded Reckitt to a buy rating, citing unsustainable drivers of growth for the former and a “compelling turnaround story” for the latter.

Why have tech stocks paused?

The surge of the tech giants has been one of the defining features of the stock market since the pandemic began. The logic is clear: firms that deliver services digitally, or can enable workers to do their jobs remotely, stand to benefit from a crisis that pushes consumers and companies towards living virtually. Interestingly, the tech stock rally has paused just as Covid-19 cases in the US soar, which logic would dictate will be positive for those companies and once again accelerate trends they are on the right side of. The answer behind why tech stocks have taken pause appears to be a relatively simple one; investors have hit a wall in terms of the valuations they are comfortable with. Amazon’s share price is up by more than 60% year-to-date, while Netflix has added close to 50%.

Crypto corner: Bitcoin soars to highest level since Feb

Bitcoin extended gains seen over the weekend to break through the $10,000 level this morning, with the largest cryptoasset trading as high as $10,314 per coin in the early hours.

The surge comes amid a weakening of the US dollar against a basket of global currencies. The dollar index, which measures the currency against a group of trading peers, fell 0.5% to its lowest level since June 2018 as investors fretted about the true health of the US economy.

It is the first time since June Bitcoin has traded above $10,000 and is just off the peak in February when it touched $10,367.

All data, figures & charts are valid as of 27/07/2020. All trading carries risk. Only risk capital you can afford to lose.