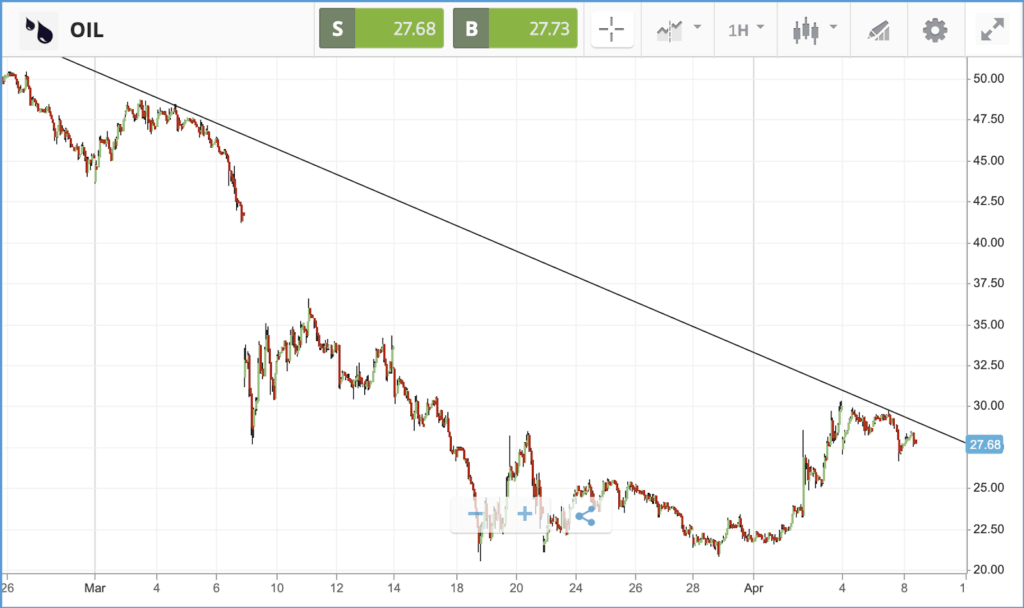

On Tuesday, US oil giant ExxonMobil cut its planned spending for the year by 30%, dialing back its investment in shale, deep water and natural gas production. The announcement follows similar moves by rivals in recent weeks, but is the deepest cut made to the budget of a major producer so far. In late March, key competitor Chevron dialed back its capital spending by 20% to $16bn for the year, making cutbacks in shale and exploration among other areas.

The price of oil has been volatile in recent days ahead of a virtual meeting between Russia and Opec later in the week. Yesterday, Russia confirmed it will be taking part in the April 9 meeting, although a deal is by no means certain. The US role in the negotiations is also uncertain; the country is likely to become a net importer of oil again, with production expected to decline by 500,000 barrels per day compared to last year, according to the Energy Department. That could open up an avenue for US involvement in any output deal. Also on Tuesday, the US Energy Information Administration cut its forecast for West Texas Intermediate and Brent Crude oil prices, putting its 2020 forecasts at $29.34 and $33.04 respectively, both cuts of more than 20% versus its forecast a month ago.

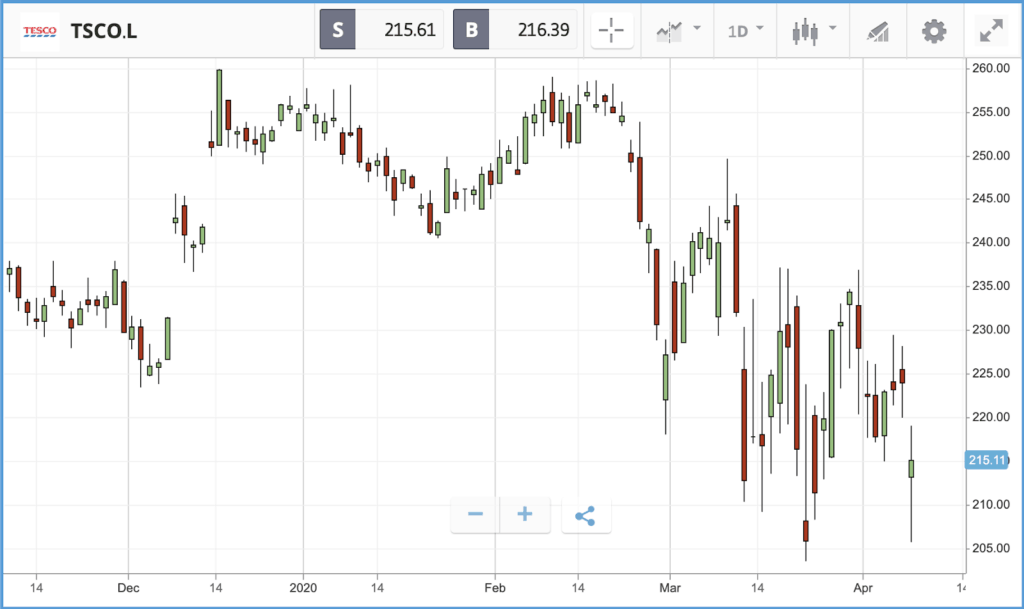

Earlier this morning, the UK financial regulator, the FCA, announced it was temporarily easing restrictions on listed companies raising cash from capital markets to protect their business against coronavirus. The watchdog said listed firms could apply for a waiver to circumvent the approval of capital raising from general meetings of shareholders. Despite this, the FTSE 100 and 250 were both down at the opening of trading this morning. The UK’s biggest supermarket Tesco was down around 5% after warning that increased costs accompanied the big boost in sales that the coronavirus outbreak brought.

