Please feel free to sign up to watch this month’s recorded webcast here.

In this webcast, we’ll go over all the latest market trends and best trading opportunities with our Senior Market Analyst, Mati Greenspan.

This presentation is free of charge for all eToro platinum and professional clients as part of our benefits package.

What we will cover today:

- US-China Trade War

- US Government Shutdown

- Brexit Getting Close

- Central Banks Getting Loose

- Bitcoin Institutional Investments

- Litecoin Bottomed out?

- CyberSecurity is Imperative

01:28min | Battle of popular investors

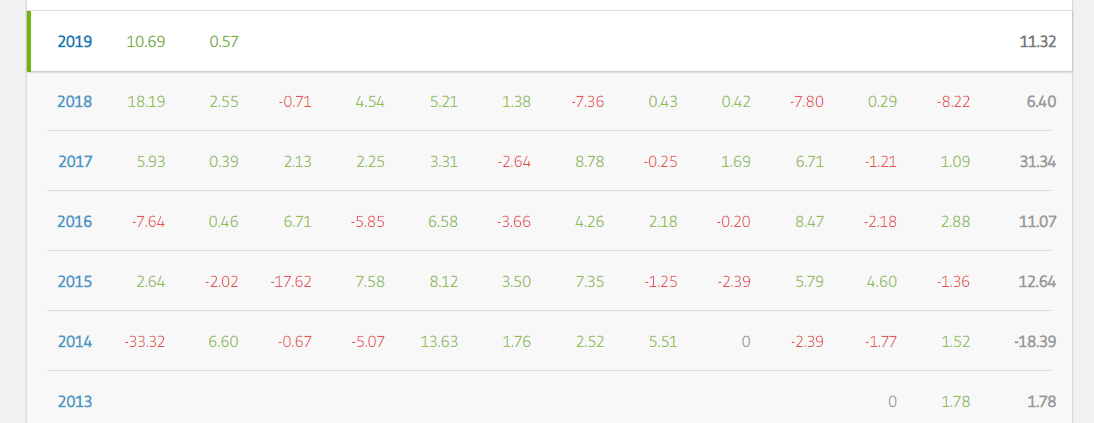

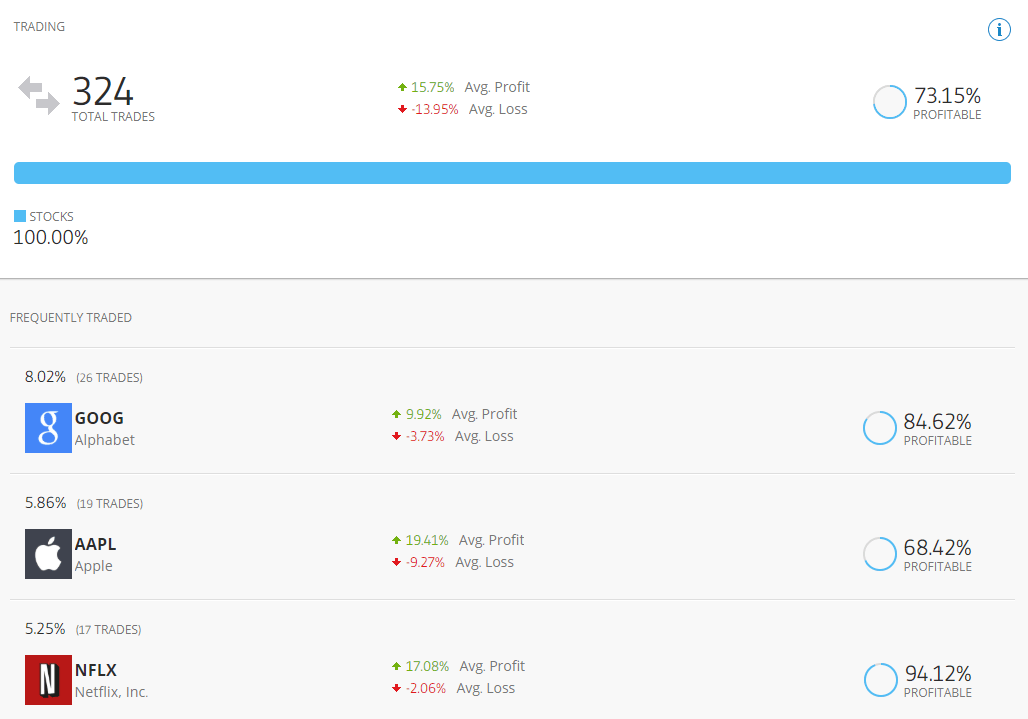

Jonasbarrelov – This Swedish Popular Investor has remained in profit since 2015 by trading mainly tech, pharma, and Swedish stocks. Jonas takes the long view on trading by carefully researching companies’ long-term outlooks. He recommends that traders copy him with $1,000 or more for at least 3 months.

MarianoPardo – Mariano is a Popular Investor from Argentina, who has been trading stocks for 6 years. He joined eToro in 2013, making significant profits in both 2015 and 2016. He suggests copying him with an initial amount of at least $1,000.

03:45min | Question: Can you trust the stats of popular investors. Full walkthrough on Popular investor stats here.

13:16min | Market opening review –

13:40min | Market events – Discussion on inflation and trader trends.

14:08min | Technical review of the NSDQ100.

14:41min | US Government Shutdown Explained.

17:38min | Volume indicators tool – Mati’s point of view on them.

Volume indicators that Mati likes to use.

19:30min | Question: Is a market crash coming?

23:22min | Question: Will the new level of US national debt affect the markets?

See the current level of the US debt here: http://usdebtclock.org/

26:15min | Brexit Getting Close – Review of GBP/USD

31:49min | Question: How would a hard Brexit impact the EUR and GBP?

33:04min | Question: How would property prices be impacted?

33:25min | UK Property ETF discussed: IUKP.L

35:00min | Question: What is Mati’s favorite strong buy for 2019?

Answer is Gold.

35:14min | Sears volatility reviewed

38:00min | EEM – Emerging Markets

39:33min Gold and how people buy when there is market uncertainty.

46:12min | How to compare Popular investors, Smart Portfolios and markets OutSmartNSDQ Smart Portfolio compared to popular investors,ReinhardtCoetzee ,Liborvasa, FabianMarco and MarianoPardo

52:02min | Question: How will the trade war affect Copper?

53:31min | Question: How will the trade war affect Oil?

Answered with an in-depth technical review.

58:30min | BNB Coin – Diverging from the rest of the crypto market, you can review the BNB research paper here. All research papers written by Mati on cryptos are available here.

62:00min | BTC What we are seeing in the charts and what we see in the news.

65:24min | Crypto volumes discussed and reviewed here

67:39min | Cybersecurity has always been a topic of importance for both enterprises and individuals. The new Smart Portfolio is now available. You can read more about it in this blogpost. You can also watch a discussion between international broadcaster, Elliott Gotkine and eToro CEO, Yoni Assia here.

If you would like to join our next webcast, make sure to review our eToro Club Benefits.

We hope you enjoyed the webcast. If you have any feedback or comments, please feel free to connect with Mati Greenspan on all social media channels: eToro, ,Twitter, LinkedIn, Telegram.

eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework. Past performance is not an indication of future results. This is not investment advice. Your capital is at risk

Data presented during the webcast is accurate as of February 13th, 2019.