Hi Everyone,

Some crypto supporters claim that you’re not a true advocate unless you’re running your own node. Well, it seems the government is about to do just that.

It’s important to note that running a node of the network is not the same as mining a cryptocurrency. A full node is a computer that downloads the entire history of a blockchain in order to verify the authenticity of the transaction history. In short, they support the network by verifying that everybody has the same version of history and nobody is cheating. This is different from miners, who add new transactions to the blockchain and receive a reward for it.

In short, anyone can run a node for any open permissionless blockchain and according to this government contract, the SEC is looking to hire a firm to set up nodes on as many cryptos as possible in order “to support its efforts to monitor risk, improve compliances and inform commission policy with respect to digital assets.

In other words, the SEC is looking to gather information about these projects and in order to do so, they are willing to become a fully participating, supportive, and contributing member of the crypto community.

eToro, Senior Market Analyst

Today’s Highlights

- Face the Music

- Taking Off

- Crypto Volume Bounce Back

Please note: All data, figures & graphs are valid as of July 31st. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

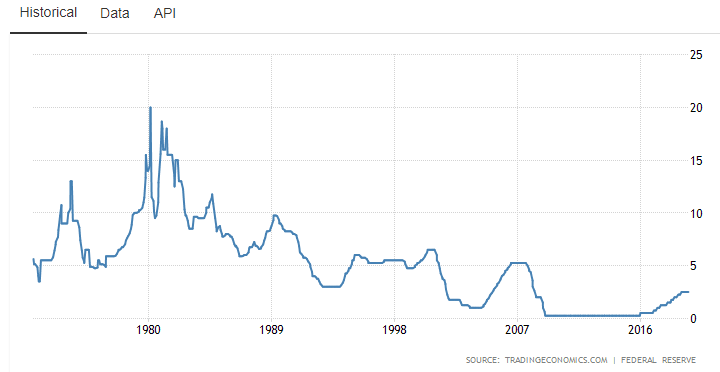

Today is the day. For the first time since the financial crisis more than a decade ago, the Federal Reserve Bank in the United States will cut its benchmark interest rate by 0.25%.

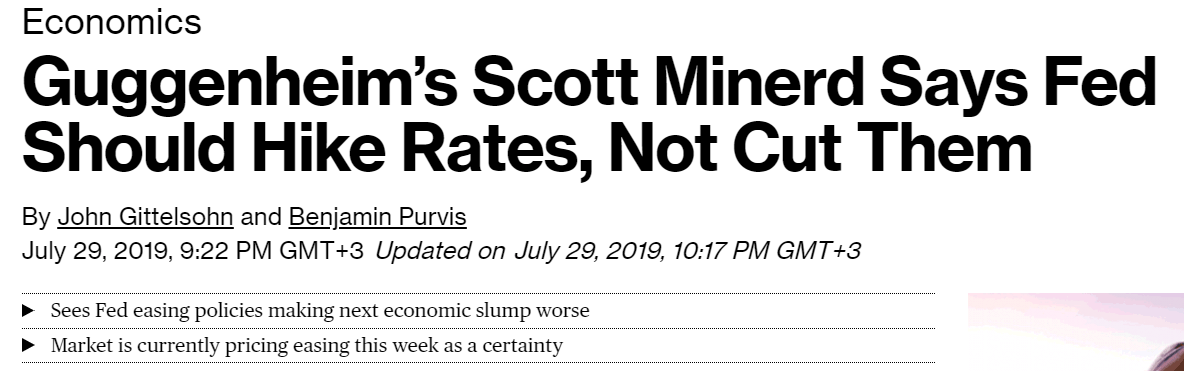

The move comes in spite of stern warnings from major economists who say that given the current economic conditions, the Fed should be raising the rates at the moment and not cutting them. Here we can see one such warning from the head of a firm that oversees approximately $270 billion.

In a note to investors (titled: On the Other Hand) one of my favorite market commentators, Howard Marks from Oaktree Capital, laid out the pros and cons of such a move. In Marks view, it’s quite clear that the Fed is bowing to pressure from the financial markets and choosing to artificially prolong the current bull run but that the long term consequences could be much worse as a result.

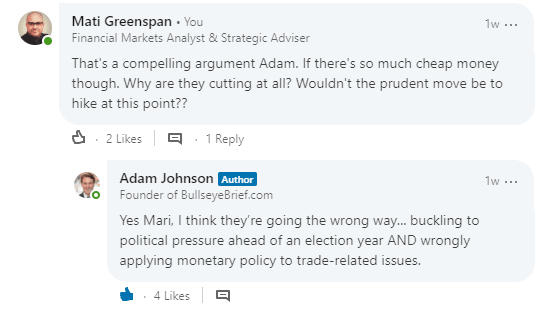

A few days ago, Adam Johnson confirmed to me on LinkedIn that the Fed is definitely going the wrong way and are frontrunning poor trade policy with poor monetary policy.

Now, because this move has been highly anticipated by the market there is a high likelihood that it is already fully priced into the markets. As of the closing bell yesterday the market was even pricing in a 17% chance that the Fed will cut the rates by 0.5% instead of the traditional 0.25%. If that happens, no doubt there will be some celebrations in the stock prices but may also signal that the economy is in much more trouble than we thought.

