Global stock markets were weaker overnight in Asia as concerns about the resurgent coronavirus continue to grow.

Both the Nikkei and the Hong Kong Hang Seng were weaker on the first day of trading for the week, down 0.2% and 0.9% respectively, as a growing number of coronavirus cases were reported, in particular in the US.

This weekend several US states said they had seen record-high daily infection rates, while the US also reported more than 30,000 new cases on Friday, the highest total since May 1, according to CNBC.

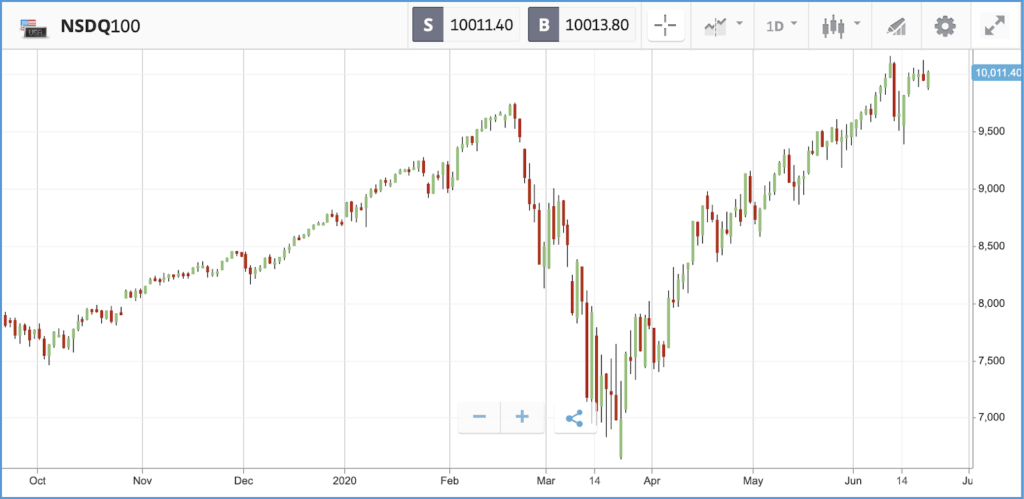

Against this backdrop, the S&P 500 index of America’s biggest public companies is up more than 30% over the past three months, but how investor sentiment shifts around the resurgence of new cases will determine the progress made from here.

Last week, the major US stock indices delivered their fourth weekly gain in the past five weeks, with the tech-heavy Nasdaq Composite up more than 3%. Both the Dow Jones Industrial Average and S&P 500 gained more than 1%.

In political news, President Trump and leading Democrats are facing off on the firing of the Manhattan US attorney over the weekend. The sacked official has now been called to testify in hearings, which will examine accusations that Trump has been purging the US justice department. The story broke as Trump launched his reelection campaign with a rally in Tulsa. For investors in US stocks, the race for the presidency has significant implications. If elected, Joe Biden is expected to roll back hefty cuts Trump made to corporation tax, which would directly hit company earnings. There has also been significant market volatility linked to tensions between the US and China, which Trump’s aggressive rhetoric has fanned the flames of repeatedly.

Tech stocks continue to lead the charge

Most of the gains posted last week by US stocks happened on Monday and Tuesday, with markets stuttering for the rest of the week. Several factors led to the gains: positive May retail sales numbers, the 11th straight week of improvement in initial jobless claim figures, rumblings of a trillion dollar infrastructure plan, and the Federal Reserve beginning to buy individual corporate bonds. Sector wise, the biggest winners in the S&P 500 last week were information technology, consumer staples and consumer discretionary stocks, with real estate the only sector in the red for the week. The information technology sector has stormed ahead in 2020 and is up double digits year-to-date. Investor concerns around the potential implications of rising Covid-19 case numbers were evident in how airline shares performed last week. United Airlines and Delta Air Lines both saw their share prices fall last week, following a monster rally for airline stocks in hopes of a return to more normal travel demand as lockdown restrictions eased.

