Hi everyone,

Welcome to the FOMC Wednesday! Tonight we are getting the FOMC meeting minutes from the July meeting. Investors will be paying special attention to the release of the minutes because they may provide important insight into the Fed officials’ outlooks prior to the escalation of trade tensions and recent equity market volatility. If the escalating trade tensions, which happened after the July meeting, were a surprise, then this could indicate that more monetary policy easing than initially expected by markets is on its way. Trump has been applying more pressure on the Fed’s Powell recently in another round of tweets, citing “the horrendous lack of vision by Jay Powell and the Fed.” He went on to say that “the Fed Rate, over a fairly short period of time, should be reduced by at least 100 basis points, with perhaps some quantitative easing as well”.

Link: CNBC Article

The Day Ahead

The key economic data event today is the July FOMC meeting minutes which are due to be released at 19.00 BST. Prior to that, data includes the UK public sector net borrowing stats for July, Canada’s Consumer Price Index which is estimated to come in at 1.7% from previously published 2%, and July’s existing home sales data in the US. The weekly EIA crude oil inventory report is also due to be released which is estimated to show a 1.885m drawdown on reserves from previously published 1.580m.

Traditional Markets

Link: Reuters Article

Baidu – Shares in the Chinese tech giant soared as much as 8% after hours, the company posted results which came in significantly ahead of expectations. China’s answer to Google resisted intense competition from peers and also experienced a strong uptake in its mobile offering. However, going forward the company may face headwinds in terms of advertising which could present a challenge.

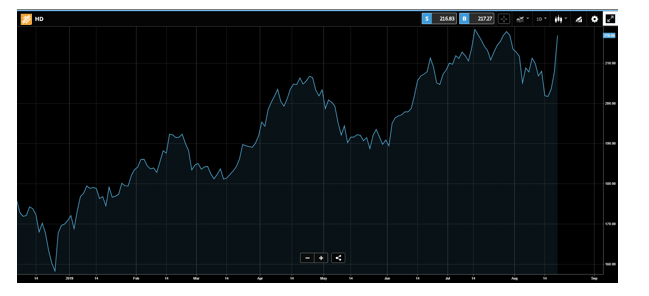

Home Depot – The home improvement retailer reported quarterly earnings of $3.17 per share, 9 cents a share above estimates. However, revenue came in below forecasts and a comparable-store sales increase of 3% was below the 3.5% consensus estimate of analysts surveyed by Refinitiv. Home Depot said its sales were impacted by declining lumber prices, and it cut its full-year sales forecast noting that tariffs could impact spending by US consumers.

Forex

UK Prime Minister Boris Johnson made his first significant attempt to renegotiate his predecessor’s agreement on the UK’s withdrawal from the European Union. He told the EU that a Brexit deal can still be approved by UK lawmakers if Brussels agrees to scrap the Irish backstop. Johnson also reiterated that he believes a deal could still be reached before the 31 October deadline, however, he feels that the backstop was “unviable” and must be removed. Johnson is scheduled to meet with the leaders of Germany and France in their capitals before attending the G7 summit which will be held from 24 to 26 August in Biarritz. The UK government also announced its plans for a publicity blitz aimed at preparing the public for a no deal exit. The GBPUSD currency pair is correcting lower from the recent 1.2170 highs. The key level to the downside is at 1.2000, confirmed loss of that level and an end of day close lower could trigger additional selling pressure. Alternatively, a spike higher and an end of day close above the psychologically important 1.2200 resistance could trigger an oversold rally potentially targeting additional upside resistances at 1.2380 (15 and 26 July lows).

Crypto

Green, Amber, Red!

Technical analysis of cryptoassets is indicating price consolidation. The recent trading ranges for Bitcoin, XRP, and Ethereum are testing resistances and confirmed breakouts higher could support further strength. Here are the key trading levels to watch.

For Bitcoin the key trading levels is at 9,964. Upside is initially capped by resistance at 11,000. Confirmed breakouts higher could target additional resistances at 11,900 followed by 12,000. Alternatively a confirmed loss and an end of day close below 9,964 could change the outlook to bearish targeting downside supports at 9,400 followed by 9,000.

The key trading level for XRP is at 0.2580. Upside is capped at 0.300 initially followed by 0.3184 and 0.3400. Alternatively a confirmed loss of the 0.2580 level could target downside supports at 0.2454 and 0.2240.

For Ethereum the key trading level is at 182.00. Upside is capped at 207.00 initially followed by 215.00 and 231.00. Alternatively, a confirmed loss of the 182.00 level could target downside supports at 166.00 and 146.50.

Libra – Facebook’s cryptocurrency has been reviewed by EU antitrust agencies

Bloomberg said in a report on August 20 that Facebook’s cryptocurrency Libra was censored by the European Union’s antitrust agency. According to a questionnaire sent by the EU antitrust regulator in early August, the committee is currently investigating potential anti-competitive practices related to the Libra Association, fearing that the proposed payment system would unfairly exclude competitors. It is reported that regulators have begun investigating how Libra is used in Facebook’s WhatsApp and Messenger applications. In addition, the report stated that the committee’s antitrust division is not the only branch of the agency that is investigating Libra. A spokesperson for the committee’s financial services division said the branch is “monitoring market developments in the area of crypto assets and payment services, including Libra and its development”.

Bitfinex and Tether to appeal ruling

After a judge dismissed Bitfinex’s motion to have their case dismissed due to lack of jurisdiction, both Bitfinex and Tether have signalled their intent to launch appeals. The New York Attorney General alleges the companies defrauded investors by concealing losses.

Bitcoin hash rate hits all time high

The hash rate or computing power of the Bitcoin network on Monday peaked at 82.5 TH/s (tera hashes per second). Some analysts argue that the higher the hash rate of the network the more secure the network becomes, and in turn the higher investor confidence, which could potentially drive up prices.

Link: Blockchain.com

All data, figures & charts are valid as of August 21st. All trading carries risk. Only risk capital you can afford to lose.

eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority. eToro (Europe) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission. eToro AUS Capital Limited is regulated by the Australian Securities and Investments Commission, ABN 66 612 791 803, AFSL 491139.

This is a marketing communication and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without having regard to any particular investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared utilizing publicly-available information.

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptoassets are volatile instruments which can fluctuate widely in a very short timeframe and therefore are not appropriate for all investors. Other than via CFDs, trading cryptoassets is unregulated and therefore is not supervised by any EU regulatory framework. Your capital is at risk.