Of course, at this point, in the off chance that they do decide to do the prudent thing and leave rates unchanged, it could send the markets into a tizzy.

For crypto advocates, today’s Fed event presents a rather unique historic landmark.

Later today, I will do a special interview with BlockTV to discuss how the markets might react to this, so watch out for that on social media in the next few hours.

Tomorrow, we’ll hear from the Bank of England who will give their interest rate decision. Unfortunately, this seems like an exact opposite situation. With Boris Johnson looking increasingly likely to trigger a hard Brexit and the Pound threatening to reach its lowest level since 1985, there is a perfectly good economic case for a rate cut, yet markets do not expect one.

Taking Off

Not to spend too much time shilling eToro’s products, but this new one is truly avant-garde. Looking at the current trends in technology it’s clear to see that the usage of autonomous drones is increasing at a rapid pace and as the regulatory landscape brings more clarity to the space, the industry only stands to gain. That’s why our team has put together the @DroneTech Smart Portfolio™.

As implied by the name, this product brings together 37 stocks from several different sectors that are involved in the development and deployment of drone technology. Make sure to check out the full prospectus at this link.

Also important to note is that in response to your feedback we’ve lowered the barrier to entry for this product and instead of a $5,000 minimum investment, you can begin with this portfolio with as little as $2,000.

Crypto Volume Bounce Back

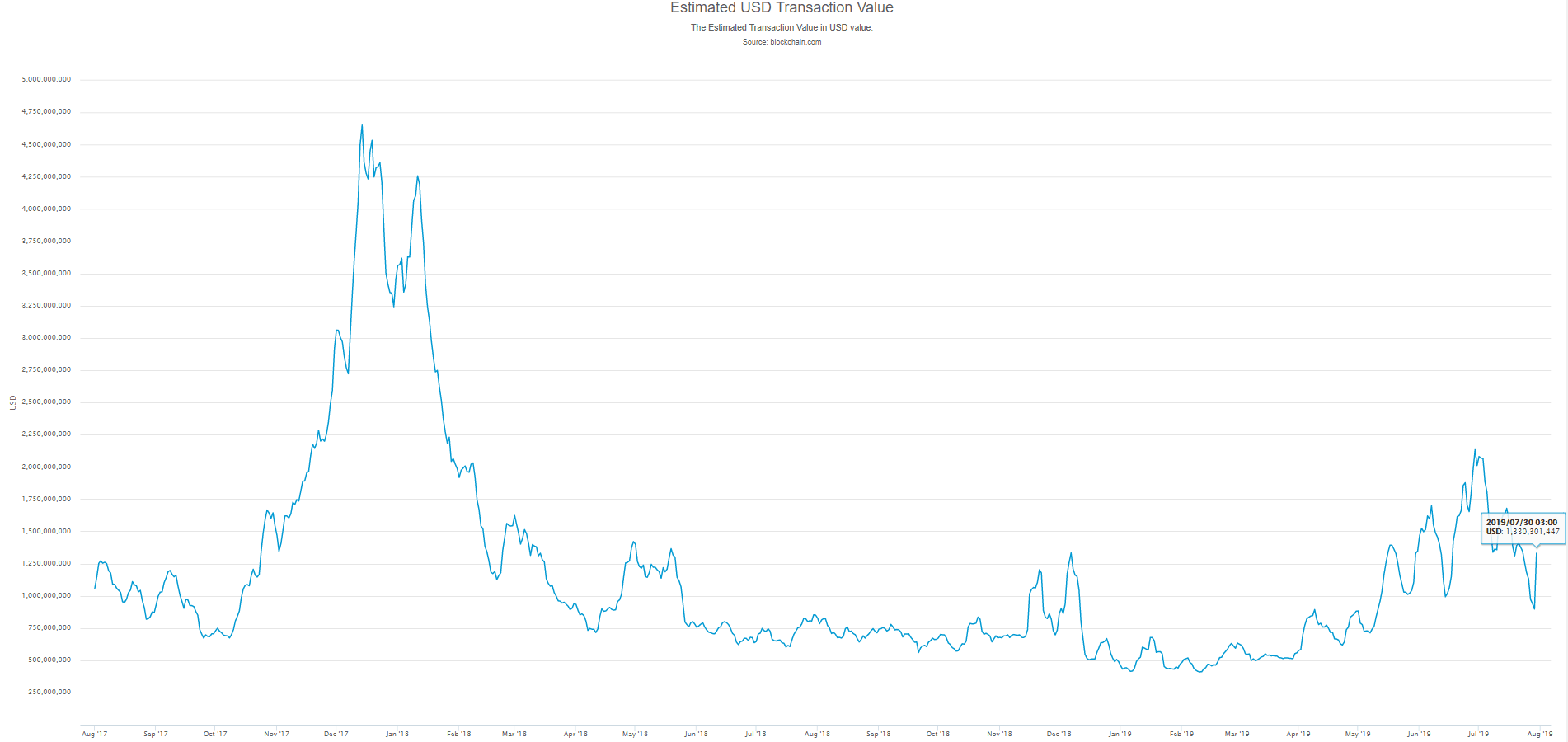

It seems that crypto market volumes did bottom out ahead of yesterday’s congressional hearings. Today action across major exchanges has returned to normal levels and even transfers on the blockchain have come back from their lows this morning.