S&P 500: -0.6% Friday, -4.1% YTD (+1.9% last week)

Dow Jones Industrial Average: -0.8% Friday, -9.4% YTD (+1% last week)

Nasdaq Composite: 0% Friday, +10.9% YTD (+3.7% last week)

Solid week for UK stocks as Bank of England pumps in more money

London-listed stocks outpaced their US rivals last week, with the FTSE 100 up 3.1% and the FTSE 250 climbing 3.6%. Both indices remain down more than 15% year-to-date, however. Last week, the Bank of England’s Monetary Policy Committee voted eight to one in favour of pumping another £100bn into the economy and left its benchmark interest rate unchanged at 0.1%. Similar to the US, stocks made their gains in the first two days of the week and were broadly flat for the remainder. Firms in the FTSE 100 derive more than 70% of their revenues from overseas, and companies in the FTSE 250 still make around 50% of their revenues overseas. As a result, both indices fluctuate based on the state of play in the US and other international markets where British companies make their money, as well as the value of the pound. A case in point is National Grid, which has reportedly joined other large utilities providers in challenging Trump administration rules, which favour petrol cars over electric. The firm oversees the main power grids in the UK, but half its business is in the US. Last week, the company reported a drop in profits and projected a near half a billion pound hit to its earnings this year due to the pandemic.

FTSE 100: +1.1% Friday, -16.6% YTD (+3.1% last week)

FTSE 250: +1% Friday, -19.2% YTD (+3.6% last week)

What to watch

US home sales: On Monday, existing home sale data for May will be released in the US, with a figure of 4.2 million anticipated, versus 4.3 million in April – a figure that was 18% lower than March’s number. New home sales data will then follow on Tuesday, with the pair of reports likely to be among the most closely watched this week. Investment firm John Hancock highlighted in a Friday note that the data may help reveal “how much of an impact the coronavirus pandemic has had on the typical surge in springtime home buying activity.”

Chicago Fed national activity index: In other economic data, the Chicago Fed’s national activity index for May will be released on Monday. The index registered a -16.7 reading in April; a zero value indicates that the economy is expanding at its historic trend rate of growth, while a negative value signals below average growth. The index comprises 85 economic indicators, 79 of which were in the red for April.

UK services and manufacturing data: On Tuesday, investors will get a view into the state of the UK services and manufacturing sectors for June. Flash purchasing manager indices (PMI) for both will be released, which provide the preliminary results of a survey of purchasing managers at companies, where those firms share data such as output, new orders and pricing. A figure below 50 indicates contraction, and above 50 expansion. For May, the manufacturing sector reported a figure of 40.7, with the services sector at 29, showing a deep decline. For June, expectations are for figures of 45.3 and 39.5 respectively, according to Trading Economics.

What is happening with US Covid-19 cases?

Much is being written about the surge of Covid-19 case numbers in the US, something which is a major determining factor in how stock markets perform from here. Here is a quick summary of what has happened so far. States across the US are in different stages of reopening and are all taking different tactics. That ranges from bars being open with no masks required and relatively large group gatherings allowed, to more restrictive states, which are still heavily limiting group gatherings and taking a slower approach to reopening the leisure sector. Over the weekend, it was reported that 12 states in total have now recorded record-high new daily case numbers, including Florida, Nevada and California. In some cases, officials are looking to bring lockdowns back into force, but others are pressing ahead with reopening, citing better healthcare capacity and the economic damage of a reversal. Just as New York dominated in terms of case numbers in the first wave of the virus, there are concerns that new epicenters of the disease are emerging in the US, which could sustain the pandemic for longer.

Crypto corner: Bitcoin braced for a $1bn event as options expire

Bitcoin traders and investors are braced for an earthquake-like event this week when almost $1bn of Bitcoin options expire this week.

The size of the options expiring on June 26 is some $930m, equivalent to around 70% of the Bitcoin currently being traded on the market, according to a report in Forbes. The potential for holders of the options to re-buy them is likely to cause a spike in volatility.

Bitcoin is up just over 30% year-to-date, trading at $9,361 today. Its peer Ethereum has nearly doubled since the start of the year, with a price of $233 currently, although both are off recent highs.

All data, figures & charts are valid as of 22/06/2020. All trading carries risk. Only risk capital you can afford to lose.