US markets snapped a five-day winning streak overnight amid a warning from a senior Federal Reserve official that the surge in coronavirus cases in many states poses a threat to the US economic recovery. Raphael Bostic, president of the Federal Reserve Bank of Atlanta, speaking to the Financial Times, said that data he is seeing suggests “the trajectory of this recovery is going to be a bit bumpier than it might otherwise.” Bostic’s district includes many of the areas worst affected by the wave of new cases, including Florida. In a note to clients, investment bank Jefferies also warned earlier this week that its own economic activity index has “flatlined” for the past three weeks, with momentum lost across a range of economic sectors. “Given the timing of the hit, official June [economic] data is likely to be spared, but there is a clear downside for July,” the note said.

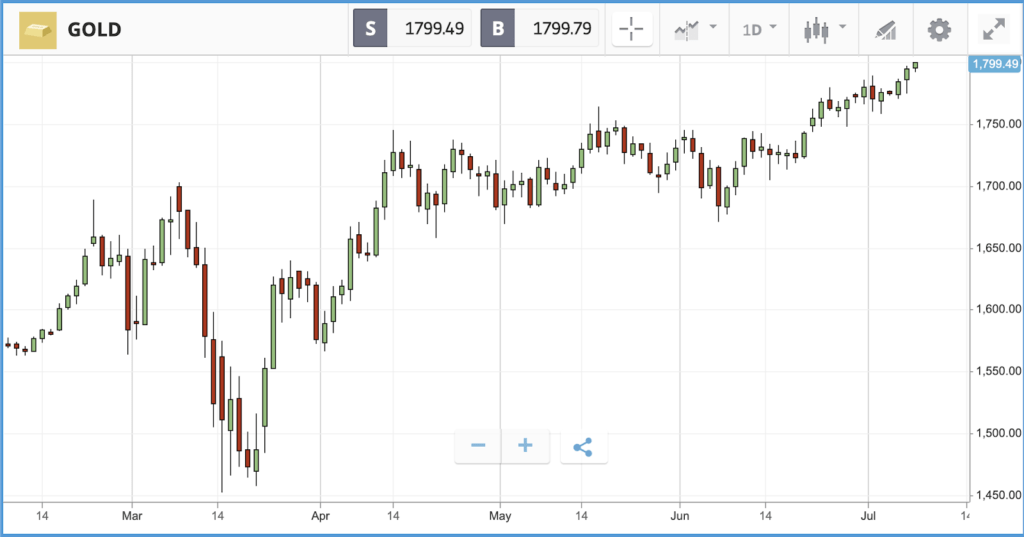

The warnings come as US shares ended the session lower on Tuesday, the first down day for a week. The S&P 500 closed down 1.1%, stopping the index short of reaching positive territory for the year, while in the UK the FTSE 100 finished the day 1.5% lower. The losses came after the European Union announced that it expects the bloc will suffer a larger economic contraction than expected due to coronavirus lockdowns. In contrast gold hit a near eight-year high after passing through the $1,800 mark for the first time since September 2012.

Later today, UK Chancellor Rishi Sunak will outline some of the government measures to be put in place to help get the economy back on its feet. These are to include a multi billion pound programme to subsidise up to 9 million jobs and cuts to the Stamp Duty tax when purchasing a property. Other rumoured measures are potential cuts to VAT and vouchers to stimulate the hospitality industry.

Walmart posts standout day after announcing plan to take on Amazon

The Nasdaq Composite held up best to Tuesday’s sell-off out of the three major US stock indices, ending the day 0.9% down. While the Dow Jones Industrial Average also sank 1.5%, with Boeing the biggest loser after tanking 4.8%, Walmart managed to buck the trend to post a 6.8% gain for the day. The gains came after the supermarket giant, which is America’s largest private employer, announced that it will launch a subscription programme later this month. For $98 annually, subscribers will get fuel discounts, free same day shipping and other benefits, undercutting Amazon’s Prime membership service. Investors reacted positively, as Walmart is one of the few companies with the scale and capabilities to take on Amazon. As a result, Amazon stock fell 1.9%, following the news. At a sector level in the S&P 500, energy stocks were the biggest losers on Tuesday, sinking 3.2% on aggregate. Energy stocks are among the most sensitive to changing sentiment around the prospects for economies reopening and the ensuing economic recovery. A return to mass lockdowns would mean demand for oil plummeting once again, threatening prices.

S&P 500: -1.1% Tuesday, -2.7% YTD

Dow Jones Industrial Average: -1.5% Tuesday, -9.3% YTD

Nasdaq Composite: -0.9% Tuesday, +15.3% YTD

OECD warns second wave would lead to 15% unemployment in UK

London-listed shares also fell on Tuesday after the OECD warned that the UK unemployment rate could jump to nearly 15% if a second wave of the Covid-19 pandemic hits. The UK is currently at a pivotal point, while it waits to see if the reopening of pubs and restaurants a few days ago will translate to a surge in cases. If a second wave is avoided, the unemployment rate is still expected to be at 11.7% by the end of the year, the OECD said. The FTSE 100 closed the day 1.5% lower, while the FTSE 250 was down 1.1%. In the FTSE 100, hospitality firm Whitbread fell hardest, finishing 5.5% down after reporting its latest quarterly earnings. The company reported a near 80% drop in sales, but said it is seeing solid demand for hotels in UK tourist destinations for the summer months. Sports fashion retailer JD reported full year earnings on Tuesday, delivering a 30% increase in revenue for the 12 months ending February 1, versus the previous year. However, the firm cut its dividend dramatically, and said it does not intend to pay a final dividend due to the pandemic. Management warned the pandemic is hurting its commercial operations and will have a material impact on its financial 2021 results.

FTSE 100: -1.5% Tuesday, -17.9% YTD

FTSE 250: -1.1% Tuesday, -20.7% YTD

What to watch

Emergency UK budget: Today at 12:30pm, Chancellor Rishi Sunak will present an emergency summer budget update, in which he is expected to announce a host of measures intended to assist the UK economy’s recovery from the coronavirus lockdown. A multi-billion pound green jobs scheme, cash for firms that hire trainees, and vouchers for households to spend in hard hit areas of the economy are all initiatives that may be announced today. National Insurance cuts, funding for the arts, and tax cuts for the hospitality sector are other ideas that have been mooted to be included.

Bed, Bath & Beyond: One of the few companies reporting earnings on Wednesday in the US is home goods retailer Bed, Bath & Beyond, which has been a rollercoaster stock for investors this year. The firm’s share price is down 40.8% year-to-date but has jumped 117.4% over the past three months. Expectations for the earnings report are low. Bed, Bath & Beyond’s fiscal Q1 covers much of March, April and May, when lockdowns meant that its stores were mostly closed. To add to that, in the same quarter last year the firm only just eked out a profit. Digital sales will be put in the spotlight, as will the revenue prospects of stores reopening. Analysts are anticipating a $1.27 per share loss for the quarter; three rate the stock as a buy, 12 as a hold and four as a sell.

Crypto corner: South America bucks global trend as Bitcoin investing surges

Bitcoin continues to grow in popularity in South America, new data has revealed, with a surge in the volume of trades placed across the continent.

New figures from investment publication Invezz showed the volume of coins transacted in Argentina, Chile and Colombia have all outstripped last year’s levels on platform LocalBitcoins.

This stands in contrast to the US, UK and China where trading volumes have dropped this year amid the coronavirus pandemic.

All data, figures & charts are valid as of 08/07/2020. All trading carries risk. Only risk capital you can afford to lose