Good morning,

In US stocks, Franklin Resources – the parent company of Franklin Templeton – announced that it is buying rival asset management firm Legg Mason for $4.5bn cash, in a deal that will see it take on around $2bn of Legg Mason’s debt. The sale price of $50 a share was 23% higher than where Legg Mason stock was on Friday, and the firm closed 24.4% higher at $50.66 on Tuesday. Franklin investors also reacted positively to the deal, which will create a $1.5trn asset manager in an industry where scale has become paramount to success. “This is a landmark acquisition for our organisation that unlocks substantial value and growth opportunities driven by greater scale, diversity and balance across investment strategies, distribution channels and geographies,” said Greg Johnson, executive chairman of the Board of Franklin Resources.

Tesla a standout as US markets sink following Apple warning

The major US indices ranged from flat for the Nasdaq Composite to down 0.6% for the Dow Jones Industrial Average on Tuesday, as $1.4trn market cap Apple sank 1.8% after its surprise negative update on Monday. Tesla posted another monster day, finishing 7.3% higher thanks to price target increases from multiple Wall Street analysts, taking its three-month gain close to 150%. In its Q4 update, Walmart’s revenues came in less than 1% off expectations, and there was a lower sales pickup in Q4 for the holiday season than the firm reported last year. Executives on the company’s earnings call pointed to soft sales in toys, videogames and clothing in the run-up to Christmas as the culprits. However, the supermarket giant did post a huge 35% gain in e-commerce sales in the fourth quarter, helping Walmart stock to close 1.5% higher on Tuesday. Also making headlines on Tuesday was movement at the sportswear giant, Nike, as CEO Mark Parker, who started last month, named a new COO and CFO. Nike stock finished 1.5% lower following the news.

S&P 500: -0.3% Tuesday, +4.3% YTD

Dow Jones Industrial Average: -0.6% Tuesday, +2.4% YTD

Nasdaq Composite: 0% Tuesday, +8.5% YTD

HSBC, Glencore a drag as London-listed stocks sink

Following a dent to coronavirus optimism from Apple’s Monday warning, London-listed stocks sank overall on Tuesday, with both the FTSE 100 and FTSE 250 ending the day 0.7% lower. The FTSE 100 continues to trail the major US indices and is currently down 2.1% since the start of the year. Some of the biggest moves downward on the day were driven by company specific news from some of the country’s biggest listed entities. HSBC closed 6.6% lower after announcing 35,000 job cuts and a huge fall in profits, while commodities giant Glencore was off 4.5% lower after reporting it had sunk to a loss. In the FTSE 250, Jupiter Fund Management was one of the biggest losers, closing 4.1% lower after announcing it is buying Merian Global Investors in a £370m stock deal. On Monday, Jupiter stock opened 8% higher after the deal was reported over the weekend but has sunk all the way back to where it started now that investors have had a chance to digest the deal.

FTSE 100: -0.7% Tuesday, -2.1% YTD

FTSE 250: -0.7% Tuesday, -0.9% YTD

Stocks to watch:

Anglo American: Miner Anglo American is one of several major London-listed stocks reporting earnings on Thursday. The firm has gained more than 20% over the past six months, digging itself out of a hole after the share price cratered at the end of July. Last month Anglo announced that it is acquiring fertilizer company Sirius Minerals for £405m in cash, stepping in to save the business that has faced difficulties securing financing to complete a Yorkshire mine. That deal is likely to be probed by analysts on the company’s earnings call, although Anglo’s 3.7% dividend is well covered and unlikely to be at risk.

Lloyds Banking Group: Following HSBC’s disastrous update, all eyes will be on Lloyds on Thursday. Brexit is likely to be a feature of the company’s earnings calls, as the bank is predominantly UK focused. Lloyds had a rocky 2019, with its share price see-sawing more than 20% in either direction over the course of the year. The stock offers a dividend yield of around 6% and a single digit price-to-earnings ratio, and has essentially been flat and volatile since the 2016 referendum result. In its Q3 update, the firm suspended share buybacks and profits sank. This is because the bank has had to set aside an additional £1.8bn in provisions for PPI compensation due to a last minute rush of claims ahead of a final deadline.

BAE Systems: BAE Systems had a solid 2019 and start of 2020, with its share price up around 40% from the start of 2019 to now, recovering from losing a third of its value in the latter half of 2018. The defense contractor reports earnings on Thursday, a month after it announced plans to pick up two business units that Raytheon and United Technologies had to unload in order to complete their merger. BAE is acquiring a military GPS business from Collins Aerospace (part of United Technologies) for $1.925bn in cash, and an airborne tactical radios business from Raytheon for $275m. Both purchases come with substantial tax benefits attached.

Crypto corner:

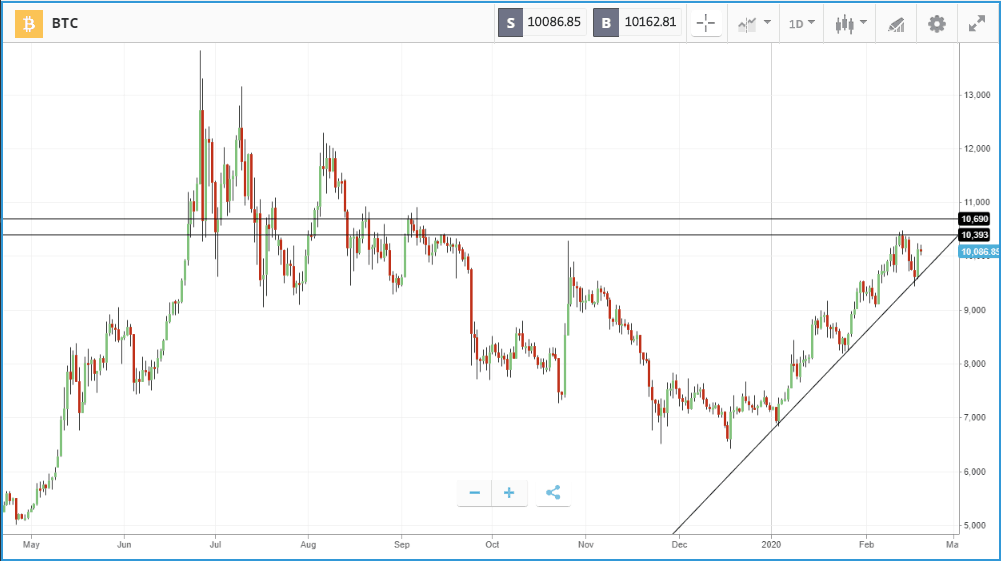

The world’s largest three cryptoassets have had a stellar start to the year and continue to flirt with multi-month highs as we hit mid-week.

Bitcoin, which has spent much of February back above the $10,000 mark, is up at $10,031 this morning, while Ethereum is holding on to gains above $270, trading at $273 this morning. Meanwhile XRP has diverged a little from peers – it is around 15% lower than its most recent peak above $0.33, currently trading at $0.288, but it remains up more than 50% year-to-date.