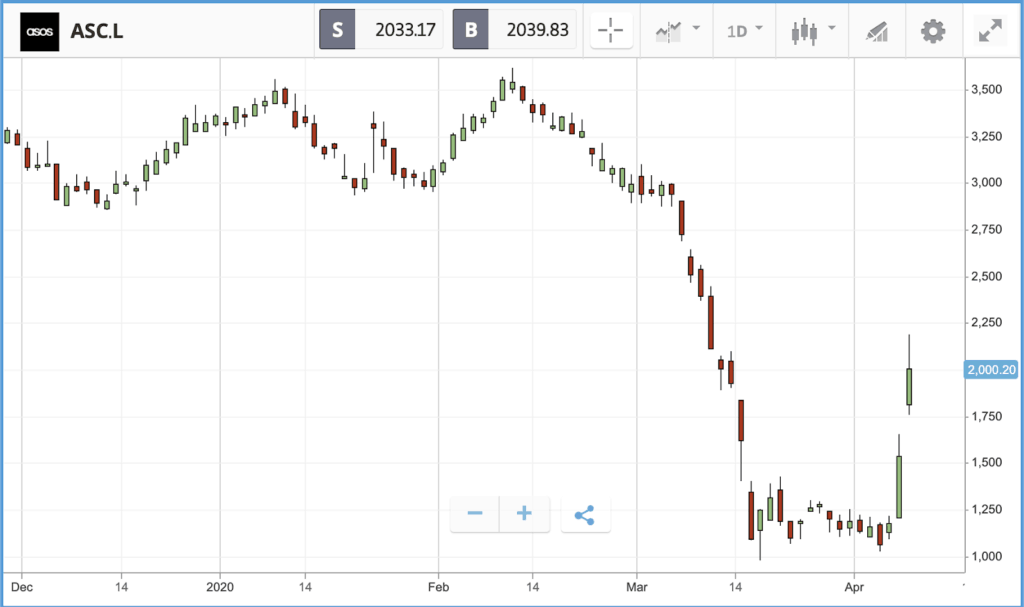

Elsewhere, online fashion retailer ASOS is on for a 30% gain for the second day in a row. The company has raised £247million in a placing to shore up its finances against the potentially prolonged effects of a downturn caused by the pandemic.

US stocks edge into negative territory after giving up early rally

Having jumped by more than 3% after opening, the S&P 500 and other major US indices slumped to a loss by the end of the day. David Lebovitz, a global market strategist at JPMorgan Asset Management, said that over the next couple of weeks investor focus is likely to shift to the micro as earnings season kicks into gear.

“This has been a very headline-driven, heavy beta environment where markets have been swinging up and down multiple percentage points in a given day … What the next couple of weeks are going to tell us, from an earnings standpoint, is going to shift that focus to more of micro and I think you’re going to see greater dispersion, greater differentiation between winners and losers,” he told CNBC.

In the S&P 500, six of the index’s 11 sectors posted a positive day, with the materials sector gaining the most at 2.4%, led by a 4.7% jump in construction materials stocks. Consumer staples was the worst performing sector, dragged lower by a 3.4% drop in household products stocks. In the Dow Jones Industrial Average, Boeing was the worst performing stock with a 4.7% loss, snapping a recent rally that had seen its shares climb more than 30%, albeit with the firm still worth less than half of what it was at the start of the year.

S&P 500: -0.2% Tuesday, -17.7% YTD

Dow Jones Industrial Average: -0.1% Tuesday, -20.6% YTD

Nasdaq Composite: -0.3% Tuesday, -12.1% YTD

Small cap UK stocks continue closing gap to large names

For the second day running, the smaller London-listed names in the FTSE 250 index continued to close in on the UK’s biggest companies, the top 100 of which make up the FTSE 100 index.

The FTSE 250 popped 5.1% on Tuesday, to the FTSE 100’s 2.2%, bringing the two indices’ year-to-date performance within five percentage points of each other. The FTSE 250 was led by Cineworld, Hammerson and Virgin Money UK, all of which posted gains of more than 20%.

In the FTSE 100, which gained 2.2%, Carnival, easyJet and Rolls Royce led the way, with gains of 22.2%, 15.1% and 12.8% respectively. On Tuesday, embattled airlines secured one cash source in the form of delayed payment in air traffic control fees. Airlines flying in European airspace will now not have to pay the charges until later in the year or early 2021. There was also another sign of the toll the lockdown is taking on airlines from Germany; Lufthansa announced it is downsizing its fleet by permanently decommissioning 43 aircraft and shutting down its low cost brand Germanwings.

FTSE 100: +2.2% Tuesday, -24.4% YTD

FTSE 250: +5.1% Tuesday, -28.9% YTD

What to watch

FOMC minutes: Today, the Federal Open Market Committee, the body which sets US interest rates, will release the minutes from two of its meetings in early and mid-March. Given how rapidly events have unfolded since then, the minutes may not provide much in the way of new insight, but will offer a view into the Fed’s decision making and its willingness to use the tools at its disposal.

Crypto corner:

After seven days of stellar gains, the world’s three major cryptoassets retreated somewhat yesterday.

Bitcoin rose in early trading before posting losses. By this morning it had recovered to around $7300, down on where it was 24 hours ago. Likewise, Ethereum trended down over the course of the day, posting heavy losses to a low of $161.28 before picking back up to around $170 in early trading today.