Hi Everyone,

According to the reports, the global anti-poverty organization known as Oxfam is deploying a new pilot to give the citizens of Vanuatu Dai, a stablecoin that resides on the Etherum blockchain to support disaster preparedness and increase the speed, transparency and cost efficiency of delivering aid in the country.

So far it seems that it’s going well. Using the old system, it took about an hour to register a disaster victim in their system and grant them the aid. Using blockchain it can be done in just six minutes.

Organizers also found this method far more secure. They used to use a centralized database to keep track of their system but found this method to be quite vulnerable to hacking attempts. Using a blockchain allows them to scale quickly in a cheap and transparent environment, which is exactly what they need.

Today’s Highlights

- Hong Kong 25%

- New Bitcoin Premium

- Bitcoin Over 9k

Traditional Markets

The protests remained largely peaceful and it does seem like they have had an impact on policy. Not only has the controversial extradition bill been delayed, the Hong Kong’s CEO (yes that’s right, they call their head of state a CEO) Carrie Lam is now fighting for her political future.

Possibly due to the calm nature of the demonstrations, the Hong Kong Stock market is holding up quite well today.

Other stock markets are flat to mixed today as we await some speeches from the world’s central bankers. Mario Draghi will be speaking at a central bank forum later today and tomorrow morning. On Wednesday, the US Federal Reserve will deliver their much-anticipated interest rate announcement.

HK BTC

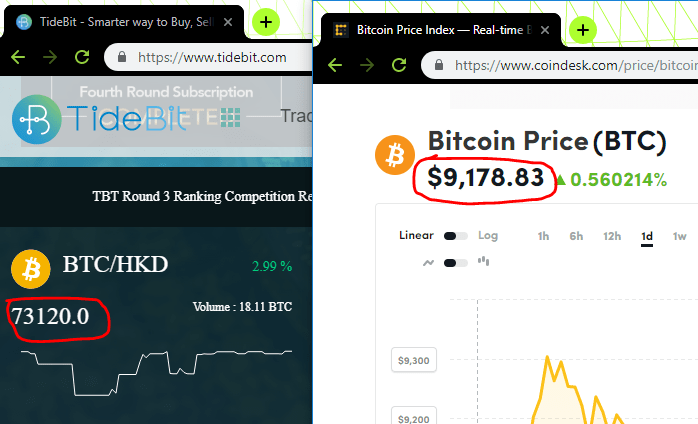

Also worth noting is that bitcoin is now trading at a premium in Hong Kong. The HK exchange site Tidebit is reporting a price per BTC that is about $160 above the rest of the crypto market.

Here I’ve taken a screenshot of the current rate on Tidebit compared to Coindesk. As you can see, at the time of this picture, the HK exchange was selling BTC for 73,120 HKD (approximately $9,337).

The premium is not astronomical, just 1.74% higher. Back in 2017, we used to see Japan and South Korea trading at premiums of 20% and more. However, the market is much more mature than it was then and the spreads across exchanges tend to stay pretty tight these days. So even this small premium certainly stands out.

Bitcoin Over $9,000

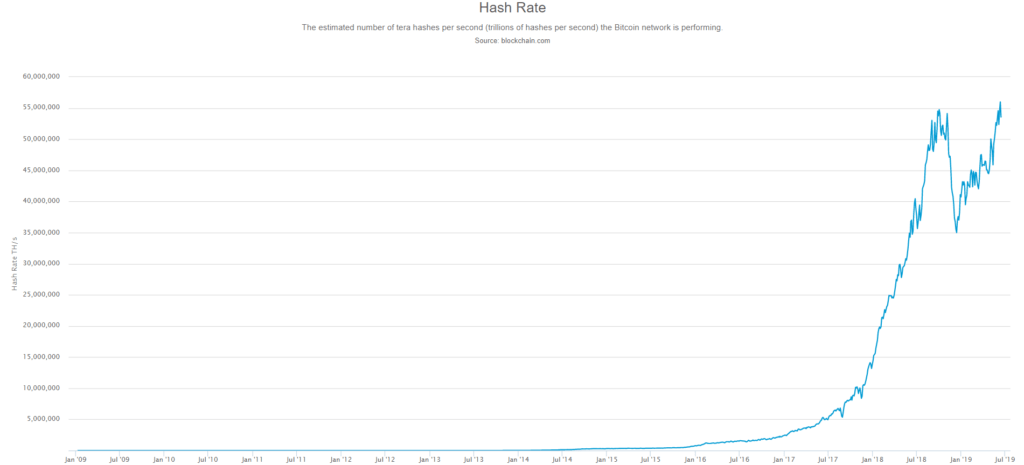

Crypto markets are making huge moves again today as prices flash bright green. There’s plenty to be bullish about too as the technicals and fundamentals remain strong.

The mini-resistance at $9,000 per bitcoin has been knocked out over the weekend and many pundits are now calling for $10,000 (dotted white line).

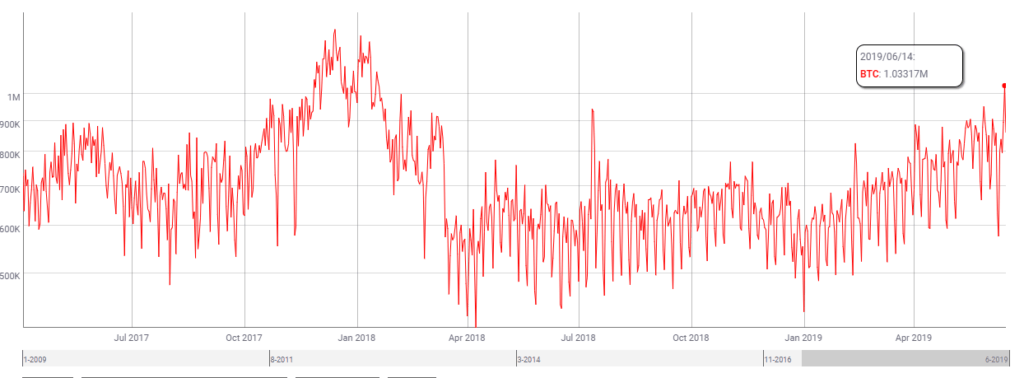

However, the data is a bit inconsistent with other sites like bitinfocharts and blockch

I guess they have different ways of calculating these figures. If any of my readers has more info on this I’d be glad to hear it. Still, all three sites do show a steady rise in blockchain activity this year.

Overall, it’s great to see that this breakout has not gotten out of control. We’ve seen the deterioration of a psychological resistance level that’s been holding for three weeks, but the breakout did not come with a drastic surge. This shows that the market is in a healthy incline, which is really the best possible scenario.

Wishing you a wonderful week ahead.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/

LinkedIn: https://www.

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.