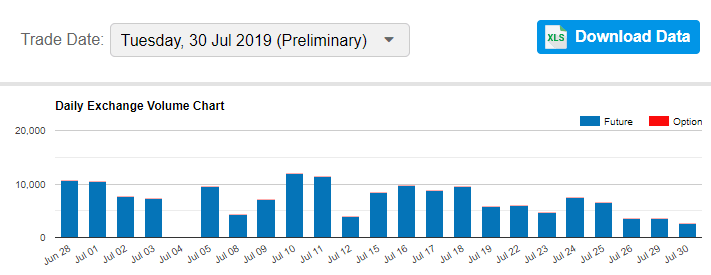

Volumes on Wall Street, however, are still lagging. As we can see, the number of contracts traded at the CME Group has been declining steadily for the last two weeks. They’ve always been laggards in this market anyway though, joining when volatility spikes and leaving when it’s low.

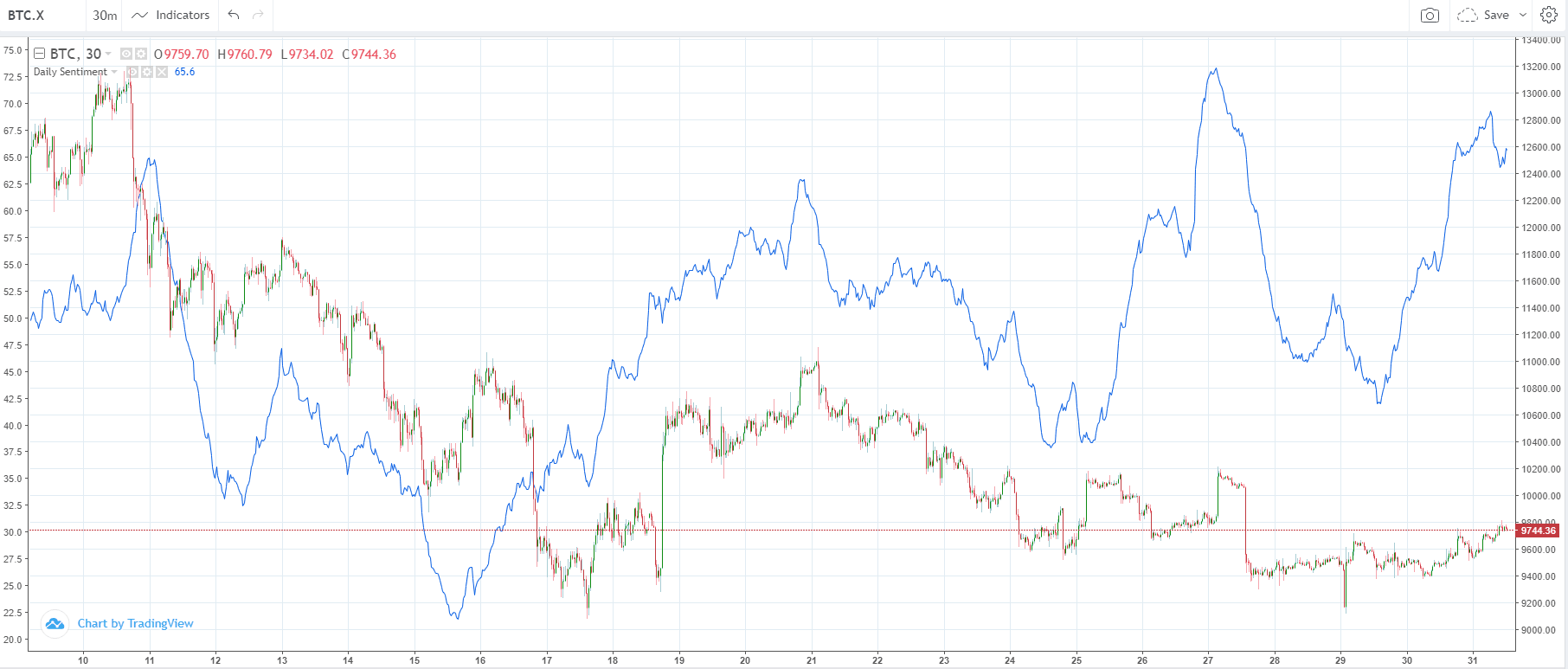

What may well be a leading indicator, on the other hand, is the sentiment on social media. As can be seen from data at TheTie.io tweeters are incredibly positive now that we’ve seen a solid bounce off the $9,000 support level.

Best regards,

Mati Greenspan

Senior Market Analyst

Connect with me on….

eToro: http://etoro.tw/Mati

Twitter: https://twitter.com/matigreenspan

LinkedIn: https://www.linkedin.com/in/matisyahu/

Your Social Investment Network – www.eToro.com

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.